Hedge Your Bets! Term Premium in U.S. Fixed Income Markets May Be Poised to Rise

Stronger Economic Data + Complacency = Higher Rates

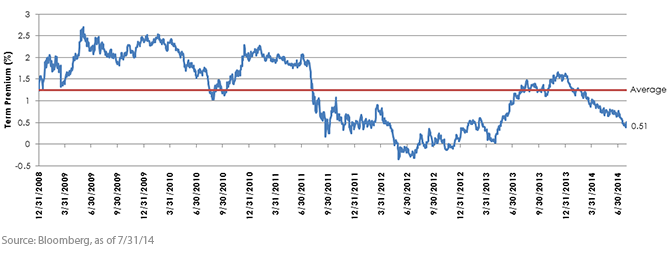

During the last week of July 2014, market participants saw a barrage of economic data that seemed to corroborate the same message: the U.S. economy is continuing to grow, and the labor force is continuing to recover. Given that the Fed has focused on both of these factors as preconditions for eventually raising short-term interest rates, the Treasury market took notice. In the week after the better-than-expected economic data was released, U.S. two-year bond yields broke through 0.51%, the recent high that was set in September 2013 when the market was convinced that then-Fed Chairman Ben Bernanke would start “tapering” the Fed’s bond-buying program.

While the spike and eventual retracement in two-year yields may point to concerns about future tightening, longer maturities seem to paint a different picture. U.S. 10 Year and 30-Year Treasury yields are a full 44 and 57 basis points lower, respectively, than they were in September 2013.2 In this scenario, the yield curve has flattened, narrowing the spread between these maturities and the two-year. This is consistent with investors being rewarded less for assuming additional interest rate risk. Put another way, we believe that the prospect of higher rates has increased, but the cost of hedging this risk has decreased.

How to Hedge

On December 18, 2013, the Fed began to reduce the pace of its asset purchases, and WisdomTree launched a suite of Funds that investors can use to help mitigate interest rate risk in their bond portfolios. In the current market environment, we believe that both the WisdomTree Barclays U.S. Aggregate Bond Zero Duration Fund (AGZD) and the WisdomTree Barclays U.S. Aggregate Bond Negative Duration Fund (AGND) may appeal to a wide range of investors. In these strategies, an investor is able to maintain exposure to a basket of bonds from the Barclays U.S. Aggregate Index, combined with an interest rate overlay that targets a zero or negative five-year duration for the overall portfolio. In these strategies, the portion of the portfolio invested in bonds helps offset the cost of maintaining the interest rate overlays.

While the zero-duration strategy simply seeks to hedge the risk of rising rates, the negative duration approach is more aggressive. In a negative duration position, investor returns could be higher if interest rates rise at the intermediate part of the yield curve. However, this strategy entails more risk, since it is possible that rates may not rise (or could even fall) at that particular part of the curve. Generally, this strategy would perform well if the yield curve steepens.

Outlook

While it is possible that our current forecast may prove incorrect and interest rates may actually fall, we still favor the risk-return tradeoff embedded in this particular position. In our view, the risk of higher interest rates far outweighs the potential benefits of a bet on lower rates in the current market environment.

1Craig Torres, “Lacker Says Markets May Be Surprised by Pace of Rate Rise,” Bloomberg, 8/4/14.

2Source: Bloomberg, as of 7/31/14.

Stronger Economic Data + Complacency = Higher Rates

During the last week of July 2014, market participants saw a barrage of economic data that seemed to corroborate the same message: the U.S. economy is continuing to grow, and the labor force is continuing to recover. Given that the Fed has focused on both of these factors as preconditions for eventually raising short-term interest rates, the Treasury market took notice. In the week after the better-than-expected economic data was released, U.S. two-year bond yields broke through 0.51%, the recent high that was set in September 2013 when the market was convinced that then-Fed Chairman Ben Bernanke would start “tapering” the Fed’s bond-buying program.

While the spike and eventual retracement in two-year yields may point to concerns about future tightening, longer maturities seem to paint a different picture. U.S. 10 Year and 30-Year Treasury yields are a full 44 and 57 basis points lower, respectively, than they were in September 2013.2 In this scenario, the yield curve has flattened, narrowing the spread between these maturities and the two-year. This is consistent with investors being rewarded less for assuming additional interest rate risk. Put another way, we believe that the prospect of higher rates has increased, but the cost of hedging this risk has decreased.

How to Hedge

On December 18, 2013, the Fed began to reduce the pace of its asset purchases, and WisdomTree launched a suite of Funds that investors can use to help mitigate interest rate risk in their bond portfolios. In the current market environment, we believe that both the WisdomTree Barclays U.S. Aggregate Bond Zero Duration Fund (AGZD) and the WisdomTree Barclays U.S. Aggregate Bond Negative Duration Fund (AGND) may appeal to a wide range of investors. In these strategies, an investor is able to maintain exposure to a basket of bonds from the Barclays U.S. Aggregate Index, combined with an interest rate overlay that targets a zero or negative five-year duration for the overall portfolio. In these strategies, the portion of the portfolio invested in bonds helps offset the cost of maintaining the interest rate overlays.

While the zero-duration strategy simply seeks to hedge the risk of rising rates, the negative duration approach is more aggressive. In a negative duration position, investor returns could be higher if interest rates rise at the intermediate part of the yield curve. However, this strategy entails more risk, since it is possible that rates may not rise (or could even fall) at that particular part of the curve. Generally, this strategy would perform well if the yield curve steepens.

Outlook

While it is possible that our current forecast may prove incorrect and interest rates may actually fall, we still favor the risk-return tradeoff embedded in this particular position. In our view, the risk of higher interest rates far outweighs the potential benefits of a bet on lower rates in the current market environment.

1Craig Torres, “Lacker Says Markets May Be Surprised by Pace of Rate Rise,” Bloomberg, 8/4/14.

2Source: Bloomberg, as of 7/31/14.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. The Funds seek to mitigate interest rate risk by taking short positions in U.S. Treasuries, but there is no guarantee this will be achieved. Derivative investments can be volatile, and these investments may be less liquid than other securities and more sensitive to the effects of varied economic conditions. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. The Funds may engage in “short sale” transactions of U.S. Treasuries where losses may be exaggerated, potentially losing more money than the actual cost of the investment, and the third party to the short sale may fail to honor its contract terms, causing a loss to the Funds. While the Funds attempt to limit credit and counterparty exposure, the value of an investment in the Funds may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of each Fund’s portfolio investments. Investing in mortgage- and asset-backed securities involves interest rate, credit, valuation, extension and liquidity risks and the risk that payments on the underlying assets are delayed, prepaid, subordinated or defaulted on. Due to the investment strategy of certain Funds, they may make higher capital gain distributions than other ETFs. Please read each Fund’s prospectus for specific details regarding each Fund’s risk profile.

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.