Time to Take the Euro Out of Germany?

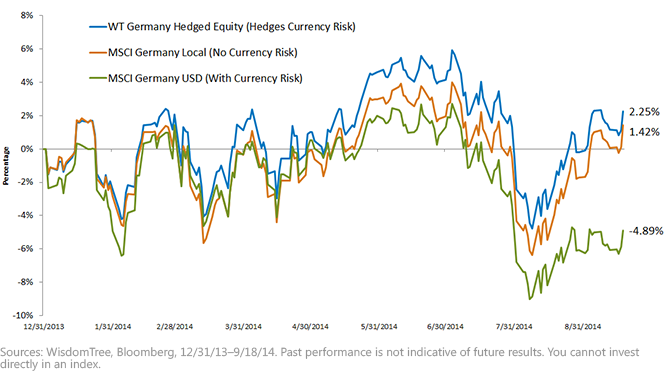

• Currency Detracting from Unhedged German Returns – The MSCI Germany Local Index (no currency risk) outperformed the MSCI Germany USD Index, (exposed to currency risk) by more than 6% year-to-date. Since these Indexes are otherwise identical, the entire performance differential is attributed to the impact of the currency. This negative currency impact is even more alarming when you consider added volatility. Over the past three years, the volatility of the currency was an annualized 8.9%.4

• The WisdomTree Difference – The WisdomTree Germany Hedged Equity Index (WTGEH), which hedges its currency risk in seeking to mitigate any exchange rate fluctuations from impacting returns, was able to outperform the local German market by an additional 83 basis points. WTGEH is a fundamentally weighted Index that screens and weights companies based on their cash dividends and then repeats this process annually. WTGEH also focuses on exporters, by screening out companies that generate more than 80% of their revenue from within Germany. Exporters have the potential to benefit from global growth even if domestic growth slows and are able to profit from the currency translation adjustment as their home currency weakens against currencies where they sell their goods.

We’ve been writing about currency hedging for some time, and we continue to advocate that, unless you have a strong opinion about the future of a foreign currency—in this case the euro—the baseline exposure should not be in a 100% unhedged approach. We’ve seen strong interest in currency hedging within the broader eurozone region but believe it is still early in the adoption for the hedged concept when applied to German equities. Given European Central Bank policy and the trend of the euro, we believe it could be time to think about currency hedging of both broad, eurozone-related equities and German equities.

1Sources: European Central Bank, Bloomberg, as of 9/4/14.

2Source: Bloomberg, 12/31/13–09/18/14.

3Sources: WisdomTree, MSCI, 12/31/87–6/30/14.

4Sources: WisdomTree, Bloomberg, 8/31/11–8/31/14.

• Currency Detracting from Unhedged German Returns – The MSCI Germany Local Index (no currency risk) outperformed the MSCI Germany USD Index, (exposed to currency risk) by more than 6% year-to-date. Since these Indexes are otherwise identical, the entire performance differential is attributed to the impact of the currency. This negative currency impact is even more alarming when you consider added volatility. Over the past three years, the volatility of the currency was an annualized 8.9%.4

• The WisdomTree Difference – The WisdomTree Germany Hedged Equity Index (WTGEH), which hedges its currency risk in seeking to mitigate any exchange rate fluctuations from impacting returns, was able to outperform the local German market by an additional 83 basis points. WTGEH is a fundamentally weighted Index that screens and weights companies based on their cash dividends and then repeats this process annually. WTGEH also focuses on exporters, by screening out companies that generate more than 80% of their revenue from within Germany. Exporters have the potential to benefit from global growth even if domestic growth slows and are able to profit from the currency translation adjustment as their home currency weakens against currencies where they sell their goods.

We’ve been writing about currency hedging for some time, and we continue to advocate that, unless you have a strong opinion about the future of a foreign currency—in this case the euro—the baseline exposure should not be in a 100% unhedged approach. We’ve seen strong interest in currency hedging within the broader eurozone region but believe it is still early in the adoption for the hedged concept when applied to German equities. Given European Central Bank policy and the trend of the euro, we believe it could be time to think about currency hedging of both broad, eurozone-related equities and German equities.

1Sources: European Central Bank, Bloomberg, as of 9/4/14.

2Source: Bloomberg, 12/31/13–09/18/14.

3Sources: WisdomTree, MSCI, 12/31/87–6/30/14.

4Sources: WisdomTree, Bloomberg, 8/31/11–8/31/14.Important Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments focused in Europe are increasing the impact of events and developments associated with the region, which can adversely affect performance. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.