Emerging Market Currencies: What’s Driving the Brazilian Real’s Strong Outperformance?

As an additional policy tool, should the currency retrace from current levels and stoke inflationary fears, the central bank could help dampen price pressures by reinstituting a fresh round of currency swaps similar to ones that the central bank let expire at the end of April. In these transactions, the central bank effectively would sell U.S. dollars for Brazilian reais, giving support to the local currency. By allowing the currency to appreciate, imports become comparatively less expensive, resulting in lower prices. Additionally, exports become less attractive to foreign buyers, potentially curbing demand. Ultimately, should the BCB reinstitute its currency swap program, we believe a new wave of real buyers would come into the market, pushing the currency higher.

Declining Support and Rumors of a Cabinet Shuffle

Unfortunately for policy makers, Brazil’s currency strength is not occurring in a vacuum. With inflation at elevated levels and economic growth stagnating at less than 2%, many Brazilians have voiced their dissatisfaction with Brazilian president Dilma Rousseff and her leadership. In our view, aggressive central bank policy has not been complemented by needed reforms on the fiscal side.

Over the last several months, President Rousseff’s approval rating has continued to fall in public opinion as well as presidential polls. On April 29, the Brazilian real appreciated by more than 1% on the news that Rousseff’s popularity had fallen compared to her competition. In the local poll conducted by MDA, if the election were held then, 37% of Brazilians surveyed said they would vote for her, compared to 43.7% in February. By comparison, her strongest competitor, Aecio Neves, perceived as the most pro-business candidate, gained ground to 21.6% from 17%.

In a similar poll, her administration’s approval rating fell to 32.9% in April from 36.4% only two months earlier. While the campaign season hasn’t even jumped into high gear, the trends in these polls are clearly inspiring investors to increase bets on a shift in policy. While technically still leading in the polls, President Rousseff may be on the verge of taking steps to ingratiate herself to business interests to help reverse her fall from grace.

Rousseff’s Potential Response

Market participants have been bullishly greeting her slide in the polls as they try to place bets in front of any potential efforts to consolidate support and appease market interests. Rumors have been circulating for months about an impending Cabinet shake-up. In the most likely scenario, current central bank governor Alexandre Tombini is expected to take over Guido Mantega’s position of finance minister. Markets appear excited about this prospect. It’s hoped that Tombini’s recent comments about the importance of refocusing the government on its fiscal deficit would signal the administration’s willingness to restrain government largesse.

In Tombini’s place, Luiz Awazu Pereira da Silva, a well-respected deputy governor and international affairs director of Brazil’s central bank, is expected to take over the top spot at the BCB. With time running out before the election and tempers potentially rising along with temperatures this summer, markets are trying to get in front of this potentially positive catalyst. While Rousseff hopes that a change in economic leadership will help put the Brazilian economy back on track, many foreign investors are hoping that her competitors will gain additional ground leading up to October.

Outlook

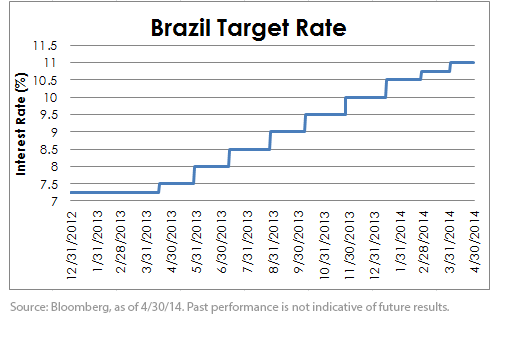

At present, many currency forecasters are predicting that the real will stay range bound leading up to the World Cup on June 12. However, should the real break through the 2.20 level on the back of strengthening demand, this could signal a shift in investor psychology, resulting in a possible move to the lows we saw last October (2.15, +3.8% appreciation).6 While interest rates are only one factor in currency trading, it is worth mentioning that rates will be a full 1.75% higher than when the currency was trading at these levels in mid-October. As we mentioned in a blog post back then, we see many potential catalysts for the real to move higher, should flows into the broader emerging markets pick up steam. While volatility in the real could increase at any time, we think it offers attractive risk-reward and total return potential near current levels.

1Source: Bloomberg, as of 4/30/14

2Banco Central do Brasil in Portuguese

3Source: Bloomberg, as of 4/30/14

4Source: Reuters, as of 2/7/14

5Source: J.P. Morgan, as of 4/30/14

6Source: Bloomberg, as of 4/30/14

As an additional policy tool, should the currency retrace from current levels and stoke inflationary fears, the central bank could help dampen price pressures by reinstituting a fresh round of currency swaps similar to ones that the central bank let expire at the end of April. In these transactions, the central bank effectively would sell U.S. dollars for Brazilian reais, giving support to the local currency. By allowing the currency to appreciate, imports become comparatively less expensive, resulting in lower prices. Additionally, exports become less attractive to foreign buyers, potentially curbing demand. Ultimately, should the BCB reinstitute its currency swap program, we believe a new wave of real buyers would come into the market, pushing the currency higher.

Declining Support and Rumors of a Cabinet Shuffle

Unfortunately for policy makers, Brazil’s currency strength is not occurring in a vacuum. With inflation at elevated levels and economic growth stagnating at less than 2%, many Brazilians have voiced their dissatisfaction with Brazilian president Dilma Rousseff and her leadership. In our view, aggressive central bank policy has not been complemented by needed reforms on the fiscal side.

Over the last several months, President Rousseff’s approval rating has continued to fall in public opinion as well as presidential polls. On April 29, the Brazilian real appreciated by more than 1% on the news that Rousseff’s popularity had fallen compared to her competition. In the local poll conducted by MDA, if the election were held then, 37% of Brazilians surveyed said they would vote for her, compared to 43.7% in February. By comparison, her strongest competitor, Aecio Neves, perceived as the most pro-business candidate, gained ground to 21.6% from 17%.

In a similar poll, her administration’s approval rating fell to 32.9% in April from 36.4% only two months earlier. While the campaign season hasn’t even jumped into high gear, the trends in these polls are clearly inspiring investors to increase bets on a shift in policy. While technically still leading in the polls, President Rousseff may be on the verge of taking steps to ingratiate herself to business interests to help reverse her fall from grace.

Rousseff’s Potential Response

Market participants have been bullishly greeting her slide in the polls as they try to place bets in front of any potential efforts to consolidate support and appease market interests. Rumors have been circulating for months about an impending Cabinet shake-up. In the most likely scenario, current central bank governor Alexandre Tombini is expected to take over Guido Mantega’s position of finance minister. Markets appear excited about this prospect. It’s hoped that Tombini’s recent comments about the importance of refocusing the government on its fiscal deficit would signal the administration’s willingness to restrain government largesse.

In Tombini’s place, Luiz Awazu Pereira da Silva, a well-respected deputy governor and international affairs director of Brazil’s central bank, is expected to take over the top spot at the BCB. With time running out before the election and tempers potentially rising along with temperatures this summer, markets are trying to get in front of this potentially positive catalyst. While Rousseff hopes that a change in economic leadership will help put the Brazilian economy back on track, many foreign investors are hoping that her competitors will gain additional ground leading up to October.

Outlook

At present, many currency forecasters are predicting that the real will stay range bound leading up to the World Cup on June 12. However, should the real break through the 2.20 level on the back of strengthening demand, this could signal a shift in investor psychology, resulting in a possible move to the lows we saw last October (2.15, +3.8% appreciation).6 While interest rates are only one factor in currency trading, it is worth mentioning that rates will be a full 1.75% higher than when the currency was trading at these levels in mid-October. As we mentioned in a blog post back then, we see many potential catalysts for the real to move higher, should flows into the broader emerging markets pick up steam. While volatility in the real could increase at any time, we think it offers attractive risk-reward and total return potential near current levels.

1Source: Bloomberg, as of 4/30/14

2Banco Central do Brasil in Portuguese

3Source: Bloomberg, as of 4/30/14

4Source: Reuters, as of 2/7/14

5Source: J.P. Morgan, as of 4/30/14

6Source: Bloomberg, as of 4/30/14Important Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Investments focused in Brazil are increasing the impact of events and developments associated with the region, which can adversely affect performance.

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.