The Differentiation in Emerging Markets Performance in 2014

Showcasing Diverging Emerging Market Equity Performance in 2014

Showcasing Diverging Emerging Market Equity Performance in 2014

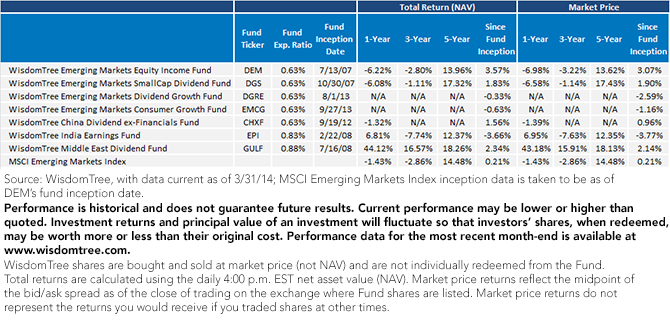

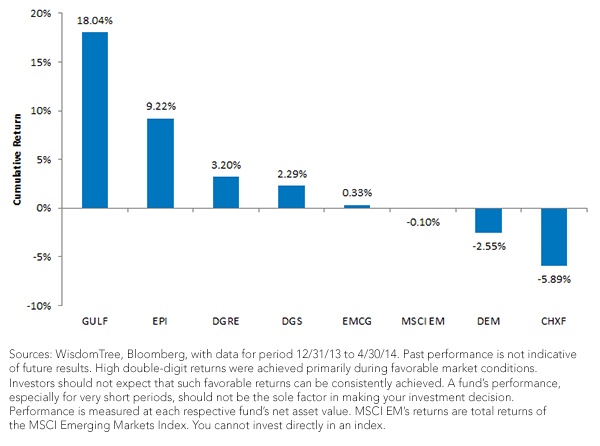

• GULF Has Led the Way: Thus far in 2014, I’ve seen countries or regions with unique catalysts leading the performance picture. The Gulf region is different in that its outperformance can perhaps be attributed to MSCI’s upgrade of the United Arab Emirates and Qatar into emerging markets. This will invariably improve liquidity considerations.

• EPI Has Benefitted from India’s Equity Markets Up on Election Optimism: India is undergoing an important election in which the candidate deemed as potentially more “pro-business” has the lion’s share of the momentum, and the equity market has been responding to the potential reform efforts going forward. India’s equities have been breaking out to new highs, as I discussed in a prior blog post.

• DGRE and EMCG Have Rebounded Since Tough Markets of 2013: Looking at 2013, Indonesia and Brazil were hit particularly hard, especially from the perspective of their currencies. Thus far in 2014, I’ve seen a recovery in these markets as they’ve made progress on important reforms. Both DGRE & EMCG, therefore, faced a performance headwind as they launched but have since been turning around. EMCG, slightly positive over this time period, has additionally benefited from exposure to India—specifically to stocks within the Consumer Discretionary sector, recovering as I mentioned above. Unfortunately, EMCG’s China exposure, particular in the Financials and Consumer Discretionary sectors, has been a headwind, accounting for its underperformance of DGRE.

• DGS Has Benefitted from Focusing on Small Caps: One of the hardest-hit areas in emerging markets, since the 2008–09 global financial crisis, have been the large, state-owned enterprises , which people most readily associate with the Russian Energy sector, the Chinese Financials sector and the Brazilian Energy and Materials sectors. These are large, global operators, and by virtue of DGS’s focus on small-cap stocks, they have been avoided. Of course, small caps have other characteristics that may cause greater potential for volatility over full market cycles, but from what I’ve seen recently, avoiding some of the most highly scrutinized state-owned enterprises has been beneficial.

• DEM Exposed to Some of the Least-Expensive Areas of Emerging Markets: The aforementioned state-owned enterprises, especially those in the Russian Energy sector and Chinese Financials sector, are some of the least expensive within the emerging market equity landscape. Since they are also some of the largest dividend payers in emerging markets, they are large exposures in DEM. Having the discipline to buy what is most inexpensive isn’t always easy, but over longer periods it has certainly been a worthwhile strategy.

Blending Strategies for a Diversified Approach

A number of these emerging market strategies make very good complements to each other. I believe the Emerging Market Consumer Growth Fund (EMCG), because its universe starts by excluding Energy, Materials and large Financials , could be a good pairing with and complement to DEM, which currently has large exposures to both Energy stocks in Russia and larger Financials in China.

So much of the emerging market story rests today with China and fears about China slowing down—even the inexpensive valuations in commodity stocks in Brazil or Russia can be tied to fears of China slowing down. China has been working to make progress on reform after its Third Plenum meeting last year, and this has invariably improved sentiment. Specifically, while I understand that these reforms are long-term in nature and will not immediately impact markets, I believe it is important for China’s government to continually indicate that it is aware of the steps that must be taken over time. This announcement showed that China’s leaders are cognizant of the plan required to help China progress on the path of economic growth over the years to come. For those contrarian investors looking for a rebound, DEM looks to be the deepest value play of the WisdomTree Funds that I show in this blog, while those looking for growth potential and higher-quality companies may want to consider EMCG.

• GULF Has Led the Way: Thus far in 2014, I’ve seen countries or regions with unique catalysts leading the performance picture. The Gulf region is different in that its outperformance can perhaps be attributed to MSCI’s upgrade of the United Arab Emirates and Qatar into emerging markets. This will invariably improve liquidity considerations.

• EPI Has Benefitted from India’s Equity Markets Up on Election Optimism: India is undergoing an important election in which the candidate deemed as potentially more “pro-business” has the lion’s share of the momentum, and the equity market has been responding to the potential reform efforts going forward. India’s equities have been breaking out to new highs, as I discussed in a prior blog post.

• DGRE and EMCG Have Rebounded Since Tough Markets of 2013: Looking at 2013, Indonesia and Brazil were hit particularly hard, especially from the perspective of their currencies. Thus far in 2014, I’ve seen a recovery in these markets as they’ve made progress on important reforms. Both DGRE & EMCG, therefore, faced a performance headwind as they launched but have since been turning around. EMCG, slightly positive over this time period, has additionally benefited from exposure to India—specifically to stocks within the Consumer Discretionary sector, recovering as I mentioned above. Unfortunately, EMCG’s China exposure, particular in the Financials and Consumer Discretionary sectors, has been a headwind, accounting for its underperformance of DGRE.

• DGS Has Benefitted from Focusing on Small Caps: One of the hardest-hit areas in emerging markets, since the 2008–09 global financial crisis, have been the large, state-owned enterprises , which people most readily associate with the Russian Energy sector, the Chinese Financials sector and the Brazilian Energy and Materials sectors. These are large, global operators, and by virtue of DGS’s focus on small-cap stocks, they have been avoided. Of course, small caps have other characteristics that may cause greater potential for volatility over full market cycles, but from what I’ve seen recently, avoiding some of the most highly scrutinized state-owned enterprises has been beneficial.

• DEM Exposed to Some of the Least-Expensive Areas of Emerging Markets: The aforementioned state-owned enterprises, especially those in the Russian Energy sector and Chinese Financials sector, are some of the least expensive within the emerging market equity landscape. Since they are also some of the largest dividend payers in emerging markets, they are large exposures in DEM. Having the discipline to buy what is most inexpensive isn’t always easy, but over longer periods it has certainly been a worthwhile strategy.

Blending Strategies for a Diversified Approach

A number of these emerging market strategies make very good complements to each other. I believe the Emerging Market Consumer Growth Fund (EMCG), because its universe starts by excluding Energy, Materials and large Financials , could be a good pairing with and complement to DEM, which currently has large exposures to both Energy stocks in Russia and larger Financials in China.

So much of the emerging market story rests today with China and fears about China slowing down—even the inexpensive valuations in commodity stocks in Brazil or Russia can be tied to fears of China slowing down. China has been working to make progress on reform after its Third Plenum meeting last year, and this has invariably improved sentiment. Specifically, while I understand that these reforms are long-term in nature and will not immediately impact markets, I believe it is important for China’s government to continually indicate that it is aware of the steps that must be taken over time. This announcement showed that China’s leaders are cognizant of the plan required to help China progress on the path of economic growth over the years to come. For those contrarian investors looking for a rebound, DEM looks to be the deepest value play of the WisdomTree Funds that I show in this blog, while those looking for growth potential and higher-quality companies may want to consider EMCG.

Important Risks Related to this Article

Diversification does not eliminate the risk of experiencing investment loss. Dividends are not guaranteed, and a company’s future ability to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Funds focusing on a single sector or region and/or smaller companies generally experience greater price volatility. Investments in emerging, offshore or frontier markets, such as the Middle East or India, are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention and political developments. Due to the investment strategy of these Funds, they may make higher capital gain distributions than other ETFs.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.