Federal Reserve Tapering Part II: Emerging Market Local Debt Performance

For the definition of GBI-EM GD Index, click here.

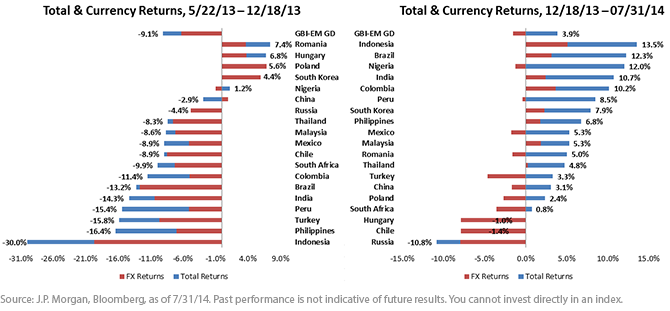

As shown in the chart above, many of the countries that were the most significant underperformers leading up to the implementation of tapering have been among the strongest outperformers so far this year. In most instances, higher income and the fall in yields from their peaks has helped many of these countries recoup losses experienced in 2013. As we noted in part one of this series, emerging market currencies have not necessarily fully participated in this recovery. In fact, only eight of 19 EM currencies in this analysis have appreciated against the U.S. dollar over this most recent period. Since tapering began in December 2013, currencies remain a modest detractor from overall returns of the asset class. In spite of this tepid rebound, total returns for investing in emerging market debt have been close to 4% over the period compared to 0.59% investing in five year U.S. Treasury bonds. In our view, this represents the fundamental value of emerging market debt. As long as currencies don’t depreciate by significant margins at the same time, emerging market fixed income can help provide investors with much greater total returns than plain-vanilla U.S. fixed income. With currency volatility continuing to be constrained so far this year, we believe that emerging market fundamentals will continue to favor currency appreciation in the long run.

Emerging Market Fixed Income Returns: May 22, 2013 – July 31, 2014

For the definition of GBI-EM GD Index, click here.

As shown in the chart above, many of the countries that were the most significant underperformers leading up to the implementation of tapering have been among the strongest outperformers so far this year. In most instances, higher income and the fall in yields from their peaks has helped many of these countries recoup losses experienced in 2013. As we noted in part one of this series, emerging market currencies have not necessarily fully participated in this recovery. In fact, only eight of 19 EM currencies in this analysis have appreciated against the U.S. dollar over this most recent period. Since tapering began in December 2013, currencies remain a modest detractor from overall returns of the asset class. In spite of this tepid rebound, total returns for investing in emerging market debt have been close to 4% over the period compared to 0.59% investing in five year U.S. Treasury bonds. In our view, this represents the fundamental value of emerging market debt. As long as currencies don’t depreciate by significant margins at the same time, emerging market fixed income can help provide investors with much greater total returns than plain-vanilla U.S. fixed income. With currency volatility continuing to be constrained so far this year, we believe that emerging market fundamentals will continue to favor currency appreciation in the long run.

Emerging Market Fixed Income Returns: May 22, 2013 – July 31, 2014

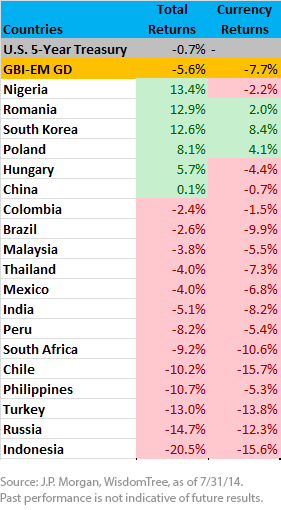

Viewing the cumulative impact of tapering since May 22, 2013 in the table above, we continue to see a high degree of dispersion in the performance of emerging market countries. Again, currencies remain much weaker against the U.S. dollar with only three (Romania, South Korea and Poland) managing to appreciate over the period since Bernanke hinted at a reduction in bond purchases. However, an interesting element of this analysis shows that six out of 19 of these markets are no worse off than investing in U.S. 5-year Treasuries over this period. While volatility is undeniably higher for emerging market fixed income, yields of 1.75% in the United States provide limited options for attractive returns if rates rise by even a modest amount, in our view.

In sum, we continue to believe in the long-term story of investing in emerging market local debt. While currency performance has served as a headwind to total returns, we do not believe this will be the case in perpetuity. In our view, faster economic growth, improving fundamental balances and increases in investor sentiment should continue to provide a positive backdrop for emerging market fixed income in the long run.

1EM local debt represented by the J.P. Morgan Government Bond Index Emerging Markets (GBI-EM) Global Diversified

2As of 7/31/14.

Viewing the cumulative impact of tapering since May 22, 2013 in the table above, we continue to see a high degree of dispersion in the performance of emerging market countries. Again, currencies remain much weaker against the U.S. dollar with only three (Romania, South Korea and Poland) managing to appreciate over the period since Bernanke hinted at a reduction in bond purchases. However, an interesting element of this analysis shows that six out of 19 of these markets are no worse off than investing in U.S. 5-year Treasuries over this period. While volatility is undeniably higher for emerging market fixed income, yields of 1.75% in the United States provide limited options for attractive returns if rates rise by even a modest amount, in our view.

In sum, we continue to believe in the long-term story of investing in emerging market local debt. While currency performance has served as a headwind to total returns, we do not believe this will be the case in perpetuity. In our view, faster economic growth, improving fundamental balances and increases in investor sentiment should continue to provide a positive backdrop for emerging market fixed income in the long run.

1EM local debt represented by the J.P. Morgan Government Bond Index Emerging Markets (GBI-EM) Global Diversified

2As of 7/31/14.Important Risks Related to this Article

Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations.