“We Aren’t Finished Here”: European Central Bank Policy Changes Explained

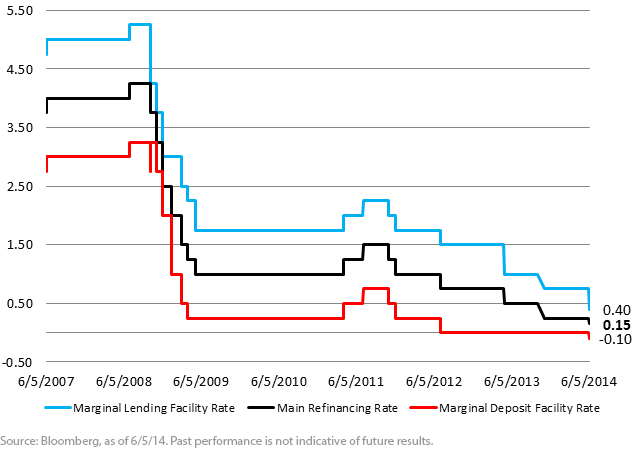

Standing Facilities

The interest rates on the marginal lending and deposit facilities normally provide a ceiling and a floor for the overnight market interest rates. Essentially, these rates create the range that banks charge one another for overnight borrowing.

Marginal Deposit Facility Rate: The rate of interest that banks receive on deposits with the central bank.

Decreased from 0.00% to -0.10% (in line with expectations)

Marginal Lending Facility Rate: The rate at which banks obtain overnight liquidity from the central bank.

Decreased from 0.75% to 0.40% (0.60% expected)

With interest rates now below zero for deposits at the ECB, this policy is meant to entice banks to lend excess cash rather than park it at the ECB. While the impact of negative interest rates is mostly symbolic, it does continue to bolster Draghi’s focus on reversing low levels of inflation.

Open Market Operations

Main Refinancing Rate: The so-called benchmark interest rate for European monetary policy.

Decreased from 0.25% to 0.15% (0.10% expected)

This rate is targeted by the ECB through one-week liquidity-providing operations referred to as main refinancing operations (MROs), as well as three-month liquidity-providing operations, referred to as longer-term refinancing operations (LTROs). MROs seek to manage short-term liquidity and interest rate targets, while LTROs seek to provide additional longer-term financing support to banks. The initial announcement of three-year LTROs in 2011 and 2012 resulted in an injection of just over €1 trillion on a gross basis.1

In this most recent announcement, the ECB expanded its lexicon to include targeted longer-term refinancing operations, which seek to improve bank lending to the euro nonfinancial private sector. Accessing this new facility will begin in two tranches in September and December and will continue quarterly for the next two years. The initial size of this program is estimated to be approximately €400 billion. The interest rates for each of the operations will reflect the main refinancing rate at the time plus a fixed spread of 10 basis points. All TLTROs from this initiative will mature in September 2018. This policy was introduced in an effort to increase lending by banks into the real economy through cheap capital.

Evolution of Nonstandard Monetary Policy

The ECB has technically had this authority, often referred to in the press as Outright Monetary Transactions, since 1999. The ECB first deployed these policies in June 2009 when it began purchasing covered bonds in order to ease liquidity and lower financing rates. During the height of the eurozone crisis in 2010, the ECB expanded this program into what is now called the Securities Markets Program (SMP).

Developed as temporary programs, the European Financial Stability Facility (EFSF) and the European Financial Stabilization Mechanism (EFSM) were established by European Union (EU) member states in order to provide assistance during times of crisis. Their primary function was to purchase one- to three-year European government debt in the secondary market in order to lower borrowing costs without violating the “no bailout” clause of the Maastricht Treaty. In order to fund these operations, the EFSF issued bonds to purchase debt of EU member states. At the time, there was concern that this new facility was essentially “printing money,” which could lead to unhealthy increases in inflation and decreases in the exchange rate. In order to allay those fears, the ECB would “sterilize” all asset purchases by draining liquidity from the money supply at weekly auctions.

As a more permanent solution, EU member states announced the formation of the European Stability Mechanism (ESM) in 2012. This facility would serve as a liquidity bridge for euro-area countries in distress to give them time to make changes in fiscal policy to ensure medium-term economic strength. Additionally, policy makers would also look to use the ESM as one way to help troubled banks recapitalize. At present, the ESM has a maximum lending capacity of €500 billion.2

Changes in Nonstandard Policy: Suspending Sterilization & Readying Purchases

Fast-forward to the meeting on June 5, 2014: The ECB announced that it would be suspending sterilization efforts from the SMP in order to increase inflation expectations and potentially weaken the exchange rate. This is expected to inject an estimated €175 billion into the banking system.3

In order to further condition the market, ECB president Draghi announced during his press conference that the ECB was preparing a “real, simple and transparent” asset-backed securities purchase program. While widely hinted at leading up to the announcement, the initiative is attempting to increase the bank’s ability to lend money into the real economy for asset purchases. By directly targeting asset-backed securities, the ECB is seeking to encourage bank lending in this specific segment of the market.

While Draghi reiterated that the ECB could do more to help the eurozone economy if needed, he continued to sound confident that economic activity was continuing to recover. Over the coming weeks, we will seek to provide greater clarity as to the direct impact these changes in policy will have for the euro, equities and bond markets.

1Source: ECB, May 2012.

2Source: ECB, as of 2/2/12.

3Source: J.P. Morgan, as of 6/5/14.

Standing Facilities

The interest rates on the marginal lending and deposit facilities normally provide a ceiling and a floor for the overnight market interest rates. Essentially, these rates create the range that banks charge one another for overnight borrowing.

Marginal Deposit Facility Rate: The rate of interest that banks receive on deposits with the central bank.

Decreased from 0.00% to -0.10% (in line with expectations)

Marginal Lending Facility Rate: The rate at which banks obtain overnight liquidity from the central bank.

Decreased from 0.75% to 0.40% (0.60% expected)

With interest rates now below zero for deposits at the ECB, this policy is meant to entice banks to lend excess cash rather than park it at the ECB. While the impact of negative interest rates is mostly symbolic, it does continue to bolster Draghi’s focus on reversing low levels of inflation.

Open Market Operations

Main Refinancing Rate: The so-called benchmark interest rate for European monetary policy.

Decreased from 0.25% to 0.15% (0.10% expected)

This rate is targeted by the ECB through one-week liquidity-providing operations referred to as main refinancing operations (MROs), as well as three-month liquidity-providing operations, referred to as longer-term refinancing operations (LTROs). MROs seek to manage short-term liquidity and interest rate targets, while LTROs seek to provide additional longer-term financing support to banks. The initial announcement of three-year LTROs in 2011 and 2012 resulted in an injection of just over €1 trillion on a gross basis.1

In this most recent announcement, the ECB expanded its lexicon to include targeted longer-term refinancing operations, which seek to improve bank lending to the euro nonfinancial private sector. Accessing this new facility will begin in two tranches in September and December and will continue quarterly for the next two years. The initial size of this program is estimated to be approximately €400 billion. The interest rates for each of the operations will reflect the main refinancing rate at the time plus a fixed spread of 10 basis points. All TLTROs from this initiative will mature in September 2018. This policy was introduced in an effort to increase lending by banks into the real economy through cheap capital.

Evolution of Nonstandard Monetary Policy

The ECB has technically had this authority, often referred to in the press as Outright Monetary Transactions, since 1999. The ECB first deployed these policies in June 2009 when it began purchasing covered bonds in order to ease liquidity and lower financing rates. During the height of the eurozone crisis in 2010, the ECB expanded this program into what is now called the Securities Markets Program (SMP).

Developed as temporary programs, the European Financial Stability Facility (EFSF) and the European Financial Stabilization Mechanism (EFSM) were established by European Union (EU) member states in order to provide assistance during times of crisis. Their primary function was to purchase one- to three-year European government debt in the secondary market in order to lower borrowing costs without violating the “no bailout” clause of the Maastricht Treaty. In order to fund these operations, the EFSF issued bonds to purchase debt of EU member states. At the time, there was concern that this new facility was essentially “printing money,” which could lead to unhealthy increases in inflation and decreases in the exchange rate. In order to allay those fears, the ECB would “sterilize” all asset purchases by draining liquidity from the money supply at weekly auctions.

As a more permanent solution, EU member states announced the formation of the European Stability Mechanism (ESM) in 2012. This facility would serve as a liquidity bridge for euro-area countries in distress to give them time to make changes in fiscal policy to ensure medium-term economic strength. Additionally, policy makers would also look to use the ESM as one way to help troubled banks recapitalize. At present, the ESM has a maximum lending capacity of €500 billion.2

Changes in Nonstandard Policy: Suspending Sterilization & Readying Purchases

Fast-forward to the meeting on June 5, 2014: The ECB announced that it would be suspending sterilization efforts from the SMP in order to increase inflation expectations and potentially weaken the exchange rate. This is expected to inject an estimated €175 billion into the banking system.3

In order to further condition the market, ECB president Draghi announced during his press conference that the ECB was preparing a “real, simple and transparent” asset-backed securities purchase program. While widely hinted at leading up to the announcement, the initiative is attempting to increase the bank’s ability to lend money into the real economy for asset purchases. By directly targeting asset-backed securities, the ECB is seeking to encourage bank lending in this specific segment of the market.

While Draghi reiterated that the ECB could do more to help the eurozone economy if needed, he continued to sound confident that economic activity was continuing to recover. Over the coming weeks, we will seek to provide greater clarity as to the direct impact these changes in policy will have for the euro, equities and bond markets.

1Source: ECB, May 2012.

2Source: ECB, as of 2/2/12.

3Source: J.P. Morgan, as of 6/5/14.

Important Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments focused in Europe may be significantly impacted by events and developments associated with the region, which can adversely affect performance.