Why European Dividend Growth Companies Look Attractively Priced

For definitions of terms and indexes in the chart, please visit our Glossary.

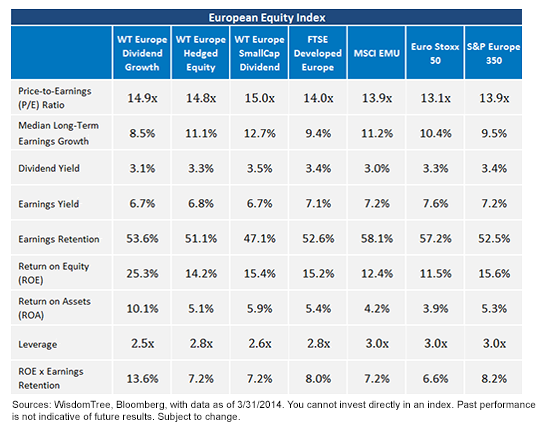

• Drivers of Dividend Growth: The dividend discount model suggests that dividend growth is critically linked to earnings retention and return on equity. Simply stated, the potential future growth of dividends is determined by the fraction of earnings put back into the firm and how profitable those earnings are in their subsequent use. While there is no way to know what any firm’s actual future dividend growth will be, I believe this metric is important when attempting to gauge a firm’s future dividend growth potential.

• WisdomTree Europe Dividend Growth: The Index’s ROE x earnings retention was 13.6%. None of the other European indexes score above 10% by this metric. This wasn’t attributable to earnings retention—that was broadly similar across each index. ROE for the WisdomTree Europe Dividend Growth Index was—by virtue of its selection methodology—nearly 26%, which was at least 9% above the ROE of the next highest index shown. This illustrates how one of the great differentiators of the current constituent list is a focus on quality companies, with quality being approximated by ROE.

Blending WisdomTree’s Indexes to Fine-Tune European Equity Exposure

The WisdomTree Europe Dividend Growth Index is actually the third broadly focused European Index in our current lineup. Below are two crucial discussions regarding how it fits in with the WisdomTree Europe Hedged Equity Index and the WisdomTree Europe SmallCap Dividend Index.

Discussion 1: Currency Exposure

Currency hedging developed international equities is a theme that WisdomTree has written about extensively, as we believe it is one of the most significant issues to think about when considering this segment of today’s equity landscape. The cost to hedge the euro is minimal, yet we face the distinct possibility that the European Central Bank (ECB) could act to support its economy, which could lead to a weaker euro against the U.S. dollar. I believe there is a chance that exposure to the euro could lead to the potential for unrewarded volatility.

To mitigate this risk, I advocate consideration of blends of the WisdomTree Europe Hedged Equity Index, weighted equally, with either our Europe Dividend Growth Index or our Europe SmallCap Dividend Index. Such equally weighted blends reflect the reality that very few people have a strong conviction which way the euro will move, especially over the short term. Combining some currency-hedged strategies with the new Europe Dividend Growth Index, as well as or in addition to the Europe SmallCap Dividend Index, can take some of that risk off the table.

Discussion 2: European Completion

The WisdomTree Europe SmallCap Dividend Index has relatively low overlap with either the WisdomTree Europe Hedged Equity Index or the Europe Dividend Growth Indexes and thus blends well with both of those Indexes from a completion standpoint.2 European small caps are often more sensitive to the local economy than large-cap companies, many of which are global exporters, Small caps also make a good potential complement in sectors and types of stocks.

Conclusion

I believe the European variant of our dividend growth methodology provides a valuable addition to the universe of indexes tracking that region’s stocks. For people who historically have appreciated a higher quality bias in their approach to U.S. equities, I believe the existence of a new option in Europe could be of particular interest. For those who think the European recovery is just getting under way, I believe this new Index should be well positioned to capitalize on the dividend growth opportunities in Europe.

1Refers to the price-to-earnings (P/E) ratio of the MSCI Europe Index measured against the P/E ratio of the S&P 500 Index, with values as of 3/31/2014.

2Based on the constituents of the WisdomTree Europe Dividend Growth, Europe Hedged Equity and Europe SmallCap Dividend Indexes as of 3/31/2014.

For definitions of terms and indexes in the chart, please visit our Glossary.

• Drivers of Dividend Growth: The dividend discount model suggests that dividend growth is critically linked to earnings retention and return on equity. Simply stated, the potential future growth of dividends is determined by the fraction of earnings put back into the firm and how profitable those earnings are in their subsequent use. While there is no way to know what any firm’s actual future dividend growth will be, I believe this metric is important when attempting to gauge a firm’s future dividend growth potential.

• WisdomTree Europe Dividend Growth: The Index’s ROE x earnings retention was 13.6%. None of the other European indexes score above 10% by this metric. This wasn’t attributable to earnings retention—that was broadly similar across each index. ROE for the WisdomTree Europe Dividend Growth Index was—by virtue of its selection methodology—nearly 26%, which was at least 9% above the ROE of the next highest index shown. This illustrates how one of the great differentiators of the current constituent list is a focus on quality companies, with quality being approximated by ROE.

Blending WisdomTree’s Indexes to Fine-Tune European Equity Exposure

The WisdomTree Europe Dividend Growth Index is actually the third broadly focused European Index in our current lineup. Below are two crucial discussions regarding how it fits in with the WisdomTree Europe Hedged Equity Index and the WisdomTree Europe SmallCap Dividend Index.

Discussion 1: Currency Exposure

Currency hedging developed international equities is a theme that WisdomTree has written about extensively, as we believe it is one of the most significant issues to think about when considering this segment of today’s equity landscape. The cost to hedge the euro is minimal, yet we face the distinct possibility that the European Central Bank (ECB) could act to support its economy, which could lead to a weaker euro against the U.S. dollar. I believe there is a chance that exposure to the euro could lead to the potential for unrewarded volatility.

To mitigate this risk, I advocate consideration of blends of the WisdomTree Europe Hedged Equity Index, weighted equally, with either our Europe Dividend Growth Index or our Europe SmallCap Dividend Index. Such equally weighted blends reflect the reality that very few people have a strong conviction which way the euro will move, especially over the short term. Combining some currency-hedged strategies with the new Europe Dividend Growth Index, as well as or in addition to the Europe SmallCap Dividend Index, can take some of that risk off the table.

Discussion 2: European Completion

The WisdomTree Europe SmallCap Dividend Index has relatively low overlap with either the WisdomTree Europe Hedged Equity Index or the Europe Dividend Growth Indexes and thus blends well with both of those Indexes from a completion standpoint.2 European small caps are often more sensitive to the local economy than large-cap companies, many of which are global exporters, Small caps also make a good potential complement in sectors and types of stocks.

Conclusion

I believe the European variant of our dividend growth methodology provides a valuable addition to the universe of indexes tracking that region’s stocks. For people who historically have appreciated a higher quality bias in their approach to U.S. equities, I believe the existence of a new option in Europe could be of particular interest. For those who think the European recovery is just getting under way, I believe this new Index should be well positioned to capitalize on the dividend growth opportunities in Europe.

1Refers to the price-to-earnings (P/E) ratio of the MSCI Europe Index measured against the P/E ratio of the S&P 500 Index, with values as of 3/31/2014.

2Based on the constituents of the WisdomTree Europe Dividend Growth, Europe Hedged Equity and Europe SmallCap Dividend Indexes as of 3/31/2014.

Important Risks Related to this Article

Investments focused in Europe are increasing the impact of events and developments associated with the region, which can adversely affect performance. Dividends are not guaranteed, and a company’s future ability to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time. Investments focusing on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.