Chinese Firms Raise Dividends 2 to 1

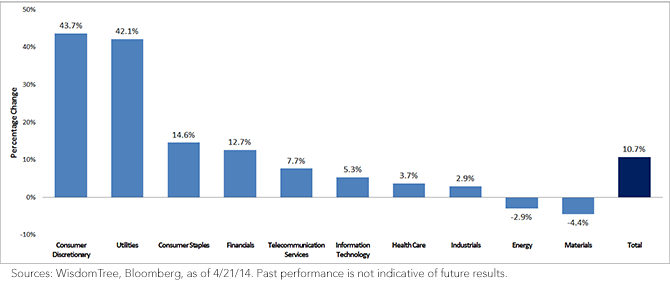

• Consumer Discretionary Displayed Highest Growth – Growth in the sector was driven by dividend increases from automobile companies. Great Wall Motor Company, Guangzhou Automobile Group and Dongfeng Motor Group all announced increases of more than 20%. I think this news is very positive and indicates that these companies have been increasing their internal cash flows and have an optimistic view of the future economy, potentially even signaling a growing class of domestic consumers.

• Financials Remain Largest Payers – The top seven Dividend Stream increases were all financial firms, and the sector remains the largest dividend-paying sector within the Index. I find it impressive that, despite having the largest payers, the sector was still able to outpace the total Index growth rate. More than 80%, or 14 out of 17 financial firms in the Index, grew their dividends by a total of 12.7%, about 2% above China’s total growth.

• Energy and Materials – These were the only two sectors that saw a Dividend Stream decrease. These two sectors have been laggards across all regional markets, mainly resulting from a slowdown in global growth and the rebalancing in China toward a consumer-driven economy and away from infrastructure- and investment-led growth. The two largest dollar decreases were both coal companies, a segment of the energy market particularly hard hit over the past few years due to demands for cleaner-burning energy and competition from increased natural gas production.

Small Caps Also Pay Dividends

When investors think of dividends, they tend to think of mature large-cap companies as their primary source. As a result, many investors may mistakenly overlook small-cap equities as attractive income options. The above analysis included 34 firms that are constituents in the WisdomTree Emerging Markets SmallCap Dividend Index. More than 70%, or 24 of the 34 firms, increased their dividends, led by the Industrial sector with 14 firms.

I find the dividend increases among smaller-capitalization firms to be a positive signal for the direction of the local economy because companies typically raise dividends when they are optimistic about their future profitability. Also, smaller firms tend to be more sensitive to the economic growth cycle, and their revenues are tied more closely to the domestic consumer. The dividend policy of these small-cap firms will be an important indicator to watch while the Chinese government transitions the economy from export-led growth to growth that’s focused more on domestic demand, with the recent dividend increases being constructive.

Conclusion

While great uncertainty remains over the success and trajectory of the Chinese economy and its financial markets, I can’t help but ask if many are too pessimistic given the positive trends in dividends, an important underlying fundamental signal. I feel the broad-based dividend growth across size capitalization and among a majority of sectors is a positive starting point for a potential turnaround, and the price-versus-valuation divergence presents an interesting investment opportunity.

For current holdings of the WisdomTree Emerging Markets Dividend Index, please click here.

• Consumer Discretionary Displayed Highest Growth – Growth in the sector was driven by dividend increases from automobile companies. Great Wall Motor Company, Guangzhou Automobile Group and Dongfeng Motor Group all announced increases of more than 20%. I think this news is very positive and indicates that these companies have been increasing their internal cash flows and have an optimistic view of the future economy, potentially even signaling a growing class of domestic consumers.

• Financials Remain Largest Payers – The top seven Dividend Stream increases were all financial firms, and the sector remains the largest dividend-paying sector within the Index. I find it impressive that, despite having the largest payers, the sector was still able to outpace the total Index growth rate. More than 80%, or 14 out of 17 financial firms in the Index, grew their dividends by a total of 12.7%, about 2% above China’s total growth.

• Energy and Materials – These were the only two sectors that saw a Dividend Stream decrease. These two sectors have been laggards across all regional markets, mainly resulting from a slowdown in global growth and the rebalancing in China toward a consumer-driven economy and away from infrastructure- and investment-led growth. The two largest dollar decreases were both coal companies, a segment of the energy market particularly hard hit over the past few years due to demands for cleaner-burning energy and competition from increased natural gas production.

Small Caps Also Pay Dividends

When investors think of dividends, they tend to think of mature large-cap companies as their primary source. As a result, many investors may mistakenly overlook small-cap equities as attractive income options. The above analysis included 34 firms that are constituents in the WisdomTree Emerging Markets SmallCap Dividend Index. More than 70%, or 24 of the 34 firms, increased their dividends, led by the Industrial sector with 14 firms.

I find the dividend increases among smaller-capitalization firms to be a positive signal for the direction of the local economy because companies typically raise dividends when they are optimistic about their future profitability. Also, smaller firms tend to be more sensitive to the economic growth cycle, and their revenues are tied more closely to the domestic consumer. The dividend policy of these small-cap firms will be an important indicator to watch while the Chinese government transitions the economy from export-led growth to growth that’s focused more on domestic demand, with the recent dividend increases being constructive.

Conclusion

While great uncertainty remains over the success and trajectory of the Chinese economy and its financial markets, I can’t help but ask if many are too pessimistic given the positive trends in dividends, an important underlying fundamental signal. I feel the broad-based dividend growth across size capitalization and among a majority of sectors is a positive starting point for a potential turnaround, and the price-versus-valuation divergence presents an interesting investment opportunity.

For current holdings of the WisdomTree Emerging Markets Dividend Index, please click here.

Important Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Investments focused in China may increase the impact of events and developments associated with the region, which can adversely affect performance. Dividends are not guaranteed, and a company’s future ability to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time.