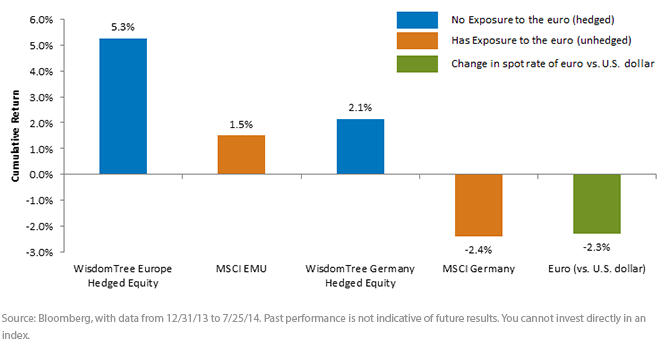

Euro Hedging Starts to Work in 2014

• Euro Depreciates More Than 2%: While the two WisdomTree Indexes hedge the impact of the euro, the two MSCI Indexes shown do not. In a depreciating euro environment, this can be an important source of potential outperformance.

• Dividend-Weighted Focus on Exporters: Both WisdomTree Indexes are weighted by dividends and focus on exporters within their respective universes. Of course, this orientation can also impact performance.

Zooming in on drivers of performance for WT Europe Hedged Equity vs. MSCI EMU:3

- Financials: Financials are currently the largest weight in the MSCI EMU Index (23.5%) but are only 13.0% of the WisdomTree Europe Hedged Equity Index. Both strong stock selection and a substantial under-weight to Financials contributed positively to performance.

- Consumer Staples: Consumer Staples are the largest sector in the WT Europe Hedged Equity currently (21%) but are only 10% of the MSCI EMU. This was one of the best-performing sectors year-to-date, contributing positively to performance. These companies often are exporters that benefit from a weaker euro.

- Utilities: Utilities were quite strong across the eurozone, but WT Europe Hedged Equity was hurt by being under-weight in this sector (2.6%) currently versus 6.5%.

Zooming in on WT Germany Hedged Equity vs. MSCI Germany: Additional outperformance came from strong stock selection within the Consumer Discretionary sector (average weight of more than 24%) and nearly double the weight to Germany’s strongest-performing sector in 2014, Utilities (more than 8% average weight). Only two sectors—Materials and Consumer Staples—hurt relative performance.4

Blending Currency Hedging with Unhedged Approaches?

We’ve been writing about currency hedging for some time, and we continue to advocate that, if an investor isn’t sure of the future direction of an international currency—in this case the euro—the baseline exposure should not be in a 100% unhedged approach. We’ve seen strong interest in currency hedging within the broader eurozone region, but those looking at the performance of German equities in particular have not yet embraced the hedged concept. Given European Central Bank policy and the trend of the euro, we believe it could be time to think about currency hedging of both broad, eurozone-related equities and German equities.

1European Central Bank, transcript of May 8, 2014, remarks after monetary policy meeting.

2Source: Bloomberg, for all euro exchange rates, as of specified dates.

3Source for sub-bullets: Bloomberg, with performance data from 12/31/13 to 7/25/14, and current sector weights as of 7/25/14.

4Source: Bloomberg, for period 12/31/13 to 7/25/14.

• Euro Depreciates More Than 2%: While the two WisdomTree Indexes hedge the impact of the euro, the two MSCI Indexes shown do not. In a depreciating euro environment, this can be an important source of potential outperformance.

• Dividend-Weighted Focus on Exporters: Both WisdomTree Indexes are weighted by dividends and focus on exporters within their respective universes. Of course, this orientation can also impact performance.

Zooming in on drivers of performance for WT Europe Hedged Equity vs. MSCI EMU:3

- Financials: Financials are currently the largest weight in the MSCI EMU Index (23.5%) but are only 13.0% of the WisdomTree Europe Hedged Equity Index. Both strong stock selection and a substantial under-weight to Financials contributed positively to performance.

- Consumer Staples: Consumer Staples are the largest sector in the WT Europe Hedged Equity currently (21%) but are only 10% of the MSCI EMU. This was one of the best-performing sectors year-to-date, contributing positively to performance. These companies often are exporters that benefit from a weaker euro.

- Utilities: Utilities were quite strong across the eurozone, but WT Europe Hedged Equity was hurt by being under-weight in this sector (2.6%) currently versus 6.5%.

Zooming in on WT Germany Hedged Equity vs. MSCI Germany: Additional outperformance came from strong stock selection within the Consumer Discretionary sector (average weight of more than 24%) and nearly double the weight to Germany’s strongest-performing sector in 2014, Utilities (more than 8% average weight). Only two sectors—Materials and Consumer Staples—hurt relative performance.4

Blending Currency Hedging with Unhedged Approaches?

We’ve been writing about currency hedging for some time, and we continue to advocate that, if an investor isn’t sure of the future direction of an international currency—in this case the euro—the baseline exposure should not be in a 100% unhedged approach. We’ve seen strong interest in currency hedging within the broader eurozone region, but those looking at the performance of German equities in particular have not yet embraced the hedged concept. Given European Central Bank policy and the trend of the euro, we believe it could be time to think about currency hedging of both broad, eurozone-related equities and German equities.

1European Central Bank, transcript of May 8, 2014, remarks after monetary policy meeting.

2Source: Bloomberg, for all euro exchange rates, as of specified dates.

3Source for sub-bullets: Bloomberg, with performance data from 12/31/13 to 7/25/14, and current sector weights as of 7/25/14.

4Source: Bloomberg, for period 12/31/13 to 7/25/14. Important Risks Related to this Article

Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.