Playing Defense in Emerging Market Fixed Income

For definitions of indexes in the chart, please visit our glossary.

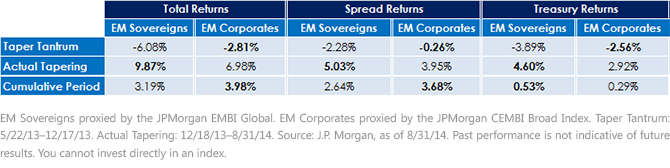

During the “taper tantrum,” many investors were initially caught off guard by the implications of Fed chairman Ben Bernanke’s comments. As the market grappled with this potential shift in policy, U.S. Treasury yields rose. At the same time, rising interest rates caused many investors to reduce their exposure to emerging markets. Investors reasoned that with rates in the U.S. heading higher, opportunities in emerging markets appeared less attractive by comparison. As investors sold, credit spreads widened. Interestingly, even though the investable universe for EM corporate debt is now significantly larger than the market for sovereign debt denominated in U.S. dollars ($806 billion versus $671 billion)2, EM sovereigns have tended to have a much higher percentage allocation in global investors’ portfolios. According to J.P. Morgan, assets benchmarked against EM sovereign debt are nearly five times as large as EM corporate debt ($296 billion versus $64 billion)3.

In our view, EM sovereigns represent a much more crowded trade than EM corporates. As a result, they may be more sensitive to changes in capital flows into and out of emerging markets. This can be clearly evidenced by EM sovereign spread returns when outflows accelerated from EM debt in the second half of 2013. Even with higher levels of income, the returns from credit cost investors more than 2%. Looking at the other driver of total returns, EM corporate bonds experienced less pain during the sell-off due to their shorter duration compared to EM sovereigns (5.44 years versus 7.23 years).4

Since the actual tapering of asset purchases began December 18, EM sovereign bonds have outperformed EM corporate bonds. However, this performance gap can largely be explained by its previous period of significant underperformance. When looking over the entire period, EM corporate bonds experienced less drawdown and greater total returns. In an environment where investors are concerned about rising U.S. rates, investors should consider a shift from EM sovereigns to EM corporates.

As we have mentioned previously, we believe emerging market corporate bonds represent a more attractive alternative to EM sovereign debt on account of wider credit spreads, lighter investor positioning and lower sensitivity to interest rate risk. While the timing and future path of U.S. interest rates remains far from certain, EM corporate bonds could represent a more defensive alternative to other emerging market fixed income options.

1As proxied by the J.P. Morgan CEMBI Broad.

2Source: J.P. Morgan, as of 8/31/14.

3Source: J.P. Morgan, June 2014.

4Source: J.P. Morgan, as of 8/31/14.

For definitions of indexes in the chart, please visit our glossary.

During the “taper tantrum,” many investors were initially caught off guard by the implications of Fed chairman Ben Bernanke’s comments. As the market grappled with this potential shift in policy, U.S. Treasury yields rose. At the same time, rising interest rates caused many investors to reduce their exposure to emerging markets. Investors reasoned that with rates in the U.S. heading higher, opportunities in emerging markets appeared less attractive by comparison. As investors sold, credit spreads widened. Interestingly, even though the investable universe for EM corporate debt is now significantly larger than the market for sovereign debt denominated in U.S. dollars ($806 billion versus $671 billion)2, EM sovereigns have tended to have a much higher percentage allocation in global investors’ portfolios. According to J.P. Morgan, assets benchmarked against EM sovereign debt are nearly five times as large as EM corporate debt ($296 billion versus $64 billion)3.

In our view, EM sovereigns represent a much more crowded trade than EM corporates. As a result, they may be more sensitive to changes in capital flows into and out of emerging markets. This can be clearly evidenced by EM sovereign spread returns when outflows accelerated from EM debt in the second half of 2013. Even with higher levels of income, the returns from credit cost investors more than 2%. Looking at the other driver of total returns, EM corporate bonds experienced less pain during the sell-off due to their shorter duration compared to EM sovereigns (5.44 years versus 7.23 years).4

Since the actual tapering of asset purchases began December 18, EM sovereign bonds have outperformed EM corporate bonds. However, this performance gap can largely be explained by its previous period of significant underperformance. When looking over the entire period, EM corporate bonds experienced less drawdown and greater total returns. In an environment where investors are concerned about rising U.S. rates, investors should consider a shift from EM sovereigns to EM corporates.

As we have mentioned previously, we believe emerging market corporate bonds represent a more attractive alternative to EM sovereign debt on account of wider credit spreads, lighter investor positioning and lower sensitivity to interest rate risk. While the timing and future path of U.S. interest rates remains far from certain, EM corporate bonds could represent a more defensive alternative to other emerging market fixed income options.

1As proxied by the J.P. Morgan CEMBI Broad.

2Source: J.P. Morgan, as of 8/31/14.

3Source: J.P. Morgan, June 2014.

4Source: J.P. Morgan, as of 8/31/14.Important Risks Related to this Article

Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. In addition, when interest rates fall, income may decline. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments.