Japan Continues to Raise the Earnings Bar

For definitions of terms in the chart, please visit our Glossary.

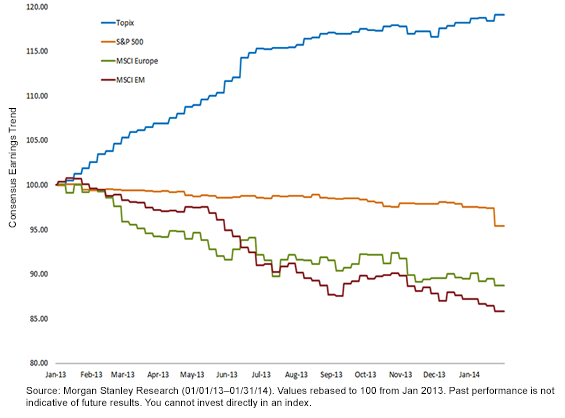

• Japan Leads Regional Markets – Based on record government stimulus and yen weakness, it is not surprising that the earnings trend for Japan has been the largest of the above regional markets. What I find most impressive is the fact that the consensus earnings trend continued to rise for Japan even though other regional market earnings were revised downward by about 10% for Europe and 15% for the emerging markets.

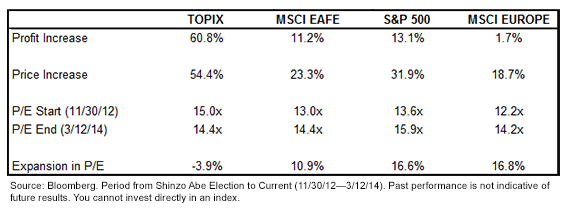

• Earnings Have Driven Price-to-Earnings (P/E) Ratio Lower – Japan’s earnings improvement has been so dramatic that the trailing price-to-earnings ratio has actually improved, even after a gain of over 40% for equity markets.2 The only other regional market to see an improvement in its price-to-earnings ratio over the period were the emerging markets, and unfortunately the change was driven by lower prices instead of higher earnings.3

Figure 2: Analysis on Profits, Prices and P/E Ratios

For definitions of terms in the chart, please visit our Glossary.

• Japan Leads Regional Markets – Based on record government stimulus and yen weakness, it is not surprising that the earnings trend for Japan has been the largest of the above regional markets. What I find most impressive is the fact that the consensus earnings trend continued to rise for Japan even though other regional market earnings were revised downward by about 10% for Europe and 15% for the emerging markets.

• Earnings Have Driven Price-to-Earnings (P/E) Ratio Lower – Japan’s earnings improvement has been so dramatic that the trailing price-to-earnings ratio has actually improved, even after a gain of over 40% for equity markets.2 The only other regional market to see an improvement in its price-to-earnings ratio over the period were the emerging markets, and unfortunately the change was driven by lower prices instead of higher earnings.3

Figure 2: Analysis on Profits, Prices and P/E Ratios

For definitPerioions of terms in the chart, please visit our Glossary.

Can Earnings Trend Continue?

When one looks at similar estimated P/E ratios for Europe and Japan (as measured by the TOPIX) and lower valuations than the United States, the question becomes, which region has better prospects for earnings growth going forward?

In a Japan strategist roundtable in February, I shared the views of Jesper Koll, Director of Japan Equity Research at J.P.Morgan Japan, who has an above-consensus outlook on earnings based on potential margin expansions, which you can read more about here. His base case is that margins get past their levels of prior to the financial crisis and head towards 5.4%. I tend to agree with him that Japan has more room than most for margin expansion, whereas many are expecting U.S. margins to face pressure in the future. I disagree with that forecast, but it is worth pointing out that Japan faces a better situation on the margin front and thus, I think, has more room for potential earnings growth.

The weaker yen has helped start the economic engine, but I feel we are still in the early innings of Japan’s transformation. A more positive virtuous cycle has been kick-started with the weakening of the yen and signs of inflation instead of deflation in price levels. I expect some positive wage developments to occur over the coming years—which can support the earnings momentum that we have seen above.

1Jonathan Garner is a Managing Director and Chief Asian and Emerging Markets Equity Strategist at Morgan Stanley

2Source: Bloomberg; refers to the TOPIX from 01/01/13 to 01/31/14.

3Source: Bloomberg; refers to the MSCI Emerging Markets Index from 01/01/13 to 01/31/14.

For definitPerioions of terms in the chart, please visit our Glossary.

Can Earnings Trend Continue?

When one looks at similar estimated P/E ratios for Europe and Japan (as measured by the TOPIX) and lower valuations than the United States, the question becomes, which region has better prospects for earnings growth going forward?

In a Japan strategist roundtable in February, I shared the views of Jesper Koll, Director of Japan Equity Research at J.P.Morgan Japan, who has an above-consensus outlook on earnings based on potential margin expansions, which you can read more about here. His base case is that margins get past their levels of prior to the financial crisis and head towards 5.4%. I tend to agree with him that Japan has more room than most for margin expansion, whereas many are expecting U.S. margins to face pressure in the future. I disagree with that forecast, but it is worth pointing out that Japan faces a better situation on the margin front and thus, I think, has more room for potential earnings growth.

The weaker yen has helped start the economic engine, but I feel we are still in the early innings of Japan’s transformation. A more positive virtuous cycle has been kick-started with the weakening of the yen and signs of inflation instead of deflation in price levels. I expect some positive wage developments to occur over the coming years—which can support the earnings momentum that we have seen above.

1Jonathan Garner is a Managing Director and Chief Asian and Emerging Markets Equity Strategist at Morgan Stanley

2Source: Bloomberg; refers to the TOPIX from 01/01/13 to 01/31/14.

3Source: Bloomberg; refers to the MSCI Emerging Markets Index from 01/01/13 to 01/31/14.Important Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments focused in Japan are increasing the impact of events and developments associated with the region, which can adversely affect performance. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. ALPS Distributors, Inc., is not affiliated with J.P. Morgan or Morgan Stanley

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.