Is the Euro the New Yen?

Why Have Correlations Turned Negative and Japan-like? Is This a Replay of the ’90s?

There was a nine-year stretch between September 1, 1992, and May 31, 2001, when European currencies in the MSCI EMU Index depreciated 40.2% cumulatively versus the U.S. dollar, and EMU stocks in local currency terms had one of their best stretches ever, returning 19.8% per year. On a trade-weighted basis, European currencies declined 27.9% over the same period. This period alone suggests the European markets can perform well during times when the euro declines.

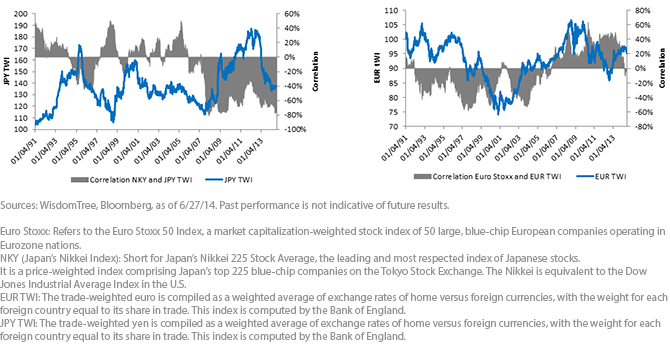

More broadly, in the 1,226 rolling 52-week periods examined from January 1991 through June 2014, the Euro Stoxx 50 had a negative correlation to the European currencies, measured on a trade-weighted index, 59.4% of the time. The Nikkei 225 Index had a negative correlation to the yen only 56.1% of the time, albeit with very highly negative correlations that began showing up in late 2007.

Below are three rationales for the euro becoming more negatively correlated, as suggested by Valentin Marinov and his research team at Citi.

• Quantitative Easing (QE) to Buoy Equity Markets and Simultaneously Weaken EUR: In light of the new policy measures announced at the June European Central Bank (ECB) meeting, many anticipate more policy action on the asset-purchase front, also referred to as QE. The expectation for more ECB action is underpinned by flat-lining growth expectations and mounting disinflation fears in the Eurozone. As was the case in Japan, this could lead to currency weakness and simultaneous stock-market outperformance, resulting in an even more negative correlation.

• Aggressive Policy Action to Encourage Currency-Hedging Activity: Through verbal intervention, negative deposit rates and other liquidity infusions (targeted longer-term refinancing operations); the ECB could succeed in guiding markets toward a weaker euro. This could ultimately result in more currency-hedging activity from foreign investors, who are further encouraged by the miniscule cost of hedging at 0.1% annually.2 Citi argues that increased currency hedging can lead to EUR underperformance, even if foreign inflows continue into the asset markets in Europe. As I argued here, it appears that Draghi is determined to cap the euro’s upside potential, rendering the currency a source of unrewarded volatility.

• EUR the New Carry Currency: As Japan returns to an environment of inflation and higher growth, the Eurozone might be fighting an uphill battle of lower-for-longer growth and persistent disinflation. Additionally, the ECB might only be in its early innings of policy easing, and its actions have thus far supported risky assets through lower bond yields and higher asset prices. The euro, as Citi suggests, is becoming the new funding currency, which should serve to further support European stocks while weakening the currency.

The Case for Euro Hedging

Given that many of the themes discussed above are likely to play out over the course of the next few years, negative correlations in the Eurozone may very well persist and become even more negative.

WisdomTree believes currency-hedged investment strategies are growing in prominence due to shifting policy winds among global central banks. While the ECB has newly embarked on aggressive easing measures, the U.S. Federal Reserve is well on its way to ending QE late in 2014 and is largely expected to begin raising rates in the middle of 2015. This policy dichotomy could signal potential for a stronger dollar in the months ahead. From this standpoint, I believe we are in the very early stages of flows heading toward currency-hedged strategies—especially for Europe.

1Sources: WisdomTree, Bloomberg, as of 6/30/14.

2Source: Bloomberg, as of 5/31/14.

Why Have Correlations Turned Negative and Japan-like? Is This a Replay of the ’90s?

There was a nine-year stretch between September 1, 1992, and May 31, 2001, when European currencies in the MSCI EMU Index depreciated 40.2% cumulatively versus the U.S. dollar, and EMU stocks in local currency terms had one of their best stretches ever, returning 19.8% per year. On a trade-weighted basis, European currencies declined 27.9% over the same period. This period alone suggests the European markets can perform well during times when the euro declines.

More broadly, in the 1,226 rolling 52-week periods examined from January 1991 through June 2014, the Euro Stoxx 50 had a negative correlation to the European currencies, measured on a trade-weighted index, 59.4% of the time. The Nikkei 225 Index had a negative correlation to the yen only 56.1% of the time, albeit with very highly negative correlations that began showing up in late 2007.

Below are three rationales for the euro becoming more negatively correlated, as suggested by Valentin Marinov and his research team at Citi.

• Quantitative Easing (QE) to Buoy Equity Markets and Simultaneously Weaken EUR: In light of the new policy measures announced at the June European Central Bank (ECB) meeting, many anticipate more policy action on the asset-purchase front, also referred to as QE. The expectation for more ECB action is underpinned by flat-lining growth expectations and mounting disinflation fears in the Eurozone. As was the case in Japan, this could lead to currency weakness and simultaneous stock-market outperformance, resulting in an even more negative correlation.

• Aggressive Policy Action to Encourage Currency-Hedging Activity: Through verbal intervention, negative deposit rates and other liquidity infusions (targeted longer-term refinancing operations); the ECB could succeed in guiding markets toward a weaker euro. This could ultimately result in more currency-hedging activity from foreign investors, who are further encouraged by the miniscule cost of hedging at 0.1% annually.2 Citi argues that increased currency hedging can lead to EUR underperformance, even if foreign inflows continue into the asset markets in Europe. As I argued here, it appears that Draghi is determined to cap the euro’s upside potential, rendering the currency a source of unrewarded volatility.

• EUR the New Carry Currency: As Japan returns to an environment of inflation and higher growth, the Eurozone might be fighting an uphill battle of lower-for-longer growth and persistent disinflation. Additionally, the ECB might only be in its early innings of policy easing, and its actions have thus far supported risky assets through lower bond yields and higher asset prices. The euro, as Citi suggests, is becoming the new funding currency, which should serve to further support European stocks while weakening the currency.

The Case for Euro Hedging

Given that many of the themes discussed above are likely to play out over the course of the next few years, negative correlations in the Eurozone may very well persist and become even more negative.

WisdomTree believes currency-hedged investment strategies are growing in prominence due to shifting policy winds among global central banks. While the ECB has newly embarked on aggressive easing measures, the U.S. Federal Reserve is well on its way to ending QE late in 2014 and is largely expected to begin raising rates in the middle of 2015. This policy dichotomy could signal potential for a stronger dollar in the months ahead. From this standpoint, I believe we are in the very early stages of flows heading toward currency-hedged strategies—especially for Europe.

1Sources: WisdomTree, Bloomberg, as of 6/30/14.

2Source: Bloomberg, as of 5/31/14.

Important Risks Related to this Article

Investments focused in Japan are increasing the impact of events and developments associated with the region, which can adversely affect performance. Investments focused in Europe are increasing the impact of events and developments associated with the region, which can adversely affect performance. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. ALPS is not affiliated with Citi.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.