India Election Spurs Gains: How to Best Participate

Click here for EPI’s standardized performance.

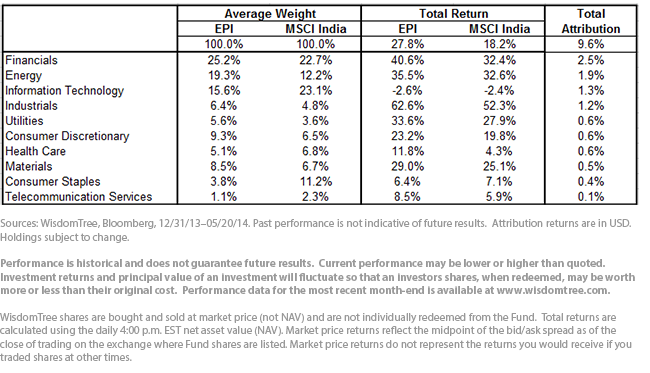

• Industrials have led the market up this year, returning over 60% during the period. Financials and Energy, the two largest sector weights in EPI, were both up over 35% through the end of the period. This is a direct reversal of last year’s disappointing performance.

• The Information Technology sector, which led the market in 2013 based on the weak rupee, was negative during the period on a stronger rupee. EPI’s under-weight position in that sector had been one of the contributing factors to its performance during the period.

• Consumer Staples, viewed as a more defensive sector and also which performed quite well in 2013, lagged the broader gains present in cyclical sectors over the most recent period. EPI’s under-weight to this sector also contributed positively to performance through the period.

Earnings Weighting Lowers the P/E Ratio

One potential concern for investors when there are such large gains in a short period is that the market may become expensive—and India historically tends to trade at premium prices versus emerging markets more generally.8 WisdomTree’s earnings-weighted approach for India helps focus on lower-priced segments of the Indian market, and the Index and Fund will rebalance in September to help manage the valuation risk from the big winners. Our research shows the WisdomTree India Earnings Index (WTIND) has historically traded at a 35% discount to the MSCI India Index since WTIND’s inception, and the discount typically widens after the rebalance.

Conclusion

Less than 12 months ago, India was considered part of a group of “fragile” emerging market countries with large vulnerabilities that sent its currency into a tailspin. The first start to improved sentiment came with the appointment of a new head of the Indian central bank, Dr. Raghuram Rajan. Rajan’s appointment coincided with the lows for the rupee and the bottom of the equity markets after he aggressively hiked interest rates to combat high levels of inflation. A worry concerning this policy was that it would hamper economic growth by raising the cost to borrow money. But now, with the new government, growth sentiment is improving.

With the tag team of Modi-Rajan, investors are seeking more gains for India. WisdomTree is a long-term bull for India based on its very favorable demographic trends. A key risk for India has typically been very high market expectations, high inflation rates and government corruption, which has been a bottleneck on the economy. The trends appear to be going in the right direction. For those looking for continued improvement, having EPI—which is broadly representative of the Indian market and economy but also employs a process to manage equity valuation risk—as part of their equity strategy might be an attractive way to gain exposure to India.

1As measured by MSCI India Index measured in local prices

2Source: WisdomTree, as of 5/20/14. Holdings subject to change

3Sources: WisdomTree, Bloomberg, as of 5/20/14

4Source: Bloomberg, as of 5/20/14

5Source: Bloomberg, 12/31/12–12/31/13

6Sources: WisdomTree, Bloomberg, 12/31/13–5/20/14

7Please keep in mind that high double-digit returns were achieved primarily during favorable market conditions. Investors should not expect that such favorable returns can be consistently achieved. A fund’s performance, especially for very short periods, should not be the sole factor in making your investment decision

8Source: Bloomberg; refers to the price-to-earnings ratio of the MSCI India Index compared to the MSCI Emerging Markets Index for the period 4/30/04–4/30/14

9Sources: WisdomTree, Bloomberg, 12/03/07–4/30/14

Click here for EPI’s standardized performance.

• Industrials have led the market up this year, returning over 60% during the period. Financials and Energy, the two largest sector weights in EPI, were both up over 35% through the end of the period. This is a direct reversal of last year’s disappointing performance.

• The Information Technology sector, which led the market in 2013 based on the weak rupee, was negative during the period on a stronger rupee. EPI’s under-weight position in that sector had been one of the contributing factors to its performance during the period.

• Consumer Staples, viewed as a more defensive sector and also which performed quite well in 2013, lagged the broader gains present in cyclical sectors over the most recent period. EPI’s under-weight to this sector also contributed positively to performance through the period.

Earnings Weighting Lowers the P/E Ratio

One potential concern for investors when there are such large gains in a short period is that the market may become expensive—and India historically tends to trade at premium prices versus emerging markets more generally.8 WisdomTree’s earnings-weighted approach for India helps focus on lower-priced segments of the Indian market, and the Index and Fund will rebalance in September to help manage the valuation risk from the big winners. Our research shows the WisdomTree India Earnings Index (WTIND) has historically traded at a 35% discount to the MSCI India Index since WTIND’s inception, and the discount typically widens after the rebalance.

Conclusion

Less than 12 months ago, India was considered part of a group of “fragile” emerging market countries with large vulnerabilities that sent its currency into a tailspin. The first start to improved sentiment came with the appointment of a new head of the Indian central bank, Dr. Raghuram Rajan. Rajan’s appointment coincided with the lows for the rupee and the bottom of the equity markets after he aggressively hiked interest rates to combat high levels of inflation. A worry concerning this policy was that it would hamper economic growth by raising the cost to borrow money. But now, with the new government, growth sentiment is improving.

With the tag team of Modi-Rajan, investors are seeking more gains for India. WisdomTree is a long-term bull for India based on its very favorable demographic trends. A key risk for India has typically been very high market expectations, high inflation rates and government corruption, which has been a bottleneck on the economy. The trends appear to be going in the right direction. For those looking for continued improvement, having EPI—which is broadly representative of the Indian market and economy but also employs a process to manage equity valuation risk—as part of their equity strategy might be an attractive way to gain exposure to India.

1As measured by MSCI India Index measured in local prices

2Source: WisdomTree, as of 5/20/14. Holdings subject to change

3Sources: WisdomTree, Bloomberg, as of 5/20/14

4Source: Bloomberg, as of 5/20/14

5Source: Bloomberg, 12/31/12–12/31/13

6Sources: WisdomTree, Bloomberg, 12/31/13–5/20/14

7Please keep in mind that high double-digit returns were achieved primarily during favorable market conditions. Investors should not expect that such favorable returns can be consistently achieved. A fund’s performance, especially for very short periods, should not be the sole factor in making your investment decision

8Source: Bloomberg; refers to the price-to-earnings ratio of the MSCI India Index compared to the MSCI Emerging Markets Index for the period 4/30/04–4/30/14

9Sources: WisdomTree, Bloomberg, 12/03/07–4/30/14Important Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. This Fund focuses its investments in India, thereby increasing the impact of events and developments associated with the region, which can adversely affect performance. Investments in emerging, offshore or frontier markets such as India are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. As this Fund has a high concentration in some sectors, the Fund can be adversely affected by changes in those sectors. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile. A fund’s performance, especially for very short time periods, should not be the sole factor in making your investment decision.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.