Global Chief Investment Officer

Follow Jeremy Schwartz

The decision by the MSCI index family to upgrade Qatar and United Arab Emirates from

"frontier markets" to

"emerging markets" is causing ripple effects throughout the investment world—in both the performance of the underlying markets and shifting allocations with strategies dedicated to frontier markets.

Qatar and UAE have recently been nearly 40% of the

MSCI Frontier Markets 100 Index, and their upgrade will result in a shift in higher allocations to Kuwait, another Middle Eastern country, and Nigeria.

1

MSCI released the names of the individual securities being included in the

MSCI Emerging Markets Indexs from both Qatar and UAE. Of the 19 stocks MSCI is adding to the MSCI Emerging Markets, 16 are in the

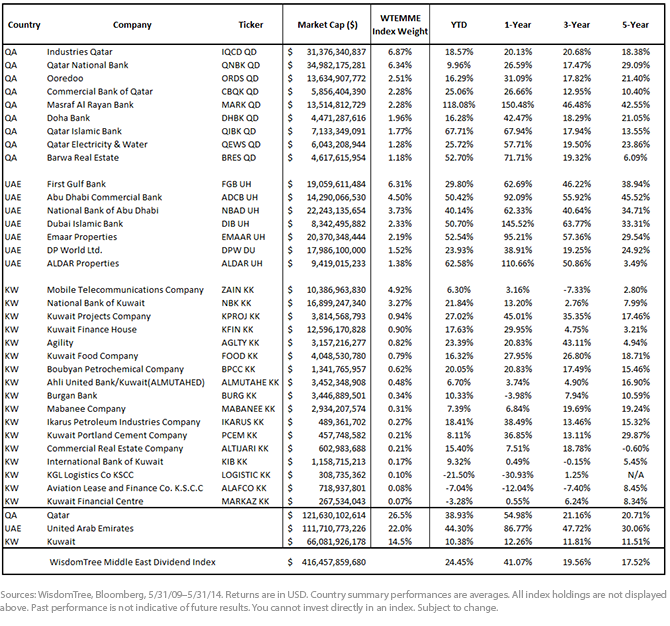

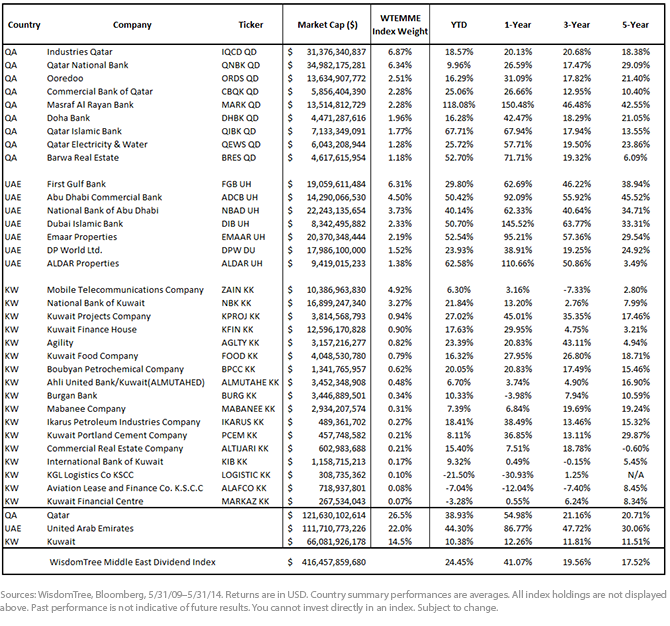

WisdomTree Middle East Dividend Index (WT Middle East); as of May 31, these 16 stocks comprised almost half the exposure of this Index. The WT Middle East thus has half its weight in stocks that will be purchased by broad-based strategies tracking the MSCI Emerging Markets Index.

But there is another Middle Eastern country in focus as a result of this transition of Qatar and UAE: Kuwait is the largest exposure in the MSCI Frontier Markets 100 Index outside of Qatar and UAE and will see an increase in weight within frontier indexes once Qatar and UAE are removed and the Index and portfolios get rebalanced. Kuwait represents approximately 15% of the exposure in the WT Middle East and together with Qatar (32%) and UAE (29%), they make up more than 75% of the WT Middle East.

2 In other words,

approximately 75% of the weight of the WT Middle East is being impacted by this transitional upgrade.

The composition of the frontier market indexes is certainly going to undertake a dramatic shift once this upgrade is completed; it is occurring in stages on a monthly basis from the end of May through November.

3 The exposures embedded in the WT Middle East offer a way to reflect what is happening in the transitional phase. For a look at the performance of the stocks being upgraded and how they compare versus the broader Middle East, we have provided the below analytics. Highlights:

• Both UAE and Qatar have outperformed the broader Middle East over the last one, three and five years.

4

• UAE stocks on average have performed better across all periods displayed below compared to Qatar, but they have underperformed if you look back to pre-financial crisis levels.

5 The financial sector makes up a large part of both markets, but it was a more significant drag on the UAE market. The financial sector has rebounded well and benefited both markets since the crisis lows.

• Kuwait stocks, although not as high as Qatar and UAE, have also been beneficiaries of this transition, with one-year average performance numbers of 12.26%. The MSCI Emerging Markets Index return over the period was 5.37%.

6 Although the outperformance is not as dramatic compared to UAE and Qatar, this is impressive given the fact that the Kuwait effect has not been a focal point of the upgrade announcement.

Many have looked at the performance of frontier market indexes as providing some diversification from general emerging market strategies, with distinct and unique profiles. A key component to the recent performance over the last three to five years in these indexes had been their Middle East exposure, which is being dramatically cut—as Qatar and UAE go from large weights in the frontier market indexes to smaller weights in the MSCI Emerging Markets Indexes. This may be motivation to increase allocations to the Middle East directly as a stand-alone allocation to help maintain the current exposure or try to participate in stocks that will see more flows with the upgrade announcement.

Middle East Summary

1

1Source: MSCI, as of 4/30/14

2Source: WisdomTree, as of 5/31/14

3Source: MSCI, MSCI Frontier Markets 100 Index Revised Methodology, April 2014

4Sources: WisdomTree, Bloomberg, as of 5/31/14

5Sources: WisdomTree, Bloomberg, 7/1/08–5/31/14

1WisdomTree, Bloomberg, 5/31/13–5/31/14. Kuwait stocks defined as MSCI Kuwait Index. The MSCI Kuwait Index is a market capitalization-weighted equity index designed to measure the performance of the Kuwaiti equity market

Important Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in emerging, offshore or frontier markets such as the Middle East are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments.

1Source: MSCI, as of 4/30/14

2Source: WisdomTree, as of 5/31/14

3Source: MSCI, MSCI Frontier Markets 100 Index Revised Methodology, April 2014

4Sources: WisdomTree, Bloomberg, as of 5/31/14

5Sources: WisdomTree, Bloomberg, 7/1/08–5/31/14

1WisdomTree, Bloomberg, 5/31/13–5/31/14. Kuwait stocks defined as MSCI Kuwait Index. The MSCI Kuwait Index is a market capitalization-weighted equity index designed to measure the performance of the Kuwaiti equity market

1Source: MSCI, as of 4/30/14

2Source: WisdomTree, as of 5/31/14

3Source: MSCI, MSCI Frontier Markets 100 Index Revised Methodology, April 2014

4Sources: WisdomTree, Bloomberg, as of 5/31/14

5Sources: WisdomTree, Bloomberg, 7/1/08–5/31/14

1WisdomTree, Bloomberg, 5/31/13–5/31/14. Kuwait stocks defined as MSCI Kuwait Index. The MSCI Kuwait Index is a market capitalization-weighted equity index designed to measure the performance of the Kuwaiti equity market