Risk Aversion and Dollar Strength

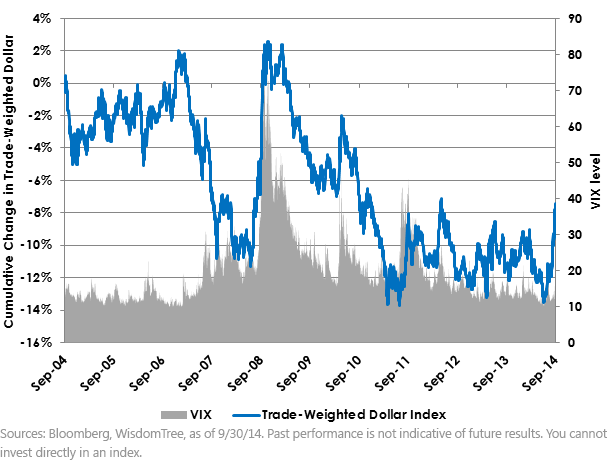

While we don’t anticipate that volatility will approach the levels seen during the financial crisis, current levels of volatility appear compressed when compared with historical averages. To us, this suggests a fair degree of complacency in the market. As shown most notably in August 2010 and September 2011, volatility can unexpectedly spike at any time. During these periods, concerns about the viability of the Eurozone caused a spike in volatility across global financial markets. As a result, investors sought the safety and liquidity of the U.S. dollar. As demand for dollars increased, the value of the currency appreciated broadly against other currencies.

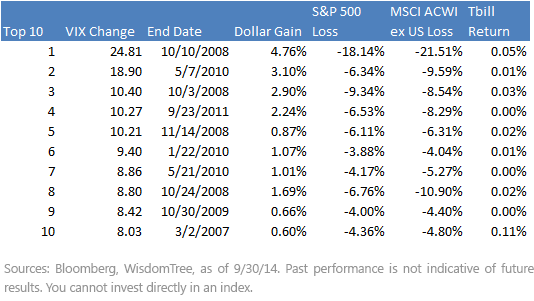

Additionally, strategies that provide long U.S. dollar exposure tend to exhibit sharply negative correlation with international equity positions. As the table below shows, spikes in volatility tend to coincide with decreases in the prices of risky assets, such as equities. Since U.S. investors may have exposure to foreign currencies through their foreign equity positions, their returns reflect not only a decrease in the price of their stock portfolios, but potential losses from fluctuations in the currency as well.

Performance of Trade-Weighted Dollar During 10 Largest Weekly Rises in the VIX,

10/1/04- 9/30/14

While we don’t anticipate that volatility will approach the levels seen during the financial crisis, current levels of volatility appear compressed when compared with historical averages. To us, this suggests a fair degree of complacency in the market. As shown most notably in August 2010 and September 2011, volatility can unexpectedly spike at any time. During these periods, concerns about the viability of the Eurozone caused a spike in volatility across global financial markets. As a result, investors sought the safety and liquidity of the U.S. dollar. As demand for dollars increased, the value of the currency appreciated broadly against other currencies.

Additionally, strategies that provide long U.S. dollar exposure tend to exhibit sharply negative correlation with international equity positions. As the table below shows, spikes in volatility tend to coincide with decreases in the prices of risky assets, such as equities. Since U.S. investors may have exposure to foreign currencies through their foreign equity positions, their returns reflect not only a decrease in the price of their stock portfolios, but potential losses from fluctuations in the currency as well.

Performance of Trade-Weighted Dollar During 10 Largest Weekly Rises in the VIX,

10/1/04- 9/30/14

For definitions of terms and Indexes in the chart, visit our glossary.

For investors concerned about this risk, currency strategies that take long positions in the U.S. dollar may help offset some of the currency risk inherent in international equity positions. With cash offering very little income and the net carry sacrifice for dollar-biased positions relatively low, we feel that dollar-bullish strategies could offer investors appealing diversification benefits if risk spikes or the U.S. economy continues to strengthen.

For definitions of terms and Indexes in the chart, visit our glossary.

For investors concerned about this risk, currency strategies that take long positions in the U.S. dollar may help offset some of the currency risk inherent in international equity positions. With cash offering very little income and the net carry sacrifice for dollar-biased positions relatively low, we feel that dollar-bullish strategies could offer investors appealing diversification benefits if risk spikes or the U.S. economy continues to strengthen.Important Risks Related to this Article

Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations.

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.