Myth: The Euro and Yen Make Good Diversifiers for U.S. Purchasing Power

What About Future Trends of the U.S. Dollar?

Putting the historical picture aside, will foreign currencies continue appreciating against the U.S. dollar? It is hard for anyone to really know where currencies are going. In many ways, evaluating the relative attractiveness of stocks, which produce a set of cash flows (earnings and dividends), can make for easier comparison of relative valuation than trying to do the same with currencies.

This is why I advocate strongly for blending currency-hedged strategies with non-hedged strategies in a strategic mix to minimize the possibility of being on the wrong side of the currency equation. If investors have no expectations for foreign currencies to continue to appreciate against the dollar on a sustained long-run basis, given the minimal cost to hedge the developed world currencies that we discussed here, they should diversify their approach to developed international allocations by adding in some currency-hedged allocations.

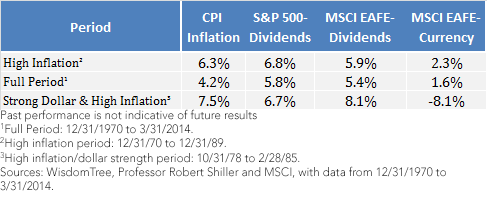

We believe that investors must really examine why they are taking on the euro and yen risk in their portfolios. If it is for diversification against purchasing power of the U.S. dollar, the historical evidence presented in this blog post suggests that these investors need to go back to the drawing board to find better inflation hedges.

1This period was chosen to coincide with the launch of the MSCI EAFE Index, which has a history starting in 1970.

2Source: Professor Robert Shiller, for period 12/31/69 to 3/31/14.

3Source: Professor Robert Shiller.

What About Future Trends of the U.S. Dollar?

Putting the historical picture aside, will foreign currencies continue appreciating against the U.S. dollar? It is hard for anyone to really know where currencies are going. In many ways, evaluating the relative attractiveness of stocks, which produce a set of cash flows (earnings and dividends), can make for easier comparison of relative valuation than trying to do the same with currencies.

This is why I advocate strongly for blending currency-hedged strategies with non-hedged strategies in a strategic mix to minimize the possibility of being on the wrong side of the currency equation. If investors have no expectations for foreign currencies to continue to appreciate against the dollar on a sustained long-run basis, given the minimal cost to hedge the developed world currencies that we discussed here, they should diversify their approach to developed international allocations by adding in some currency-hedged allocations.

We believe that investors must really examine why they are taking on the euro and yen risk in their portfolios. If it is for diversification against purchasing power of the U.S. dollar, the historical evidence presented in this blog post suggests that these investors need to go back to the drawing board to find better inflation hedges.

1This period was chosen to coincide with the launch of the MSCI EAFE Index, which has a history starting in 1970.

2Source: Professor Robert Shiller, for period 12/31/69 to 3/31/14.

3Source: Professor Robert Shiller.

Important Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Investments focused in Europe or Japan may increase the impact of events and developments associated with those regions, which can adversely affect performance. Dividends are not guaranteed, and a company’s future ability to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time. Diversification does not eliminate the risk of experiencing investment losses

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.