Why the Sun Is Still Set to Rise in Japan

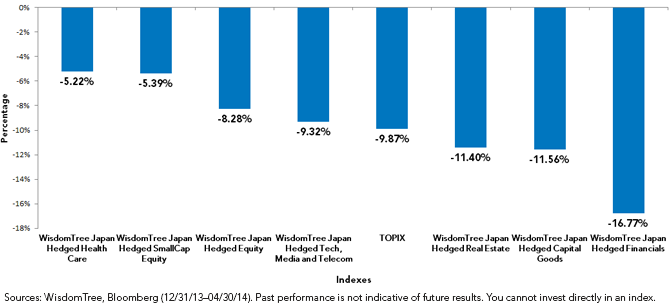

• Small Caps Lead: I find it impressive that small caps were able to outperform their large-cap peers during the most recent pullback. Typically, one would expect small caps to have a higher beta exposure. Also, since the consumption tax hike is one of the most controversial policies this year, one might expect small-cap stocks—which are local to the economic performance—to be hit the most. But they have actually been the best performers, which might indicate that the consumption tax hike is not as big a deal as many claim.

• Yen-Sensitive Capital Goods Stocks Underperform: The capital goods sector draws only 40% of its revenue from Japan, the rest coming from overseas.3 This is a higher beta sector, and it did decline more than the TOPIX or WisdomTree’s broad-based Japan Hedged Equity Index. This reflects, in my view, yen sensitivity and global growth concerns (i.e., China) more than concerns over Japan’s local economic performance.

• A Large Divergence between Sectors: The 10-percentage-point difference between the WisdomTree Japan Hedged Financials Index (WTJFH) and the WisdomTree Japan Hedged Health Care Index (WTJHCH) is quite large. The health care stocks, typically more defensive, have high dividend yields and have been focal points for some individual investors in the new tax-incentivized savings accounts being set up in Japan. The financials are the cheapest part of the market and could be a higher beta exposure for those who want to make a contrarian allocation in the “cheapest” part of Japan, as measured by the price-to-earnings ratios or price-to-book ratios.

Land of the Rising Sun

I believe 2013 marked the start of a multi-year bull market in equities, and this recent pullback offers an opportunity to increase under-weight allocations or add new positions. Japan is one of the lowest-priced regional markets on a price-to-earnings basis and the only market that actually had earnings outpace price gains over the most recent year.4 I believe equity markets will remain supported as Abenomics continues to gain traction and especially as Abe makes more progress on his growth strategy for Japan (the third arrow of Abenomics). While broad-based approaches should continue to serve many investors well, I believe there is also a place for more finely honed precision tools, such as sector allocations or small caps, to express specific views regarding how Abenomics will play out.

1Sources:WisdomTree, Bloomberg (04/30/14)

2Period: (12/31/13-04/30/14)

3Sources: WisdomTree, Bloomberg, as of 12/13/13

4Sources: WisdomTree, Bloomberg. Most recent year is 04/30/13–04/30/14

• Small Caps Lead: I find it impressive that small caps were able to outperform their large-cap peers during the most recent pullback. Typically, one would expect small caps to have a higher beta exposure. Also, since the consumption tax hike is one of the most controversial policies this year, one might expect small-cap stocks—which are local to the economic performance—to be hit the most. But they have actually been the best performers, which might indicate that the consumption tax hike is not as big a deal as many claim.

• Yen-Sensitive Capital Goods Stocks Underperform: The capital goods sector draws only 40% of its revenue from Japan, the rest coming from overseas.3 This is a higher beta sector, and it did decline more than the TOPIX or WisdomTree’s broad-based Japan Hedged Equity Index. This reflects, in my view, yen sensitivity and global growth concerns (i.e., China) more than concerns over Japan’s local economic performance.

• A Large Divergence between Sectors: The 10-percentage-point difference between the WisdomTree Japan Hedged Financials Index (WTJFH) and the WisdomTree Japan Hedged Health Care Index (WTJHCH) is quite large. The health care stocks, typically more defensive, have high dividend yields and have been focal points for some individual investors in the new tax-incentivized savings accounts being set up in Japan. The financials are the cheapest part of the market and could be a higher beta exposure for those who want to make a contrarian allocation in the “cheapest” part of Japan, as measured by the price-to-earnings ratios or price-to-book ratios.

Land of the Rising Sun

I believe 2013 marked the start of a multi-year bull market in equities, and this recent pullback offers an opportunity to increase under-weight allocations or add new positions. Japan is one of the lowest-priced regional markets on a price-to-earnings basis and the only market that actually had earnings outpace price gains over the most recent year.4 I believe equity markets will remain supported as Abenomics continues to gain traction and especially as Abe makes more progress on his growth strategy for Japan (the third arrow of Abenomics). While broad-based approaches should continue to serve many investors well, I believe there is also a place for more finely honed precision tools, such as sector allocations or small caps, to express specific views regarding how Abenomics will play out.

1Sources:WisdomTree, Bloomberg (04/30/14)

2Period: (12/31/13-04/30/14)

3Sources: WisdomTree, Bloomberg, as of 12/13/13

4Sources: WisdomTree, Bloomberg. Most recent year is 04/30/13–04/30/14

Important Risks Related to this Article

The Funds focus their investments in Japan, thereby increasing the impact of events and developments associated with the region, which can adversely affect performance. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Investments focusing on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.