Targeting Benchmark Size Exposures with Smart Beta Indexes

For definitions of terms and Indexes in the chart, visit our glossary.

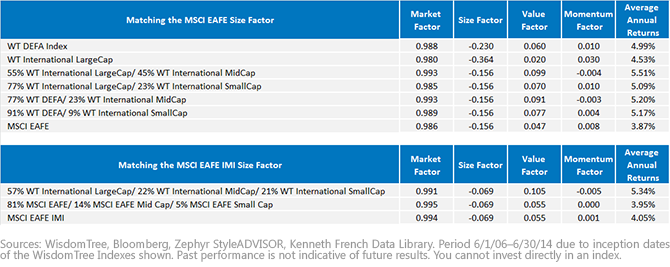

• How Large is LARGE? In this table, a greater negative number in the size factor column indicates greater exposure to large-cap stocks. The MSCI EAFE Index comes in at -0.156, thereby setting the bar. The WT DEFA Index comes in at -0.230, while the WT International Large Cap Dividends comes in at -0.364, or more than twice as exposed to large caps as the MSCI EAFE Index.

• Adding 9%–45% Weight to Mid or Small Caps to Match MSCI EAFE: The fact that the WT DEFA and the WT International LargeCap Dividend are so large means that we can add anywhere from 9% to 45% exposure to mid- or small-cap stocks, defined by blends with the WT International MidCap Index or the WT International SmallCap Index. The important thing is that we can do this without taking any size bet relative to the MSCI EAFE Index, based on the returns exhibited over the period of time represented by the table, June 1, 2006, through June 30, 2014. We believe that it is beneficial to think in this manner because adding small or mid-caps can build a more complete exposure to a particular region, not to mention that all of the blends outperformed the MSCI EAFE Index over this period.

- Blending with WT Int. LargeCap Dividend: It’s clear that this Index is the largest, so when it is used as the foundation of a blend, it allows the use of 45% weight toward the WT International MidCap Dividend Index or 23% weight toward the WT International SmallCap Dividend Index while maintaining the same overall size exposure as the MSCI EAFE Index. The 45% weight toward mid caps certainly contributed to the 5.51% average annual return—the best of all blends shown in this table.

- Blending with WT DEFA: This Index isn’t quite as large as the WT International LargeCap Dividend and does include exposure to large-, mid- and small-cap size segments. Still, we have the flexibility to add 23% exposure to the WT International MidCap Dividend Index or 9% to the WT International SmallCap Dividend Index without taking a size bet relative to the MSCI EAFE.

• What about the MSCI EAFE IMI? Even MSCI has recognized that the MSCI EAFE Index is not necessarily a “total market” exposure, largely missing out on the small-cap size segment. That’s one of the main reasons that the MSCI EAFE IMI has been gaining attention; it does in fact include large-, mid- and small-cap stocks, and it is broader than the MSCI EAFE Index.

- Even though the MSCI EAFE IMI has greater exposure to small caps than the MSCI EAFE Index, as seen by its -0.069 size factor loading, a WisdomTree blend of large cap, mid cap and small cap focused Indexes can match this size exposure while tilting significantly more weight toward mid- and small-cap stocks, specifically 43%. This is even true if we compare to the MSCI EAFE size-focused options, which stand at 19%. This is a big reason why we think the blend of 57% WT International LargeCap Dividend, 22% WT International MidCap Dividend and 21% WT International SmallCap Dividend Indexes delivered the second-best performance of the blends shown in this table, 5.34% average annual returns.

Read full research on International Smart Beta here.

For definitions of terms and Indexes in the chart, visit our glossary.

• How Large is LARGE? In this table, a greater negative number in the size factor column indicates greater exposure to large-cap stocks. The MSCI EAFE Index comes in at -0.156, thereby setting the bar. The WT DEFA Index comes in at -0.230, while the WT International Large Cap Dividends comes in at -0.364, or more than twice as exposed to large caps as the MSCI EAFE Index.

• Adding 9%–45% Weight to Mid or Small Caps to Match MSCI EAFE: The fact that the WT DEFA and the WT International LargeCap Dividend are so large means that we can add anywhere from 9% to 45% exposure to mid- or small-cap stocks, defined by blends with the WT International MidCap Index or the WT International SmallCap Index. The important thing is that we can do this without taking any size bet relative to the MSCI EAFE Index, based on the returns exhibited over the period of time represented by the table, June 1, 2006, through June 30, 2014. We believe that it is beneficial to think in this manner because adding small or mid-caps can build a more complete exposure to a particular region, not to mention that all of the blends outperformed the MSCI EAFE Index over this period.

- Blending with WT Int. LargeCap Dividend: It’s clear that this Index is the largest, so when it is used as the foundation of a blend, it allows the use of 45% weight toward the WT International MidCap Dividend Index or 23% weight toward the WT International SmallCap Dividend Index while maintaining the same overall size exposure as the MSCI EAFE Index. The 45% weight toward mid caps certainly contributed to the 5.51% average annual return—the best of all blends shown in this table.

- Blending with WT DEFA: This Index isn’t quite as large as the WT International LargeCap Dividend and does include exposure to large-, mid- and small-cap size segments. Still, we have the flexibility to add 23% exposure to the WT International MidCap Dividend Index or 9% to the WT International SmallCap Dividend Index without taking a size bet relative to the MSCI EAFE.

• What about the MSCI EAFE IMI? Even MSCI has recognized that the MSCI EAFE Index is not necessarily a “total market” exposure, largely missing out on the small-cap size segment. That’s one of the main reasons that the MSCI EAFE IMI has been gaining attention; it does in fact include large-, mid- and small-cap stocks, and it is broader than the MSCI EAFE Index.

- Even though the MSCI EAFE IMI has greater exposure to small caps than the MSCI EAFE Index, as seen by its -0.069 size factor loading, a WisdomTree blend of large cap, mid cap and small cap focused Indexes can match this size exposure while tilting significantly more weight toward mid- and small-cap stocks, specifically 43%. This is even true if we compare to the MSCI EAFE size-focused options, which stand at 19%. This is a big reason why we think the blend of 57% WT International LargeCap Dividend, 22% WT International MidCap Dividend and 21% WT International SmallCap Dividend Indexes delivered the second-best performance of the blends shown in this table, 5.34% average annual returns.

Read full research on International Smart Beta here.

Important Risks Related to this Article

Investments focusing on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.