When investors allocate to foreign stocks, they implicitly assume a secondary currency exposure on top of their local equity market returns. One of the arguments we often hear is that currencies offer no expected return in the long run; their returns are assumed to ultimately be a wash based on a concept called

purchasing power parity (PPP).

However, there is no question currencies offer a source of additional uncertainty about their potential impact on future returns. So why should the default be to assume this currency

risk if they offer no expected return? A more natural starting point would be a baseline of

hedging the currency exposure for the developed international world before adding in the secondary currency exposure when the investor has a stronger view that those currencies are going to appreciate.

To argue against currency hedging, there’s an assumption that it is expensive to hedge away that currency risk. But we discussed previously

here that the costs are currently minimal to hedge certain currencies, and one might actually get paid to hedge the developed world currencies—such as the euro or the yen—if the U.S. raises

interest rates before Europe or Japan. Even with a near-zero cost, we wonder why it is valuable to

increase the risk to investing in foreign equities

without expecting additional return—as the default option historically has been in investment vehicles that take on currency risk

unhedged.

Over the last 5 to 10 years, currency contributed approximately 25% to 35% to the total

volatility of the

MSCI EAFE Index measured in U.S. dollar terms.

1 One way to view currency-hedged strategies is to take this additional risk off the table and just get the equity market diversification.

When Is It Best to Own Foreign Markets?

Going beyond the motivation to remove a source of unrewarded volatility, there is evidence that the best time to own foreign markets is when their currencies are depreciating.

Over the last 40 years,

2 the U.S. dollar moved in secular trends that often lasted from 6 to 10 years. The latest cycle for the U.S. dollar, beginning in March 2002, represents a significant period of dollar weakness. We may be entering a period where the U.S. dollar appreciates on a sustained basis versus the developed world currencies such as the euro and yen.

The fact that the dollar is appreciating does not make these foreign markets any less attractive. Japan was a prime example of this in 2013, when the yen weakened (the U.S. dollar strengthened) and Japan was one of the best performing global equity markets. This example actually has relevance to the broader international indexes as well. Some of the very best times to own foreign markets have been when their currencies were depreciating (U.S. dollar strengthening).

Take, for instance, the period from November 1, 1978, to February 28 1985, when currency movements against the U.S. dollar reduced returns of the MSCI EAFE Index by 41.3% cumulatively, with an average annual reduction of 8.11%.

But in local currency terms, this was one of the best seven years to own the MSCI EAFE Index, which returned 16.9% per year, measured in local currency, over this period.

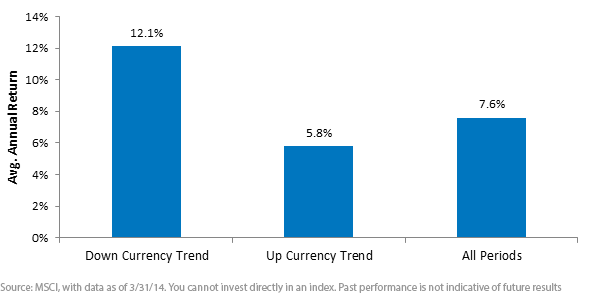

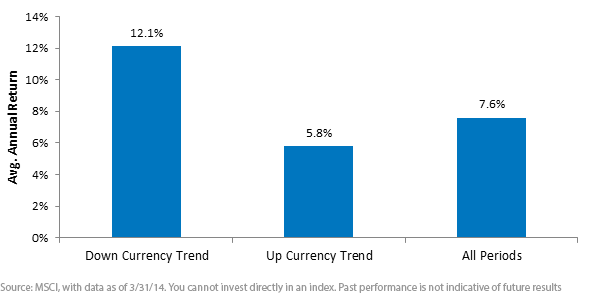

Up Currency Trends vs. Down Currency Trends

By categorizing the MSCI EAFE Index into periods when its currencies were in a “down trend” or an “up trend,” one finds that as currencies were weakening (like the yen in 2013), local equity markets strongly outperformed the periods when currencies were strengthening. The down currency periods had more than twice the average annual returns as the up currency periods.

When utilizing foreign markets and currency-hedged approaches, investors should increase allocation to foreign markets when the currencies look like they are in one of these depreciating trends. And when those currencies are appreciating, there is less reason to own those equity markets, at least judging by the historical performance record.

When Did International Equities See Their Strongest Returns?

MSCI EAFE Index in Local Currency (12/31/1969-3/31/2014)

The Importance of International Equity Exposure

The Importance of International Equity Exposure

An important justification for maintaining international investments in the face of a rising dollar is that diversification and

valuation opportunities may be better overseas. Just as investing in only 5 of the 10 sectors of the U.S. economy provides little diversification, restricting investments to just half the world (the United States

3) may not provide adequate diversification. Moreover, healthy equity returns existed in overseas markets during previous periods of U.S. dollar strength. If one were able to mitigate the negative impact of currency movements, the potential would exist to better capitalize on this occurrence. In our next blog post, we will discuss the broad-based approach to currency-hedging developed international equities that we launched.

1Sources: MSCI & Zephyr StyleADVISOR, with data as of 3/31/14

2Period: 12/31/69 to 3/31/14. Refers to the performance of the U.S. dollar against the currencies represented in the MSCI EAFE Index

3Refers to how U.S. stocks comprised nearly 50% of the weight of the MSCI ACWI Index as of 3/31/14

Important Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Investments focused in Europe or Japan may increase the impact of events and developments associated with these regions, which can adversely affect performance. Diversification does not eliminate the risk of experiencing investment losses.

The Importance of International Equity Exposure

An important justification for maintaining international investments in the face of a rising dollar is that diversification and valuation opportunities may be better overseas. Just as investing in only 5 of the 10 sectors of the U.S. economy provides little diversification, restricting investments to just half the world (the United States3) may not provide adequate diversification. Moreover, healthy equity returns existed in overseas markets during previous periods of U.S. dollar strength. If one were able to mitigate the negative impact of currency movements, the potential would exist to better capitalize on this occurrence. In our next blog post, we will discuss the broad-based approach to currency-hedging developed international equities that we launched.

1Sources: MSCI & Zephyr StyleADVISOR, with data as of 3/31/14

2Period: 12/31/69 to 3/31/14. Refers to the performance of the U.S. dollar against the currencies represented in the MSCI EAFE Index

3Refers to how U.S. stocks comprised nearly 50% of the weight of the MSCI ACWI Index as of 3/31/14

The Importance of International Equity Exposure

An important justification for maintaining international investments in the face of a rising dollar is that diversification and valuation opportunities may be better overseas. Just as investing in only 5 of the 10 sectors of the U.S. economy provides little diversification, restricting investments to just half the world (the United States3) may not provide adequate diversification. Moreover, healthy equity returns existed in overseas markets during previous periods of U.S. dollar strength. If one were able to mitigate the negative impact of currency movements, the potential would exist to better capitalize on this occurrence. In our next blog post, we will discuss the broad-based approach to currency-hedging developed international equities that we launched.

1Sources: MSCI & Zephyr StyleADVISOR, with data as of 3/31/14

2Period: 12/31/69 to 3/31/14. Refers to the performance of the U.S. dollar against the currencies represented in the MSCI EAFE Index

3Refers to how U.S. stocks comprised nearly 50% of the weight of the MSCI ACWI Index as of 3/31/14