Smart Beta Goes International

For definitions of terms and Indexes in the chart, visit our glossary.

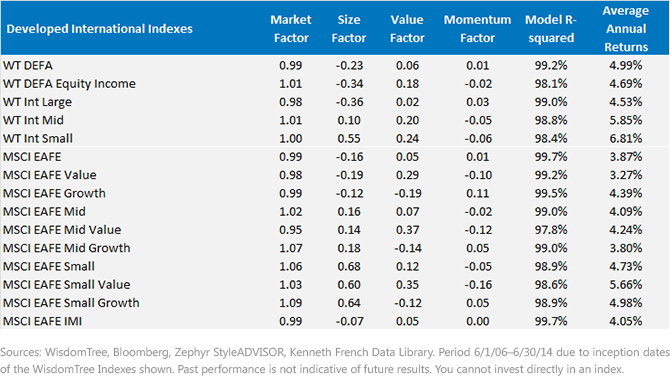

Market Factors Takeaways: In our U.S. factor analysis, discussed in an earlier blog post, the dividend-weighted indexes showed lower “market factor” sensitivity or market factor loadings. On the international front, the market sensitivity factors more closely resembled the traditional market cap-weighted indexes with readings close to 1.0. One reason for this is that the U.S. is an outlier country in terms of dividend payout ratios. Internationally, the indexes provide greater representation and coverage of international markets. The indexes therefore provide market sensitivity close to the broad-market indexes.

Value Factor Takeaways: All WisdomTree-related strategies listed above weight securities by their Dividend Stream®. These strategies tend to tilt more toward the value segment of the markets. However, for the broad WT DEFA Index, the value loading is almost identical to that of the MSCI EAFE Index. Furthermore, the WT International LargeCap Dividend Index had a value loading lower than that of the MSCI EAFE Index. One reason for this is country allocations. Japan, for instance would show a low price-to-book value ratio and may represent considerable weight in the value factors, whereas on a dividend basis, Japan is under-weighted compared to a market cap-weighted index. This would lead to a natural bias in dividend strategies away from loading to the value factor that has greater exposure to Japan on a price-to-book value basis.

o The value factor is particularly strong in dividend strategies focused on small- and mid-cap segments. Although the small-cap segment has a much stronger value tilt than the mid-caps, both have a much larger tilt to the value spectrum than the broad market strategies.

o Note that the market cap-weighted value MSCI EAFE Mid Cap Value and MSCI EAFE Small Cap Value Indexes were more value-tilted than the dividend-weighted approach. The dividend weighting therefore was between the traditional market cap-weighted indexes and the value segments of those indexes when measured on sensitivity to this value factor.

Size Factor Takeaways: In terms of size tilts, WT DEFA, WT DEFA Equity Income and WT International LargeCap Dividend have the biggest large-cap tilts when compared with all other strategies listed above. In other words, the three strategies have the “purest” large-cap return attribution in the developed international space. When we look at the WisdomTree strategies focused on the small-caps, we cannot describe these Indexes as solely exposed to the small-cap premium. Instead, the WT International SmallCap Dividend Index has an equally notable tilt to the value segment, through a methodology that weights its constituents by dividends.

o The capability to access multiple tilts within one indexing strategy is an important point to note. As we have previously discussed, Fama/French1 has shown the persistence of both a small-cap and a value premium, both of which can be accessed by the WT International SmallCap Dividend Index.

Momentum Factor Takeaways: While dividend strategies in the U.S. tend to display strong anti-momentum tendencies, it is less clear in the developed international space. Many of the WisdomTree strategies still have a small tilt toward being anti-momentum.

Knowing Factor Exposures can Help with Portfolio Construction

Knowing these factor loadings, in our opinion, is only a first step. The critical question regards how to apply this information to portfolio construction. In a future blog post, we will examine how we might go about building a portfolio that matches the size exposure of the MSCI EAFE Index but uses different mixes of WisdomTree Index tools to get there.

Read full research on International Smart Beta here.

1Fama and French: Refers to the factor work that Eugene Fama and Kenneth French have done to describe stock returns.

For definitions of terms and Indexes in the chart, visit our glossary.

Market Factors Takeaways: In our U.S. factor analysis, discussed in an earlier blog post, the dividend-weighted indexes showed lower “market factor” sensitivity or market factor loadings. On the international front, the market sensitivity factors more closely resembled the traditional market cap-weighted indexes with readings close to 1.0. One reason for this is that the U.S. is an outlier country in terms of dividend payout ratios. Internationally, the indexes provide greater representation and coverage of international markets. The indexes therefore provide market sensitivity close to the broad-market indexes.

Value Factor Takeaways: All WisdomTree-related strategies listed above weight securities by their Dividend Stream®. These strategies tend to tilt more toward the value segment of the markets. However, for the broad WT DEFA Index, the value loading is almost identical to that of the MSCI EAFE Index. Furthermore, the WT International LargeCap Dividend Index had a value loading lower than that of the MSCI EAFE Index. One reason for this is country allocations. Japan, for instance would show a low price-to-book value ratio and may represent considerable weight in the value factors, whereas on a dividend basis, Japan is under-weighted compared to a market cap-weighted index. This would lead to a natural bias in dividend strategies away from loading to the value factor that has greater exposure to Japan on a price-to-book value basis.

o The value factor is particularly strong in dividend strategies focused on small- and mid-cap segments. Although the small-cap segment has a much stronger value tilt than the mid-caps, both have a much larger tilt to the value spectrum than the broad market strategies.

o Note that the market cap-weighted value MSCI EAFE Mid Cap Value and MSCI EAFE Small Cap Value Indexes were more value-tilted than the dividend-weighted approach. The dividend weighting therefore was between the traditional market cap-weighted indexes and the value segments of those indexes when measured on sensitivity to this value factor.

Size Factor Takeaways: In terms of size tilts, WT DEFA, WT DEFA Equity Income and WT International LargeCap Dividend have the biggest large-cap tilts when compared with all other strategies listed above. In other words, the three strategies have the “purest” large-cap return attribution in the developed international space. When we look at the WisdomTree strategies focused on the small-caps, we cannot describe these Indexes as solely exposed to the small-cap premium. Instead, the WT International SmallCap Dividend Index has an equally notable tilt to the value segment, through a methodology that weights its constituents by dividends.

o The capability to access multiple tilts within one indexing strategy is an important point to note. As we have previously discussed, Fama/French1 has shown the persistence of both a small-cap and a value premium, both of which can be accessed by the WT International SmallCap Dividend Index.

Momentum Factor Takeaways: While dividend strategies in the U.S. tend to display strong anti-momentum tendencies, it is less clear in the developed international space. Many of the WisdomTree strategies still have a small tilt toward being anti-momentum.

Knowing Factor Exposures can Help with Portfolio Construction

Knowing these factor loadings, in our opinion, is only a first step. The critical question regards how to apply this information to portfolio construction. In a future blog post, we will examine how we might go about building a portfolio that matches the size exposure of the MSCI EAFE Index but uses different mixes of WisdomTree Index tools to get there.

Read full research on International Smart Beta here.

1Fama and French: Refers to the factor work that Eugene Fama and Kenneth French have done to describe stock returns.

Important Risks Related to this Article

Dividends are not guaranteed, and a company’s future ability to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time. Investments focusing on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.