Chinese Banks Announce New Dividend Hikes

For definitions of indexes in the chart, please visit our glossary.

Attractive Dividend Yields That Were Just Hiked Double Digits on Average

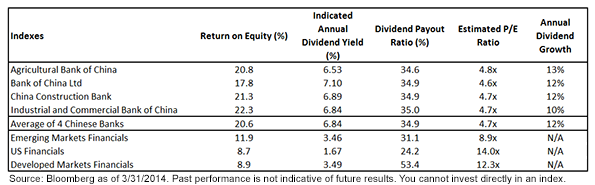

A key metric in assessing the ongoing profitability of a firm, in our opinion, is its dividend payout policy. A firm that is able to sustain and grow its dividends can serve to increase shareholder value through higher total returns. The figures in the table indicate what we believe is a significant valuation opportunity. Specifically, its dividend yields were among the top four banks that averaged 6.84%, while yields in developed market banks averaged a paltry 3.49%.

One way, of course, to exhibit a high dividend yield is with a declining share price and a constant dividend level, but ideally firms are able to showcase actual dividend growth. All four of the Chinese banks mentioned above have also announced an increase in their annual dividends.—The four banks’ dividend growth averaged 12% and ranged from 10% to 13%.

Is This “for Real”?

There is no question that these companies can be mired in complexity and may not always be the most transparent companies on the global stage. By the same token, dividends are tougher to manipulate; the fact that these banks are increasing dividends indicates to us that cash is coming in and that management wants to make a statement that it has the cash flows to pay these dividends. We take this as another sign of confidence by their management teams. The payout ratios are also at very reasonable rates—only 34.9%, not showing signs of stretching their reinvestment and capital building needs.

Increase in Equity Returns

The financial sector in China also happens to be one of the most depressed sectors in the emerging markets space, trading at a P/E multiple of 5.8x3, while MSCI EM Financials Index P/E is 8.9x4. Much of this underperformance can be attributed to the markets’ preoccupation with the shadow-banking sector in China and what impact that might have on non-performing loans and ultimately bank bailouts. However, we can’t help but ask whether markets are too pessimistic given that these companies have grown both their profits and their dividends. This price-versus-valuation divergence presents an interesting investment opportunity in this downtrodden sector of the Chinese markets.

1“Global Top 100, Companies by Market Capitalization,” PWC, 6/13.

2Source: Bloomberg, Company Specific Investor Relations; profitability numbers are from 12/31/2012 to 12/31/2013.

3Source: Bloomberg, MSCI China Financials as of 3/31/2014.

4Source: Bloomberg as of 3/31/2014.

For definitions of indexes in the chart, please visit our glossary.

Attractive Dividend Yields That Were Just Hiked Double Digits on Average

A key metric in assessing the ongoing profitability of a firm, in our opinion, is its dividend payout policy. A firm that is able to sustain and grow its dividends can serve to increase shareholder value through higher total returns. The figures in the table indicate what we believe is a significant valuation opportunity. Specifically, its dividend yields were among the top four banks that averaged 6.84%, while yields in developed market banks averaged a paltry 3.49%.

One way, of course, to exhibit a high dividend yield is with a declining share price and a constant dividend level, but ideally firms are able to showcase actual dividend growth. All four of the Chinese banks mentioned above have also announced an increase in their annual dividends.—The four banks’ dividend growth averaged 12% and ranged from 10% to 13%.

Is This “for Real”?

There is no question that these companies can be mired in complexity and may not always be the most transparent companies on the global stage. By the same token, dividends are tougher to manipulate; the fact that these banks are increasing dividends indicates to us that cash is coming in and that management wants to make a statement that it has the cash flows to pay these dividends. We take this as another sign of confidence by their management teams. The payout ratios are also at very reasonable rates—only 34.9%, not showing signs of stretching their reinvestment and capital building needs.

Increase in Equity Returns

The financial sector in China also happens to be one of the most depressed sectors in the emerging markets space, trading at a P/E multiple of 5.8x3, while MSCI EM Financials Index P/E is 8.9x4. Much of this underperformance can be attributed to the markets’ preoccupation with the shadow-banking sector in China and what impact that might have on non-performing loans and ultimately bank bailouts. However, we can’t help but ask whether markets are too pessimistic given that these companies have grown both their profits and their dividends. This price-versus-valuation divergence presents an interesting investment opportunity in this downtrodden sector of the Chinese markets.

1“Global Top 100, Companies by Market Capitalization,” PWC, 6/13.

2Source: Bloomberg, Company Specific Investor Relations; profitability numbers are from 12/31/2012 to 12/31/2013.

3Source: Bloomberg, MSCI China Financials as of 3/31/2014.

4Source: Bloomberg as of 3/31/2014.Important Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Investments focused in China are increasing the impact of events and developments associated with the region, which can adversely affect performance. Dividends are not guaranteed and a company’s future abilities to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.