EM Consumer Growth: Cheaper Valuations and Higher Quality

For definitions of terms in the chart, please visit our glossary.

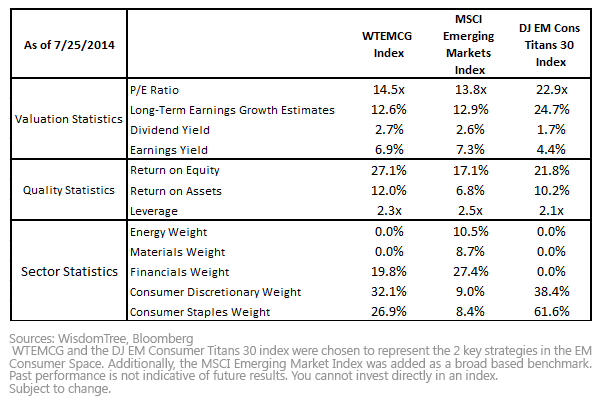

• Attractive P/E Valuation: WTEMCG has a 14.5x P/E, which trades at a 37% discount to the 22.9x P/E of the Dow Jones Emerging Markets Consumer Titans 30 Index. The Dow Jones Index consists of thirty firms in the Consumer Discretionary and Consumer Staples sectors in EM, weighted by market capitalization. WTEMCG’s large P/E discount speaks volumes about the benefits of both sector and security diversification in emerging markets3.

• Explaining WTEMCG’s Sector Exposure: The MSCI Emerging Markets Index has more than 18% of its exposure in the Energy and Materials sectors4. WTEMCG, on the other hand, excludes the aforementioned sectors and instead has approximately 75% of its weight in domestic demand sectors . We believe that these sectors are consistent with the theme of growth in the emerging markets’ middle class and are therefore supportive of domestic demand. WTEMCG’s allocation away from Energy and into the domestic demand sectors partially contributes to the higher P/E when compared with the MSCI Emerging Markets Index.

• WTEMCG for Income Potential: Even though WTEMCG weights according to net income, which results in a lower P/E tilt to construction, WTEMCG’s 2.7% dividend yield offers an important income buffer for those seeking exposure to the emerging markets. WTEMCG’s dividend yield is a full 1% higher than that of the Dow Jones Emerging Markets Consumer Titans 30 Index and is slightly higher than the broad MSCI Emerging Markets Index.

• An Emphasis on Quality: WTEMCG’s valuation story is incomplete without a discussion of quality. Its methodology rewards companies that show promise in terms of return on equity (ROE) and return on assets (ROA). This combination of ROE and ROA not only rewards companies that are highly efficient in utilizing their assets and equities to generate net income, it also penalizes companies that employ immense leverage in doing so. As a result, WTEMCG has the highest ROE and ROA of the Indexes listed above.

WTEMCG has a broad focus on the emerging markets consumer growth theme. The Index identifies securities whose revenue is primarily based in emerging markets. Further, it has the benefit of being broadly focused on the EM domestic demand story, which is reflective of the growth in emerging markets’ middle class. A key consideration in its methodology is sensitivity to valuation, employing a two-part process to enhance WTEMCG’s valuation focus:

• Stock Selection: Index screening incorporates a one-third ranking to the earnings yield—in other words, a focus on stocks with lower prices relative to the earnings they have generated

• Weighting: Weighting by net income with an annual rebalance

This ultimately results in an Index that likely has a bias for less expensive valuation and higher quality5 compared with its competitors.

1Source: Bloomberg, as of 7/25/14. Past performance is not indicative of future results.

A fund’s performance, especially for very short time periods, should not be the sole factor in making your investment decision.

2Growth, quality and valuation measures: One-third weighted to the rank of long-term estimated earnings growth, one-third weighted to the rank of historical three-year average return on equity and historical three-year average return on assets, and one-third weighted to the rank of the earnings yield.

3As of 7/25/14, WTEMCG has 248 constituents and seven sectors that have over a 1% weight.

4Domestic demand sectors are Consumer Staples, Consumer Discretionary, Telecommunication Services, Utilities and Health Care.

5Measures through higher ROE and ROA as well as lower leverage.

For definitions of terms in the chart, please visit our glossary.

• Attractive P/E Valuation: WTEMCG has a 14.5x P/E, which trades at a 37% discount to the 22.9x P/E of the Dow Jones Emerging Markets Consumer Titans 30 Index. The Dow Jones Index consists of thirty firms in the Consumer Discretionary and Consumer Staples sectors in EM, weighted by market capitalization. WTEMCG’s large P/E discount speaks volumes about the benefits of both sector and security diversification in emerging markets3.

• Explaining WTEMCG’s Sector Exposure: The MSCI Emerging Markets Index has more than 18% of its exposure in the Energy and Materials sectors4. WTEMCG, on the other hand, excludes the aforementioned sectors and instead has approximately 75% of its weight in domestic demand sectors . We believe that these sectors are consistent with the theme of growth in the emerging markets’ middle class and are therefore supportive of domestic demand. WTEMCG’s allocation away from Energy and into the domestic demand sectors partially contributes to the higher P/E when compared with the MSCI Emerging Markets Index.

• WTEMCG for Income Potential: Even though WTEMCG weights according to net income, which results in a lower P/E tilt to construction, WTEMCG’s 2.7% dividend yield offers an important income buffer for those seeking exposure to the emerging markets. WTEMCG’s dividend yield is a full 1% higher than that of the Dow Jones Emerging Markets Consumer Titans 30 Index and is slightly higher than the broad MSCI Emerging Markets Index.

• An Emphasis on Quality: WTEMCG’s valuation story is incomplete without a discussion of quality. Its methodology rewards companies that show promise in terms of return on equity (ROE) and return on assets (ROA). This combination of ROE and ROA not only rewards companies that are highly efficient in utilizing their assets and equities to generate net income, it also penalizes companies that employ immense leverage in doing so. As a result, WTEMCG has the highest ROE and ROA of the Indexes listed above.

WTEMCG has a broad focus on the emerging markets consumer growth theme. The Index identifies securities whose revenue is primarily based in emerging markets. Further, it has the benefit of being broadly focused on the EM domestic demand story, which is reflective of the growth in emerging markets’ middle class. A key consideration in its methodology is sensitivity to valuation, employing a two-part process to enhance WTEMCG’s valuation focus:

• Stock Selection: Index screening incorporates a one-third ranking to the earnings yield—in other words, a focus on stocks with lower prices relative to the earnings they have generated

• Weighting: Weighting by net income with an annual rebalance

This ultimately results in an Index that likely has a bias for less expensive valuation and higher quality5 compared with its competitors.

1Source: Bloomberg, as of 7/25/14. Past performance is not indicative of future results.

A fund’s performance, especially for very short time periods, should not be the sole factor in making your investment decision.

2Growth, quality and valuation measures: One-third weighted to the rank of long-term estimated earnings growth, one-third weighted to the rank of historical three-year average return on equity and historical three-year average return on assets, and one-third weighted to the rank of the earnings yield.

3As of 7/25/14, WTEMCG has 248 constituents and seven sectors that have over a 1% weight.

4Domestic demand sectors are Consumer Staples, Consumer Discretionary, Telecommunication Services, Utilities and Health Care.

5Measures through higher ROE and ROA as well as lower leverage.Important Risks Related to this Article

You cannot invest directly in an index. Diversification does not eliminate the risk of experiencing investment losses.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.