With Small Cap Valuations Stretched, Can You Find Pockets of Value in Small Caps?

For definitions of terms and indexes in the chart, please visit our Glossary.

Quite a Powerful Combination

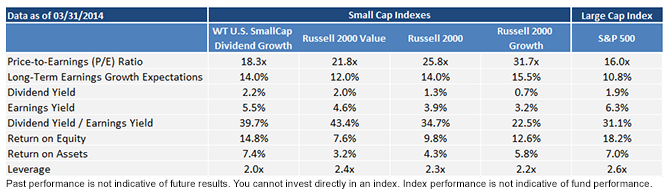

In short, as of March 31, 2014, WTSDG offered what could be a potentially inexpensive valuation compared to other measures of U.S. small-cap equities. Usually, the trade-off for lower valuation is lower growth expectations or lower quality. At least at this time, that is not the case for WTSDG, in that, compared to the other Russell Indexes shown, we see the lowest P/E, highest dividend yield, highest return on equity, highest return on assets, lowest leverage and significant growth expectations (trailing only the Russell 2000 Growth Index). We think that this offers a powerful combination for those interested in considering U.S. small caps in today’s market environment.

1Source: Josh Brown, author of The Reformed Broker and regular contributor to CNBC, Investment News, the Daily Beast and many other outlets for financial news. Josh Brown is not affiliated with WisdomTree or ALPS Distributors, Inc.

2Sources: Ibbotson, Zephyr, BMO Private Bank. Small caps include listed U.S. equities on the New York Stock Exchange, NASDAQ and American Stock Exchange and include the bottom 50% of the market capitalization. Large caps include listed U.S. equities on these same exchanges and include the top 20% of the market capitalization.

3Refers to the Russell 2000 Value Index.

4Source: Joe Light, “How to Invest as Interest Rates Rise,” Wall Street Journal, 1/3/14.

5Refers to the WisdomTree U.S. SmallCap Dividend Growth Index.

6Refers to the WisdomTree SmallCap Dividend Index.

7Refers to long-term earnings growth expectations, which are compilations of analyst estimates of the growth in operating earnings expected to occur over the next full business cycle, typically three to five years.

8Refers to the combination of three-year average return on equity and three-year average return on assets used in the selection process for the Index.

9Dividend yield: Refers to the trailing 12-month dividend yield.

For definitions of terms and indexes in the chart, please visit our Glossary.

Quite a Powerful Combination

In short, as of March 31, 2014, WTSDG offered what could be a potentially inexpensive valuation compared to other measures of U.S. small-cap equities. Usually, the trade-off for lower valuation is lower growth expectations or lower quality. At least at this time, that is not the case for WTSDG, in that, compared to the other Russell Indexes shown, we see the lowest P/E, highest dividend yield, highest return on equity, highest return on assets, lowest leverage and significant growth expectations (trailing only the Russell 2000 Growth Index). We think that this offers a powerful combination for those interested in considering U.S. small caps in today’s market environment.

1Source: Josh Brown, author of The Reformed Broker and regular contributor to CNBC, Investment News, the Daily Beast and many other outlets for financial news. Josh Brown is not affiliated with WisdomTree or ALPS Distributors, Inc.

2Sources: Ibbotson, Zephyr, BMO Private Bank. Small caps include listed U.S. equities on the New York Stock Exchange, NASDAQ and American Stock Exchange and include the bottom 50% of the market capitalization. Large caps include listed U.S. equities on these same exchanges and include the top 20% of the market capitalization.

3Refers to the Russell 2000 Value Index.

4Source: Joe Light, “How to Invest as Interest Rates Rise,” Wall Street Journal, 1/3/14.

5Refers to the WisdomTree U.S. SmallCap Dividend Growth Index.

6Refers to the WisdomTree SmallCap Dividend Index.

7Refers to long-term earnings growth expectations, which are compilations of analyst estimates of the growth in operating earnings expected to occur over the next full business cycle, typically three to five years.

8Refers to the combination of three-year average return on equity and three-year average return on assets used in the selection process for the Index.

9Dividend yield: Refers to the trailing 12-month dividend yield.Important Risks Related to this Article

Dividends are not guaranteed, and a company’s future ability to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time. Investments focusing on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.