Rising Rates and the U.S. Dollar

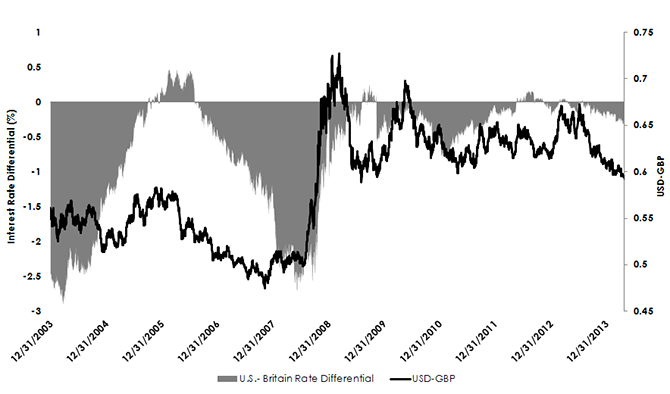

U.S. & Britain: 2- Year Interest Rate Differentials vs. Exchange Rates

U.S. & Britain: 2- Year Interest Rate Differentials vs. Exchange Rates

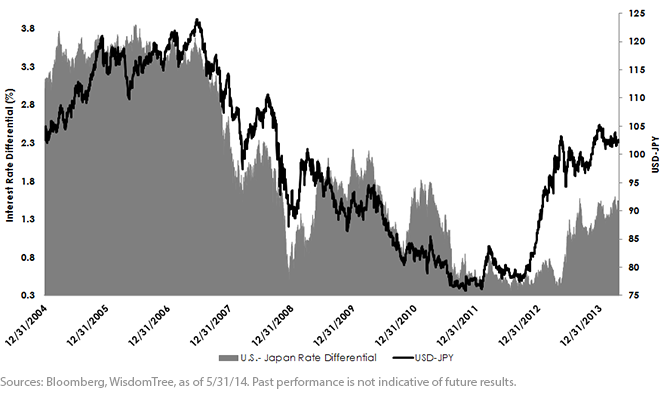

U.S. & Japan: 5-Year Interest Rate Differentials vs. Exchange Rates

U.S. & Japan: 5-Year Interest Rate Differentials vs. Exchange Rates

This phenomenon can largely be explained by the change in the relative costs associated with holding foreign currencies against the dollar. In countries where the interest rate differential is positive, these currencies tend to attract capital to take advantage of higher interest rates compared to lower-yielding alternatives. As we have noted previously on our blog, the costs associated with hedging a foreign currency are primarily driven by these relative interest rate differentials.

Swings in the Central Bank Policy Pendulum

While relative interest rates can often explain a large percentage of relative moves in currencies, these differences are clearly not the only determinant over time. As various pieces of economic or trade data are released, traders attempt to adjust their positioning and prices to account for new information.

Currencies react to supply and demand.

Recently, the currency markets had to digest a great deal of posturing by central bankers. On June 5, European Central Bank (ECB) president Mario Draghi announced new initiatives to inject liquidity into the eurozone via negative deposit rates. As a result, the euro weakened against the U.S. dollar. In Great Britain, Bank of England (BOE) governor Mark Carney warned that rates may rise “sooner than markets currently expect.” As a result, the British pound rose in value compared to the U.S. dollar. In both instances, potential changes in the economic outlook and the outlook for monetary policy had a strong impact on the value of the currencies against one another. In our view, the Federal Reserve and BOE are in a dead heat for who will hike rates first in 2015. In the case of Europe, we believe that a primary objective of ECB policy going forward will be to weaken the euro in order to help the European economy grow via cheaper exports.

Ultimately, we believe investors will continue to take a greater interest in the role that currency plays on their increasingly global portfolios. As this awareness increases, we believe that many will seek to express these views through currency and currency-hedged equity exchange-traded funds.

This phenomenon can largely be explained by the change in the relative costs associated with holding foreign currencies against the dollar. In countries where the interest rate differential is positive, these currencies tend to attract capital to take advantage of higher interest rates compared to lower-yielding alternatives. As we have noted previously on our blog, the costs associated with hedging a foreign currency are primarily driven by these relative interest rate differentials.

Swings in the Central Bank Policy Pendulum

While relative interest rates can often explain a large percentage of relative moves in currencies, these differences are clearly not the only determinant over time. As various pieces of economic or trade data are released, traders attempt to adjust their positioning and prices to account for new information.

Currencies react to supply and demand.

Recently, the currency markets had to digest a great deal of posturing by central bankers. On June 5, European Central Bank (ECB) president Mario Draghi announced new initiatives to inject liquidity into the eurozone via negative deposit rates. As a result, the euro weakened against the U.S. dollar. In Great Britain, Bank of England (BOE) governor Mark Carney warned that rates may rise “sooner than markets currently expect.” As a result, the British pound rose in value compared to the U.S. dollar. In both instances, potential changes in the economic outlook and the outlook for monetary policy had a strong impact on the value of the currencies against one another. In our view, the Federal Reserve and BOE are in a dead heat for who will hike rates first in 2015. In the case of Europe, we believe that a primary objective of ECB policy going forward will be to weaken the euro in order to help the European economy grow via cheaper exports.

Ultimately, we believe investors will continue to take a greater interest in the role that currency plays on their increasingly global portfolios. As this awareness increases, we believe that many will seek to express these views through currency and currency-hedged equity exchange-traded funds.Important Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments focused in Europe are increasing the impact of events and developments associated with the region, which can adversely affect performance.