ETFs can be used in many ways, but one of the most popular is the “core and explore” approach. Investors use ETFs to implement core positions, often with funds tracking capitalization-weighted indexes, and use tactical ETFs or

active managers in the periphery of the portfolio to pursue

alpha.

If most active managers, after fees and expenses, fail to outperform the core

beta benchmarks for most asset classes, the use of low-fee ETFs or index funds that provide such access makes a great deal of sense. But what if the underlying capitalization-weighted indexes designed to provide the equity market’s

beta returns were on average costing investors 1 to 2 percentage points each year? If that is the “drag” created over time by traditional cap-weighted indexes, then rather than trying to add alpha in the periphery of the portfolio, investors may actually want to “explore the core” of their portfolios in search of alpha—or, at a minimum, a better kind of beta.

It’s rare today not to hear the phrase “

smart beta” discussed at industry conferences or in the financial press.

Smart beta has become a catch-all phrase for indexing strategies that seek to outperform the market, or generate better

risk-adjusted returns than the market, by weighting index constituents by a measure other than

market capitalization. I am encouraged that much of the investing world is now openly debating this issue. When I invented WisdomTree’s patented

dividend-weighted approach with Jonathan Steinberg about a decade ago, I suspected that we would need at least 10 years of real-time results before the investing community would acknowledge that cap-weighted indexes may not provide the best risk and return characteristics for

passive portfolios.

In recent months, research papers have helped advance this notion. When Towers Watson said in July of 2013 that “somewhere between alpha and beta, lies smart beta,”

1 the global consulting firm established a framework for evaluating four major categories of non-capitalization-weighted, or smart beta, indexes: equally weighted,

fundamentally weighted,

volatility weighted and factor based.

Further research has emerged substantiating the claim that cap-weighted indexes may not be rewarding investors for the risk they are taking. According to Cass Consulting, a research-led consultancy service provided by Cass Business School, returns of traditional, market capitalization-weighted indexes lagged various fundamentally weighted—or smart beta—indexes by as much as 2% per year from 1969 to 2011.

2

So, although the majority of ETF assets in the market today track cap-weighted indexes, it may not be surprising that alternative methods are growing in popularity. Last year, U.S.-listed ETFs tracking non-market cap-weighted indexes gathered $65 billion, or approximately one-third of the industry’s net inflows.

3

In 2014, investors have a treasure trove of data to compare how fundamentally weighted indexes fare against their comparable cap-weighted indexes in real time. At WisdomTree, the greatest outperformance we have seen has occurred in the more inefficient markets—U.S.

small caps,

mid caps and emerging markets.

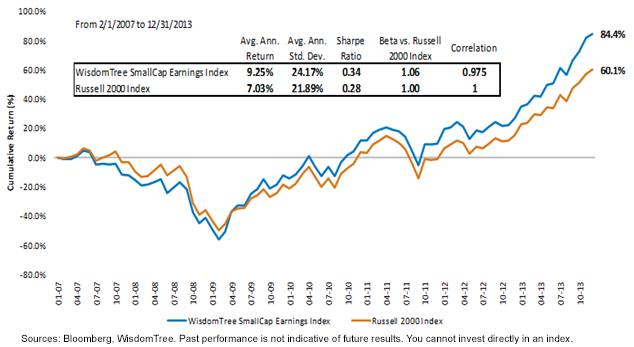

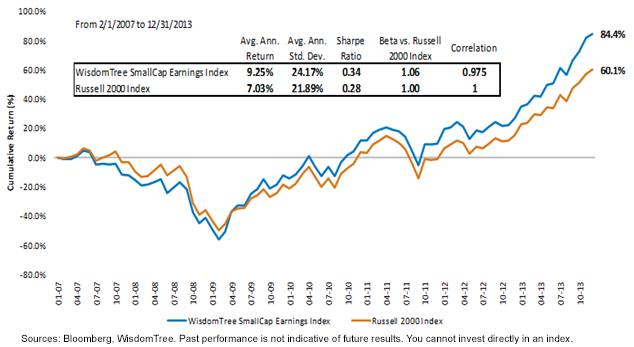

Let’s take U.S. small caps for a moment, for it is here that WisdomTree has been conducting a very interesting experiment in real time. We created an Index, the

WisdomTree SmallCap Earnings Index, which in effect includes all the profitable small-cap companies in America and then weights them once a year based on the profits they generated in the prior year. It’s a broad-based small-cap Index, including nearly 900 stocks with an aggregate market capitalization of nearly $700 billion. Over the past seven years it has had a

correlation to the

Russell 2000 Index of about .98, yet it’s outperformed the Russell 2000 by more than 2 percentage points annualized over that period, and by more than 500

basis points annualized over the last five years.

WisdomTree SmallCap Earnings Index vs. Russell 2000 Index (2/1/2007—12/31/2013)

Remember, in the small-cap space in the U.S. there are literally tens of billions of ETF dollars tracking the Russell 2000. Billions more track the

S&P SmallCap 600 and the relatively new capitalization-weighted small-cap indexes from MSCI and CRSP. Each of these cap-weighted indexes has its own unique selection methodology, so defining what exactly is small-cap beta is very much in the eye of the beholder. I believe that this choice is a positive, because it gives advisors and advisory firms more latitude to consider smart beta alternatives such as the

WisdomTree SmallCap Earnings Index.

In the next part of this series, we’ll take a look at what happens when you weight mid- and

large-cap segments of the U.S. by earnings rather than by market value.

1Towers Watson, “Understanding Smart Beta,” July 2013.

2Source: Andrew Clare et al., “An Evaluation of Alternative Equity Indices, Part 2: Fundamental Weighting Schemes,” Cass Consulting, March 2013.

3Source: Dodd Kittsley, “What You Need to Know about Strategic Beta,” Blackrock, 1/15/14.

Important Risks Related to this Article

Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Investments focusing on certain sectors and/or mid- or small cap companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility.

Remember, in the small-cap space in the U.S. there are literally tens of billions of ETF dollars tracking the Russell 2000. Billions more track the S&P SmallCap 600 and the relatively new capitalization-weighted small-cap indexes from MSCI and CRSP. Each of these cap-weighted indexes has its own unique selection methodology, so defining what exactly is small-cap beta is very much in the eye of the beholder. I believe that this choice is a positive, because it gives advisors and advisory firms more latitude to consider smart beta alternatives such as the WisdomTree SmallCap Earnings Index.

In the next part of this series, we’ll take a look at what happens when you weight mid- and large-cap segments of the U.S. by earnings rather than by market value.

1Towers Watson, “Understanding Smart Beta,” July 2013.

2Source: Andrew Clare et al., “An Evaluation of Alternative Equity Indices, Part 2: Fundamental Weighting Schemes,” Cass Consulting, March 2013.

3Source: Dodd Kittsley, “What You Need to Know about Strategic Beta,” Blackrock, 1/15/14.

Remember, in the small-cap space in the U.S. there are literally tens of billions of ETF dollars tracking the Russell 2000. Billions more track the S&P SmallCap 600 and the relatively new capitalization-weighted small-cap indexes from MSCI and CRSP. Each of these cap-weighted indexes has its own unique selection methodology, so defining what exactly is small-cap beta is very much in the eye of the beholder. I believe that this choice is a positive, because it gives advisors and advisory firms more latitude to consider smart beta alternatives such as the WisdomTree SmallCap Earnings Index.

In the next part of this series, we’ll take a look at what happens when you weight mid- and large-cap segments of the U.S. by earnings rather than by market value.

1Towers Watson, “Understanding Smart Beta,” July 2013.

2Source: Andrew Clare et al., “An Evaluation of Alternative Equity Indices, Part 2: Fundamental Weighting Schemes,” Cass Consulting, March 2013.

3Source: Dodd Kittsley, “What You Need to Know about Strategic Beta,” Blackrock, 1/15/14.