On March 18, 2014, we had the opportunity to attend HSBC’s CEEMEA Investor Forum in New York City. We were particularly excited to be able to meet with three sizable banks from the United Arab Emirates (UAE). Each of these firms is actually a holding in the

WisdomTree Middle East Dividend Fund (GULF). As of March 19, 2014

1:

• First Gulf Bank (6.24%)

• Abu Dhabi Commercial Bank (3.97%)

• Dubai Islamic Bank (1.95%)

As Index creators seeking broad exposure to

dividend-paying companies in the region, we have a rules-based approach to allocating company weight in our Indexes. But it is still useful to meet with company management to hear color on their businesses and especially what they view as prospects for future dividend increases. We are especially appreciative of HSBC for inviting us to its conference and facilitating the meetings with company management—especially right before MSCI announces qualifying constituents from Qatar and UAE for its

Emerging Markets Index2.

First Gulf Bank: “Cannot Talk about First Gulf Bank without Talking about the Dividend”

At the start of every meeting, we made it quite clear that our primary focus was on the respective firm’s dividend and dividend policy. The representative for First Gulf Bank, in my opinion, had the most spirited response, saying, “One cannot talk about First Gulf Bank without talking about the dividend.” First Gulf Bank’s

dividend payout ratio in 2009 was 20% of its

net profits. By contrast, in 2012 it was 60% of net profits, and the proposed dividend payout ratio cited for 2013, subject to shareholder approval, was 63%.

3

Is the dividend sustainable? First Gulf Bank’s representative pointed out its measures of

Basel II capital adequacy. Excluding the impact of a sizable loan from the UAE ministry of finance, this figure over the past five years has been stable at between 18% and 20%. The key point about this number is not so much its absolute level but rather its stability; if First Gulf Bank were exhibiting wide fluctuation within this metric, that could indicate greater exposure to issues overhanging from the global financial crisis of 2008–09 and exposures to Dubai real estate. As long as this stability remains, he feels comfortable with the dividend payout ratio, but of course we recognize that the future can never be forecast with certainty.

First Gulf Bank’s breakdown of revenues comprises wholesale banking (40%), consumer banking (40%) and other banking activities (20%). The company’s representative cited 350,000 credit card relationships and indicated that the

average yield earned by the bank on these accounts was 27%. Additionally, approximately 60% to 70% of these borrowers tend to be “revolvers,” meaning that they do not pay off their balances every month, making them potentially very lucrative customers for the bank.

Abu Dhabi Commercial Bank: Another High Dividend Payout Ratio

Abu Dhabi Commercial Bank also looks to pay out a substantial portion of its earnings as dividends, recommending a 30% payout ratio relative to 2013’s net income.

4 Another way in which capital was returned in 2013 was through a

buyback of approximately 7% of Abu Dhabi Commercial Bank’s outstanding shares. Guidance along this line was that there was approval to purchase an additional 3% of the outstanding shares this year. This is a significant percentage of shares outstanding and returning cash to shareholders.

Dubai Islamic Bank: Excitement over the MSCI Reclassification

Every UAE firm that we met with on March 18, 2014, was excited about the prospect of membership in the MSCI Emerging Markets Index—an event that is thought to be able to bring significant

liquidity to the region’s equity markets. Dubai Islamic Bank, however, was taking direct action on this front to help facilitate liquidity.

At the time of our meeting, the amount of outstanding shares eligible to be purchased by foreigners stood at 15% for Dubai Islamic Bank. However, filings with the UAE government and central bank were in the process of bringing this limit up to 25%—a move made in direct response to MSCI’s upgrade of UAE from frontier to emerging market (EM) status. Generally speaking, one of the biggest issues plaguing UAE companies, at least from an index creator perspective, is the limited availability of shares for foreign investors, so we took this limit increase as a positive sign of a firm taking direct action on this point.

For reference, the maximum amount of shares available to foreign investors, at least from the UAE government’s perspective, is 49%.

5 When lower amounts of shares of UAE companies are available for ownership by foreign investors, it is actually a company-level decision, and companies have the ability to ask for an increase in levels from their boards of directors and shareholder bases if they see demand from greater levels of index inclusions.

Assessing Risk

Ultimately, these markets have been classified as emerging markets for a reason, so it’s important to understand how some of the key risk factors relate to broader benchmarks of the Financials sector around the world.

•

Recent Performance: Many are paying attention to the UAE and Qatar markets today because of their recent performance. For the year ending February 28, 2013, First Gulf Bank was the low performer of the three (75.5%), Abu Dhabi Commercial Bank was in the middle (92.5%), and Dubai Islamic Bank was the top performer (198.2%). As a point of contrast, U.S. financials

6 had a great year last year, but their returns didn’t even crack 30%.

7

•

Valuation: Of course, given these performance differentials, it is easy to come to the conclusion that these three UAE banks would be much more expensive than U.S. financials

8, but that would be incorrect. As of March 19, 2014, U.S. financials were trading at approximately 14.0x, developed international market financials

9 were trading at approximately 14.6x and emerging markets financials

10 were trading at approximately 8.5x. To compare, Abu Dhabi Commercial Bank was trading at 11.2x, and First Gulf Bank was trading at 12.9x as of this time. While these banks certainly aren’t showing the depressed multiples seen in the larger EM financials, such as those located in China,

11 which are trading at a

P/E ratio of 5.1x, they are actually less expensive than U.S. financials on a price-to-earnings ratio basis. Dubai Islamic Bank registered a P/E multiple of 14.7x, which is basically in line with developed international market financials.

12

•

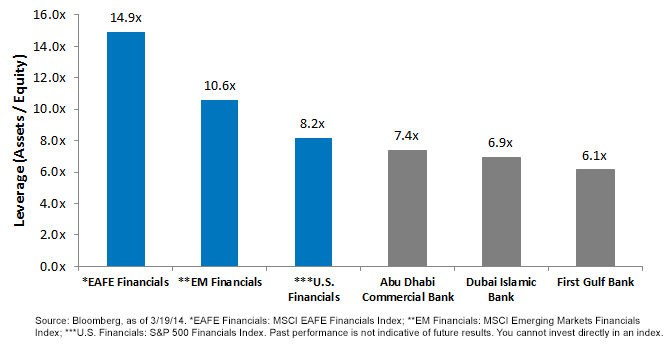

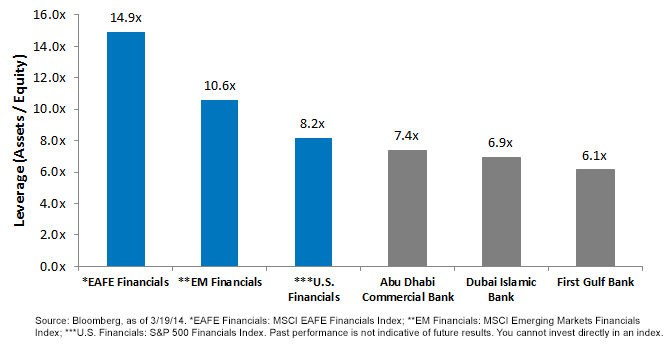

Leverage: One measure of risk for a bank is leverage , in essence the level of the bank’s assets relative to its equity. Many might logically assume that because these banks are in the UAE, there is a close association with Dubai, and since Dubai’s real estate wasn’t immune to the global financial crisis of 2008–09, these banks are still highly leveraged. However, what we found was surprising:

UAE Banks Not Necessarily Highly Leveraged

Each of these banks has lower leverage than the average level for U.S. financials, not to mention EAFE Financials or EM Financials. We recognize, of course, that leverage is only one measure of a bank’s exposure to risk but show this merely to counter the line of reasoning that since these firms are in close proximity to Dubai, they must be highly leveraged.

An Exciting Time for UAE Equities

There were times in the not-too-distant past when more accessible emerging market countries had lower accessibility than they do at present—each has been moving along its own continuum. UAE equities could be at an inflection point on their path, leading to potentially greater access for foreigners and increased liquidity in the near future.

1Holdings subject to change.

2Source: MSCI. Constituents for the MSCI Emerging Markets Index from Qatar and UAE are expected to be announced on 5/14/14.

3Source: First Gulf Bank’s Investor Presentation, dated March 2014.

4Source: Abu Dhabi Commercial Bank; 1/26/14 press release.

5Source: “Dubai’s Mashreq Ups Foreign Ownership Limit to 49%,” Reuters, 2/17/14.

6Refers to the performance of the S&P 500 Financials Index.

7Source: All performance sourced from Bloomberg, calculated from 2/28/2013 to 2/28/2014. High double-digit returns were achieved primarily during favorable market conditions. Investors should not expect that such favorable returns can be consistently achieved. A company’s performance, especially for very short periods, should not be the sole factor in making your investment decision.

8Refers to the MSCI EAFE Financials Index.

9Refers to the

MSCI Emerging Markets Financials Index, which is designed to measure the combined equity market performance of the Financials sector of emerging market countries.

10Refers to the MSCI China Financial Sector Index, which is a free float-adjusted market capitalization-weighted equity index designed to measure the performance of the Chinese equity market.

11Source: All P/E ratios in this bullet point are sourced from Bloomberg, as of 3/19/14.

Important Risks Related to this Article

Dividends are not guaranteed, and a company’s future ability to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time. There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. This Fund focuses its investments in the Middle East, thereby increasing the impact of events and developments associated with the region, which can adversely affect performance. Investments in emerging, offshore or frontier markets such as the Middle East are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. As this Fund has a high concentration in some sectors, the Fund can be adversely affected by changes in those sectors. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile. ALPS Distributors, Inc., is not affiliated with HSBC, MSCI, First Gulf Bank, Abu Dhabi Commercial Bank or Dubai Islamic Bank.

Each of these banks has lower leverage than the average level for U.S. financials, not to mention EAFE Financials or EM Financials. We recognize, of course, that leverage is only one measure of a bank’s exposure to risk but show this merely to counter the line of reasoning that since these firms are in close proximity to Dubai, they must be highly leveraged.

An Exciting Time for UAE Equities

There were times in the not-too-distant past when more accessible emerging market countries had lower accessibility than they do at present—each has been moving along its own continuum. UAE equities could be at an inflection point on their path, leading to potentially greater access for foreigners and increased liquidity in the near future.

1Holdings subject to change.

2Source: MSCI. Constituents for the MSCI Emerging Markets Index from Qatar and UAE are expected to be announced on 5/14/14.

3Source: First Gulf Bank’s Investor Presentation, dated March 2014.

4Source: Abu Dhabi Commercial Bank; 1/26/14 press release.

5Source: “Dubai’s Mashreq Ups Foreign Ownership Limit to 49%,” Reuters, 2/17/14.

6Refers to the performance of the S&P 500 Financials Index.

7Source: All performance sourced from Bloomberg, calculated from 2/28/2013 to 2/28/2014. High double-digit returns were achieved primarily during favorable market conditions. Investors should not expect that such favorable returns can be consistently achieved. A company’s performance, especially for very short periods, should not be the sole factor in making your investment decision.

8Refers to the MSCI EAFE Financials Index.

9Refers to the MSCI Emerging Markets Financials Index, which is designed to measure the combined equity market performance of the Financials sector of emerging market countries.

10Refers to the MSCI China Financial Sector Index, which is a free float-adjusted market capitalization-weighted equity index designed to measure the performance of the Chinese equity market.

11Source: All P/E ratios in this bullet point are sourced from Bloomberg, as of 3/19/14.

Each of these banks has lower leverage than the average level for U.S. financials, not to mention EAFE Financials or EM Financials. We recognize, of course, that leverage is only one measure of a bank’s exposure to risk but show this merely to counter the line of reasoning that since these firms are in close proximity to Dubai, they must be highly leveraged.

An Exciting Time for UAE Equities

There were times in the not-too-distant past when more accessible emerging market countries had lower accessibility than they do at present—each has been moving along its own continuum. UAE equities could be at an inflection point on their path, leading to potentially greater access for foreigners and increased liquidity in the near future.

1Holdings subject to change.

2Source: MSCI. Constituents for the MSCI Emerging Markets Index from Qatar and UAE are expected to be announced on 5/14/14.

3Source: First Gulf Bank’s Investor Presentation, dated March 2014.

4Source: Abu Dhabi Commercial Bank; 1/26/14 press release.

5Source: “Dubai’s Mashreq Ups Foreign Ownership Limit to 49%,” Reuters, 2/17/14.

6Refers to the performance of the S&P 500 Financials Index.

7Source: All performance sourced from Bloomberg, calculated from 2/28/2013 to 2/28/2014. High double-digit returns were achieved primarily during favorable market conditions. Investors should not expect that such favorable returns can be consistently achieved. A company’s performance, especially for very short periods, should not be the sole factor in making your investment decision.

8Refers to the MSCI EAFE Financials Index.

9Refers to the MSCI Emerging Markets Financials Index, which is designed to measure the combined equity market performance of the Financials sector of emerging market countries.

10Refers to the MSCI China Financial Sector Index, which is a free float-adjusted market capitalization-weighted equity index designed to measure the performance of the Chinese equity market.

11Source: All P/E ratios in this bullet point are sourced from Bloomberg, as of 3/19/14.