What’s Your India Portfolio Sensitivity to the Rupee?

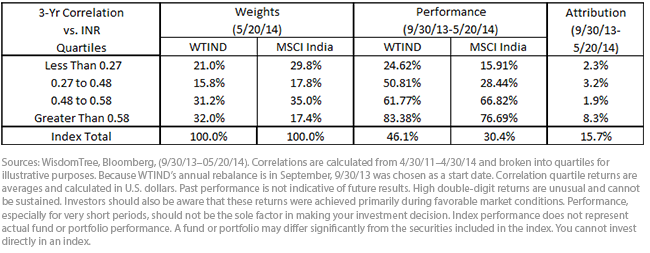

• High Correlation Over-Weight Led Outperformance – WTIND’s over-weight exposure to the highest correlation bucket of stocks added more than 8% of outperformance compared to the MSCI India Index. This is impressive considering it accounted for more than half the total 15.7% outperformance during the period.

• More Weight in Higher Correlated Stocks – The WTIND had almost 2x more weight in firms with the highest rupee sensitivity and almost two-thirds of its weights in firms within the highest two correlation buckets. WTIND is currently over-weight the Financials and Energy sectors and under-weight Information Technology and Consumer Staples. Over the past three years, the former sectors showed a higher degree of correlation than the latter sectors.

• Higher Correlated Firms Outperformed – Firms within the highest quartile outperformed firms in the lowest quartile by around 60% within both WTIND and MSCI India. Although the performance differentials among quartiles for the indexes were similar, WTIND was able to outperform over the period as a result of its over-weight to stocks within the highest correlation quartiles.

Weighting by Earnings Focuses on Lower Price-to-Earnings (P/E) Ratios

In order to garner significant weights in the WTIND Index, the index methodology requires that a company grow its profits rather than increase its market capitalization. As a result, we can generalize the impact of the rebalance as follows:

• Typical Additions in Weight – Firms whose share prices may have performed poorly or stayed flat but whose earnings increased

• Typical Reductions in Weight – Firms whose share prices may have performed quite well but whose earnings growth was negative or flat

Last year’s rebalance saw a huge shift in weight to companies that were relatively cheap, which at the time were the stocks correlating highest to the rupee due to the crisis environment. At this year’s upcoming rebalance, after seeing large gains in these stocks, WTIND may potentially lower weight to them—especially if their recent performance trend continues. The key for understanding the process driving the WTIND: There is a dynamic process that identifies value, and last year that value was in the stocks with the highest correlation to the rupee.

Conclusion

The Indian stock market measured in local prices had already made new all-time highs, but the market measured in dollars would still need to appreciate more than 25% to reach its 2010 highs and more than 50% to reach its early 2008 highs1. Although the rupee has been a significant headwind for performance over the past few years, we feel the worst might be behind us and are intrigued by the recent relative strength of both the equity market and the rupee.

The landslide victory in the Indian election by Prime Minister Narendra Modi and his pro-business party has been supportive of the equity markets and currency. Also, the new central bank governor, Raghuram Rajan, has helped restore market confidence in the inflation-fighting credentials of the Reserve Bank of India, by proactively hiking rates to stem inflationary pressures last year. We are optimistic that a Modi-Rajan tag team may be able to rectify India’s fiscal house and unlock the country’s great potential through pro-business initiatives and reforms. If investors share this positive view on the currency and general economic potential, we believe that this market and EPI could be of particular interest.

1Source: Bloomberg, India stock market refers to the MSCI India Index, as of 5/20/14

• High Correlation Over-Weight Led Outperformance – WTIND’s over-weight exposure to the highest correlation bucket of stocks added more than 8% of outperformance compared to the MSCI India Index. This is impressive considering it accounted for more than half the total 15.7% outperformance during the period.

• More Weight in Higher Correlated Stocks – The WTIND had almost 2x more weight in firms with the highest rupee sensitivity and almost two-thirds of its weights in firms within the highest two correlation buckets. WTIND is currently over-weight the Financials and Energy sectors and under-weight Information Technology and Consumer Staples. Over the past three years, the former sectors showed a higher degree of correlation than the latter sectors.

• Higher Correlated Firms Outperformed – Firms within the highest quartile outperformed firms in the lowest quartile by around 60% within both WTIND and MSCI India. Although the performance differentials among quartiles for the indexes were similar, WTIND was able to outperform over the period as a result of its over-weight to stocks within the highest correlation quartiles.

Weighting by Earnings Focuses on Lower Price-to-Earnings (P/E) Ratios

In order to garner significant weights in the WTIND Index, the index methodology requires that a company grow its profits rather than increase its market capitalization. As a result, we can generalize the impact of the rebalance as follows:

• Typical Additions in Weight – Firms whose share prices may have performed poorly or stayed flat but whose earnings increased

• Typical Reductions in Weight – Firms whose share prices may have performed quite well but whose earnings growth was negative or flat

Last year’s rebalance saw a huge shift in weight to companies that were relatively cheap, which at the time were the stocks correlating highest to the rupee due to the crisis environment. At this year’s upcoming rebalance, after seeing large gains in these stocks, WTIND may potentially lower weight to them—especially if their recent performance trend continues. The key for understanding the process driving the WTIND: There is a dynamic process that identifies value, and last year that value was in the stocks with the highest correlation to the rupee.

Conclusion

The Indian stock market measured in local prices had already made new all-time highs, but the market measured in dollars would still need to appreciate more than 25% to reach its 2010 highs and more than 50% to reach its early 2008 highs1. Although the rupee has been a significant headwind for performance over the past few years, we feel the worst might be behind us and are intrigued by the recent relative strength of both the equity market and the rupee.

The landslide victory in the Indian election by Prime Minister Narendra Modi and his pro-business party has been supportive of the equity markets and currency. Also, the new central bank governor, Raghuram Rajan, has helped restore market confidence in the inflation-fighting credentials of the Reserve Bank of India, by proactively hiking rates to stem inflationary pressures last year. We are optimistic that a Modi-Rajan tag team may be able to rectify India’s fiscal house and unlock the country’s great potential through pro-business initiatives and reforms. If investors share this positive view on the currency and general economic potential, we believe that this market and EPI could be of particular interest.

1Source: Bloomberg, India stock market refers to the MSCI India Index, as of 5/20/14Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. This Fund focuses its investments in India, thereby increasing the impact of events and developments associated with the region, which can adversely affect performance. Investments in emerging, offshore or frontier markets such as India are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. As this Fund has a high concentration in some sectors, the Fund can be adversely affected by changes in those sectors. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.