Answering the Call for Income in Developed Markets

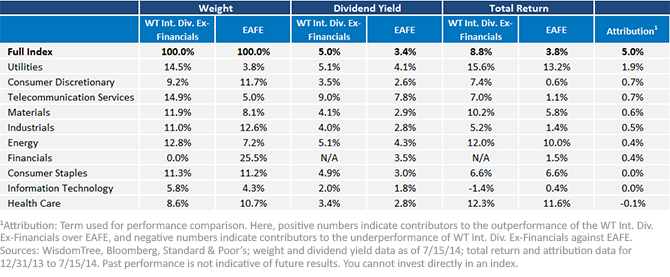

• Approximately 50% Exposure to Defensive Sectors: We consider the defensive sectors to be Utilities, Telecommunication Services, Health Care and Consumer Staples. In both EAFE and WT Int. Div. Ex-Financials, Utilities and Telecommunication Services are among the highest-yielding sectors. A critical difference regards the weighting—in the WisdomTree Index, approximately 10% more weight was allocated to each of these sectors, as of July 15, 2014.

o Beyond that, we can call attention to the methodology behind WT Int. Div. Ex-Financials. On an annual basis3, outside of Financials, the 300 largest constituents from the WisdomTree DEFA Index are selected. From there, the 10 highest-yielding stocks from each of the remaining nine sectors are selected. These are weighted on the basis of their dividend yields. EAFE is simply weighted by a function of float-adjusted market capitalization. We believe that WisdomTree’s focus on yield is the critical factor behind this Index’s strong performance during this period.

• Nine out of 10 Sectors Contribute Positively to Relative Performance: The attribution column of the table is also informative. The biggest contribution to WT Int. Div. ex-Financials’ outperformance of EAFE came from the Utilities sector. We’re not surprised by this—Utilities are a common starting point for people seeking potentially stable dividend income from equities, as they tend to have stable cash flows and slow but incremental growth, and, in this sector, it is difficult for new entrants to upset the balance of established competitors. The fact that the attribution was positive in every other sector except Health Care, however, is a strong sign and really speaks to WT Int. Div. ex-Financials’ preference for higher-yielding stocks across nearly all sectors.

o It’s worth noting that, even though Health Care was the lone detractor from relative performance, it was still one of the top-performing sectors, as its defensive, income-generating nature was in favor. It just so happens that EAFE had the greater weight to the sector, which gave it the advantage.

Where May We Go from Here?

It’s worth remembering that, at the end of 2013, there was a widespread consensus that interest rates would continue to exhibit a rising trend in 2014—something that has, thus far, turned out to be incorrect, especially when measured using the U.S. 10-Year Treasury note.4 This unexpected behavior has brought higher-yielding dividend payers into favor as potential sources of income replacement. Should rates begin to rise, we might change our view of WT Int. Div. ex-Financials as the most favorably positioned Index, but so long as developed market interest rates remain low, we think it has the potential to zero in on dividend-yield opportunities across developed markets outside the United States.

For the full research on the WisdomTree International Developed Indexes rebalance, click here.

1Refers to the U.S. 10-Year Treasury note, which had an interest rate of 2.49% on 6/30/13 and an interest rate of 3.03% on 12/31/13. Source: Bloomberg.

2We audited the behavior of 10-year government bond yields in five large markets in the MSCI EAFE Index universe of developed international markets. Yields for 10-year government bonds from 7/15/14 and 12/31/13 respectively were: Japan: down to 0.539% from 0.735%; United Kingdom: down to 2.64% from 3.02%; Germany: down to 1.20% from 1.93%; Spain: down to 2.71% from 4.15%; Australia: down to 3.44% from 4.24%. Source: Bloomberg.

3Annual basis refers to the annual Index screening date, 5/31, for WT Int. Div. ex-Financials.

4Source: Bloomberg, with data from 12/31/13 to 7/15/14.

• Approximately 50% Exposure to Defensive Sectors: We consider the defensive sectors to be Utilities, Telecommunication Services, Health Care and Consumer Staples. In both EAFE and WT Int. Div. Ex-Financials, Utilities and Telecommunication Services are among the highest-yielding sectors. A critical difference regards the weighting—in the WisdomTree Index, approximately 10% more weight was allocated to each of these sectors, as of July 15, 2014.

o Beyond that, we can call attention to the methodology behind WT Int. Div. Ex-Financials. On an annual basis3, outside of Financials, the 300 largest constituents from the WisdomTree DEFA Index are selected. From there, the 10 highest-yielding stocks from each of the remaining nine sectors are selected. These are weighted on the basis of their dividend yields. EAFE is simply weighted by a function of float-adjusted market capitalization. We believe that WisdomTree’s focus on yield is the critical factor behind this Index’s strong performance during this period.

• Nine out of 10 Sectors Contribute Positively to Relative Performance: The attribution column of the table is also informative. The biggest contribution to WT Int. Div. ex-Financials’ outperformance of EAFE came from the Utilities sector. We’re not surprised by this—Utilities are a common starting point for people seeking potentially stable dividend income from equities, as they tend to have stable cash flows and slow but incremental growth, and, in this sector, it is difficult for new entrants to upset the balance of established competitors. The fact that the attribution was positive in every other sector except Health Care, however, is a strong sign and really speaks to WT Int. Div. ex-Financials’ preference for higher-yielding stocks across nearly all sectors.

o It’s worth noting that, even though Health Care was the lone detractor from relative performance, it was still one of the top-performing sectors, as its defensive, income-generating nature was in favor. It just so happens that EAFE had the greater weight to the sector, which gave it the advantage.

Where May We Go from Here?

It’s worth remembering that, at the end of 2013, there was a widespread consensus that interest rates would continue to exhibit a rising trend in 2014—something that has, thus far, turned out to be incorrect, especially when measured using the U.S. 10-Year Treasury note.4 This unexpected behavior has brought higher-yielding dividend payers into favor as potential sources of income replacement. Should rates begin to rise, we might change our view of WT Int. Div. ex-Financials as the most favorably positioned Index, but so long as developed market interest rates remain low, we think it has the potential to zero in on dividend-yield opportunities across developed markets outside the United States.

For the full research on the WisdomTree International Developed Indexes rebalance, click here.

1Refers to the U.S. 10-Year Treasury note, which had an interest rate of 2.49% on 6/30/13 and an interest rate of 3.03% on 12/31/13. Source: Bloomberg.

2We audited the behavior of 10-year government bond yields in five large markets in the MSCI EAFE Index universe of developed international markets. Yields for 10-year government bonds from 7/15/14 and 12/31/13 respectively were: Japan: down to 0.539% from 0.735%; United Kingdom: down to 2.64% from 3.02%; Germany: down to 1.20% from 1.93%; Spain: down to 2.71% from 4.15%; Australia: down to 3.44% from 4.24%. Source: Bloomberg.

3Annual basis refers to the annual Index screening date, 5/31, for WT Int. Div. ex-Financials.

4Source: Bloomberg, with data from 12/31/13 to 7/15/14.

Important Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.