Emerging market equities have not been much comfort to investors in 2014. We’ve had a number of detailed discussions on our blog about our

Emerging Markets Equity Income Fund (DEM), which tracks the performance of our

Emerging Markets Equity Income Index —an Index designed to locate some of the best

valuation opportunities across

dividend-paying emerging markets stocks.

Sometimes Value Investing Requires Patience

In many cases, finding what might look inexpensive in an equity market is only part of the battle. A bigger issue is being able to maintain the conviction in the face of how what is inexpensive may not appreciate in price immediately. We’ve had many of those discussions with regard to DEM, particularly about the Russian Energy and Chinese Financials sectors. These are some of the most inexpensive areas of emerging markets today, and they have been prominent holdings within DEM since June 2012. For current holdings of DEM click

here.

A critical question from investors has not been whether these stocks may represent a buying opportunity from a valuation perspective; on that point we’ve seen wide agreement. Rather, a critical question—and one we could never answer with perfect certainty—is

when might there be a catalyst to shift sentiment that could potentially allow these sectors to rally?

Case Study of the Past Two Months

Since every rally starts somewhere, we decided to take a look at Russian Energy and Chinese Financials stocks over the past two months—specifically March 21 to May 23, 2014. At the start of this period, concerns over Russia’s actions in Ukraine were in full swing. Additionally, it seems like each year China comes into the news with the potential of an economic “hard-landing”—meaning in essence a quick transition from economic growth to economic recession. Central to this discussion in China’s equity markets are large, state-owned financial institutions, as the feeling is that if China does run into economic problems, these companies may be at the center of the storm.

Over the course of this period, each of DEM’s top three holdings within the Russian Energy and Chinese Financials sectors announced a dividend increase.

1 The reason we mention this is simple: Each of these companies has committed to distribute more cash to its shareholders. Our viewpoint is that this may indicate that the situation—both within these Chinese Financials as well as these Russian Energy companies—may not be as dire as what was being reported in March 2014 when negative sentiment was widespread, and we’ve actually analyzed dividend increases broadly in

China and

Russia in prior blogs. Of course, these dividend announcements shouldn’t be taken as an indication that these firms are risk-free—far from it, and we also recognize that this is a short-term period and there is no way to know with certainty whether it will continue. We just believe it may be time to take a second look at what we believe to be attractive valuation opportunities in emerging markets, as opposed to having a knee-jerk reaction to avoid these firms.

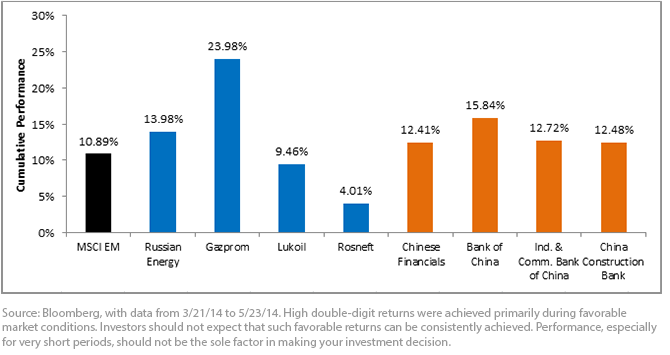

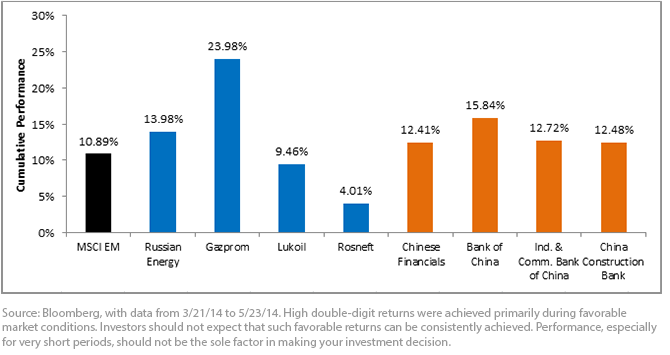

Taking a step back for a moment, we set up a series of comparisons of performance back to the broad

MSCI Emerging Markets Index (MSCI EM). Ultimately, this is the emerging markets benchmark that many look to when judging the performance of the asset class. To it, we compare the performance of Chinese Financials sector stocks within DEM, as well as the Russian Energy sector stocks. While we recognize that the MSCI EM is a broad emerging market benchmark, its ultimate performance is heavily related to people’s feelings about emerging markets, and those feelings are presently tied to Russia’s and China’s activities. Within Russia’s and China’s equity markets, Energy and Financials are the dominant sectors, both if weighting by market capitalization, as the MSCI EM does, and if weighting by dividends, as the WisdomTree Emerging Markets Equity Income Index does.

We also look at the performance of the top three individual holdings within each of these sectors, which are responsible for the majority of DEM’s exposures within each. It’s important to note that within the MSCI EM these are also larger positions that are influential in determining the overall performance generated by the MSCI EM’s China and Russia exposure.

•

Russian Energy Stocks within DEM: As a sector, Russian Energy stocks within DEM outperformed the MSCI Emerging Markets Index (MSCI EM) by approximately 3% over this period. The bulk of this performance came from Gazprom (average weight of 5.27% for period). Lukoil (average weight of 2.18% for period) and Rosneft (average weight of 4.13% for period) clearly did not perform as well. We believe that the major catalyst for Gazprom’s performance was the striking of an important natural gas supply deal with China—38 billion cubic meters per year for 30 years—which could have a value of approximately $400 billion.

2 This deal had been under negotiations for 15 years and eliminates an important source of uncertainty hanging over the company’s stock price. Still, after this positive performance, each of these three stocks had price-to-earnings

(P/E) ratios below 5.6x. As of the same time, the MSCI EM had a P/E ratio of 11.1x.

3

•

Chinese Financials within DEM: As a sector, Chinese Financials within DEM outperformed the MSCI EM by approximately 1.5% over this period. Relative to what we saw in the Russian Energy sector, the performance of DEM’s top three holdings in the sector was clustered much more closely together. China Construction Bank (average weight of 4.38% for period) led the way, but Industrial & Commercial Bank of China (average weight of 3.13% for period) and Bank of China (average weight of 2.04% for period) also outperformed the MSCI EM. After this period of positive performance, each of these three stocks still had a P/E ratio below 5.0x.

4

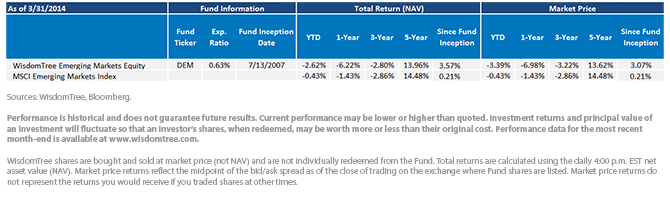

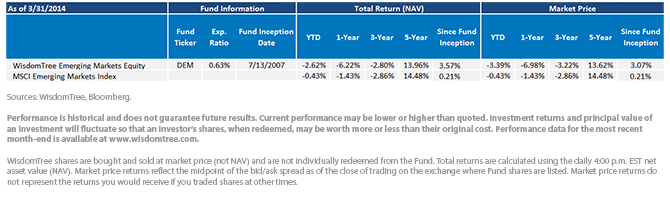

Average Annual Returns for DEM

Cumulative Performance over Last Two Months (3/21/14–5/23/14)

Cumulative Performance over Last Two Months (3/21/14–5/23/14)

Gauging Sentiment: Dire to Less Dire

Gauging Sentiment: Dire to Less Dire

What we seem to see here is not that the risks to Russian Energy firms or Chinese Financials have completely abated—they’ve just receded a bit and seem less immediately dire. Sometimes in emerging markets, the movement in sentiment from dire to less dire could lead to positive performance, and we look forward to seeing if this two-month rally can continue.

1Source: Bloomberg, as of 5/23/14.

2Source: Matthew Philips, “Is the Russia-China Gas Deal for Real—or Just Fumes?” Bloomberg Businessweek, 5/21/14.

3Source for P/E ratio data: Bloomberg, as of 5/23/14.

4Source: Bloomberg, as of 5/23/14.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Funds focusing on a single sector generally experience greater price volatility. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention and political developments. Investments focused in Russia and China are impacted by events and developments associated with the regions, which can adversely affect performance. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Cumulative Performance over Last Two Months (3/21/14–5/23/14)

Cumulative Performance over Last Two Months (3/21/14–5/23/14)

Gauging Sentiment: Dire to Less Dire

What we seem to see here is not that the risks to Russian Energy firms or Chinese Financials have completely abated—they’ve just receded a bit and seem less immediately dire. Sometimes in emerging markets, the movement in sentiment from dire to less dire could lead to positive performance, and we look forward to seeing if this two-month rally can continue.

1Source: Bloomberg, as of 5/23/14.

2Source: Matthew Philips, “Is the Russia-China Gas Deal for Real—or Just Fumes?” Bloomberg Businessweek, 5/21/14.

3Source for P/E ratio data: Bloomberg, as of 5/23/14.

4Source: Bloomberg, as of 5/23/14.

Gauging Sentiment: Dire to Less Dire

What we seem to see here is not that the risks to Russian Energy firms or Chinese Financials have completely abated—they’ve just receded a bit and seem less immediately dire. Sometimes in emerging markets, the movement in sentiment from dire to less dire could lead to positive performance, and we look forward to seeing if this two-month rally can continue.

1Source: Bloomberg, as of 5/23/14.

2Source: Matthew Philips, “Is the Russia-China Gas Deal for Real—or Just Fumes?” Bloomberg Businessweek, 5/21/14.

3Source for P/E ratio data: Bloomberg, as of 5/23/14.

4Source: Bloomberg, as of 5/23/14.