Japanese Dividends Set New Highs

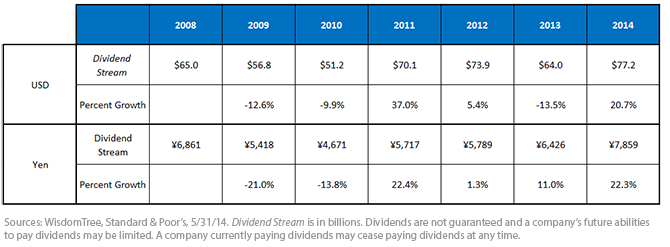

• Japan Dividend Stream Reaches New High – The Dividend Stream has reached a new high of ¥7.86 trillion, an increase of 14.6% from the 2008 high. In dollar terms, the Dividend Stream also reached a new high of $77.2 billion, an increase of 4.5% from the 2012 high.

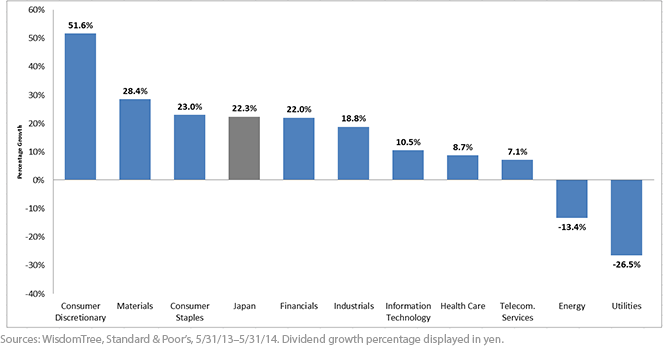

The most recent annual dividend growth was led by larger companies such as Toyota that are typically more export focused and benefited from a weaker yen.2 Even though the total dollar value of dividend growth was up significantly more than the median or typical stock’s dividend growth, growth was still broad based, with increases across eight out of 10 sectors.

Figure 2: Sector Dividend Stream Growth

• Japan Dividend Stream Reaches New High – The Dividend Stream has reached a new high of ¥7.86 trillion, an increase of 14.6% from the 2008 high. In dollar terms, the Dividend Stream also reached a new high of $77.2 billion, an increase of 4.5% from the 2012 high.

The most recent annual dividend growth was led by larger companies such as Toyota that are typically more export focused and benefited from a weaker yen.2 Even though the total dollar value of dividend growth was up significantly more than the median or typical stock’s dividend growth, growth was still broad based, with increases across eight out of 10 sectors.

Figure 2: Sector Dividend Stream Growth

• Consumer Discretionary-Led Sectors – The sector displayed the highest percentage increase and became the largest cash dividend-paying sector at more than ¥1.8 trillion, representing approximately 23% of the total Dividend Stream. The growth was led by large cash increases among exporters such as Toyota Motor Corp., Panasonic and Bridgestone. Toyota and Bridgestone also had significantly higher percentage growth than the Consumer Discretionary sector, while Panasonic recently reinstated its dividend after canceling it in 2012.

• Utilities and Energy Lagged – Although both sectors saw double-digit declines in percentage growth, neither was significant in terms of the total stream because they represent the two lowest-paying sectors, each less than ¥100 billion.

Conclusion

Since Shinzo Abe was elected, Japan has been the best-performing regional market. But I take comfort in the fact that the overall valuations of Japanese stocks, even after impressive price gains, have actually become cheaper on a price-to-earnings basis because earnings increased even more; note that this stands in stark contrast to the situation of European or United States indexes, where smaller gains were all driven by market price-to-earnings ratios rising.

Two key initiatives from Abenomics’ third-arrow reforms revolve around corporate governance and investor stewardship. Both reform initiatives are designed to encourage companies to become better allocators of capital and encourage them to use their stockpiles of cash, leading to more distributions to shareholders. We see this trend of higher dividend payouts as sustainable for some time, especially as profits continue to increase.

To read the full research on our Japan Index rebalance, click here.

1Source:WisdomTree, Bloomberg, as of 05/31/14.

2Toyota was a 0.98% weight in the WisdomTree DEFA Index as of 6/24/14

• Consumer Discretionary-Led Sectors – The sector displayed the highest percentage increase and became the largest cash dividend-paying sector at more than ¥1.8 trillion, representing approximately 23% of the total Dividend Stream. The growth was led by large cash increases among exporters such as Toyota Motor Corp., Panasonic and Bridgestone. Toyota and Bridgestone also had significantly higher percentage growth than the Consumer Discretionary sector, while Panasonic recently reinstated its dividend after canceling it in 2012.

• Utilities and Energy Lagged – Although both sectors saw double-digit declines in percentage growth, neither was significant in terms of the total stream because they represent the two lowest-paying sectors, each less than ¥100 billion.

Conclusion

Since Shinzo Abe was elected, Japan has been the best-performing regional market. But I take comfort in the fact that the overall valuations of Japanese stocks, even after impressive price gains, have actually become cheaper on a price-to-earnings basis because earnings increased even more; note that this stands in stark contrast to the situation of European or United States indexes, where smaller gains were all driven by market price-to-earnings ratios rising.

Two key initiatives from Abenomics’ third-arrow reforms revolve around corporate governance and investor stewardship. Both reform initiatives are designed to encourage companies to become better allocators of capital and encourage them to use their stockpiles of cash, leading to more distributions to shareholders. We see this trend of higher dividend payouts as sustainable for some time, especially as profits continue to increase.

To read the full research on our Japan Index rebalance, click here.

1Source:WisdomTree, Bloomberg, as of 05/31/14.

2Toyota was a 0.98% weight in the WisdomTree DEFA Index as of 6/24/14Important Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments focused in Japan are increasing the impact of events and developments associated with the region, which can adversely affect performance. Dividends are not guaranteed and a company’s future abilities to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.