Where to Search for Value in Emerging Markets

For definitions of indexes in the chart, please visit our Glossary.

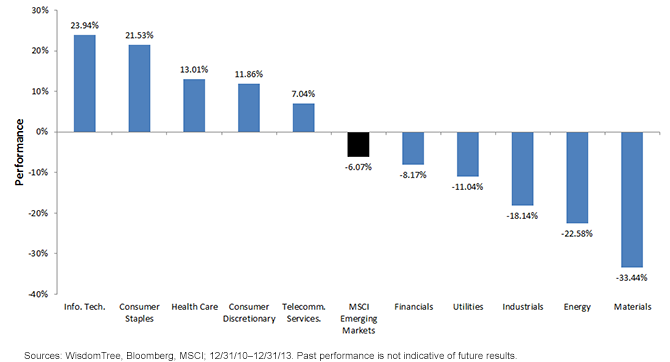

• Domestic-Demand Consumer Growth Sectors Outperform: These sectors would include Consumer Staples, Consumer Discretionary, Telecommunication Services and Health Care. I believe one reason these sectors have exhibited strong performance is their exposure to the emerging market consumer. I also believe the growing emerging market consumer class has the potential to drive much of the economic growth in the region. Given the emerging markets’ youthful demographics and the potential for their low per capita incomes to catch up with those of the developed world, this segment is likely to be a major driver of the region and of global growth. Yet most major market indexes have very little exposure to these indexes as a group—the traditional MSCI Emerging Markets Index has around 27% exposure to these sectors.1 This is one of the reasons we created the WisdomTree Emerging Markets Consumer Growth Index (WTEMCG), which has around 73% exposure to these sectors.2

• Commodity Sectors Underperform: Commodity sectors encompass Energy and Materials, which are very globally sensitive and whose performance is largely driven by global events and China’s demand, in particular. I believe one of the reasons commodity sectors have exhibited some of the worst relative performance is a result of the economic slowdown in the region, and the economic rebalancing that is occurring in China from investment-led growth to a consumer focus. Energy and Materials also comprise a large percentage of traditional exposure to emerging markets, on average around 25% of the MSCI Emerging Markets Index over the prior three years. Note that WTEMCG starts by screening these sectors out and thus has zero exposure to them.

• Financials Sector Underperforms: Although the global financial crisis began in the United States, it had repercussions around the world. While financials have been healing and performing better in the U.S. over the last three years, emerging market financials have been laggards during that time. Concerns over rapid credit expansion and the potential for a rise in bad loans seem to be most prevalent among Chinese banks, specifically regarding the “true” quality of the loans on the banks’ books. In a slowing economy, and certainly in a recession, defaults rise, and this is a potential concern for many.

Potential Emerging Market Outtakes

• Focus on Emerging Market Consumers: Investors who are steadfast in their belief that a growing middle class in the emerging markets will continue to support local economic consumption, but who are concerned about macro-sensitive sectors, should look toward the WisdomTree Emerging Markets Consumer Growth Index. WTEMCG is a fundamentally weighted index that consists of stocks that best exemplify growth trends in emerging market consumers and their local economies by focusing on stocks in the consumer growth sectors and at the same time excluding some of the more macro-sensitive sectors—especially energy and materials stocks. One of the reasons I think the stocks in WTEMCG are attractive at the present time is that they sell at a similar valuation multiple to the MSCI Emerging Markets Index as a whole, but without some of the more depressed areas such as commodity sectors or the large Chinese banks. This fact alone makes it an attractive basket to me.

• Focus on Valuations: Investors who are interested in identifying the lowest-priced sectors should focus on the WisdomTree Emerging Markets Equity Income Index (WTEMHY). WTEMHY is a fundamentally weighted index that screens for the highest-dividend-yielding stocks within the emerging markets and then weights those stocks based on cash dividends paid. Currently the methodology has positioned the bulk of the index weight in the Financials, Energy and Materials sectors, which happen to be some of the lowest-priced sectors in the emerging markets. For investors looking for the most value-centric part of emerging markets, WTEMHY currently embodies this valuation mindset.

Conclusion

I believe the recent emerging market performance and negative sentiment has created potential opportunities. While not all sectors have performed poorly, it is important to understand the relationship between prices and fundamentals. Markets may deviate from the underlying fundamental value for a number of reasons and can stay irrational for long periods, but I believe they eventually revert back to the underlying fundamentals. As a result, investors shouldn’t abandon the asset class but instead focus on an area of the market they feel confident about and do so through a rules-based strategy that focuses on fundamentals.

1Sector weight as of 12/31/13.

2Sector weight as of 12/31/13.

For definitions of indexes in the chart, please visit our Glossary.

• Domestic-Demand Consumer Growth Sectors Outperform: These sectors would include Consumer Staples, Consumer Discretionary, Telecommunication Services and Health Care. I believe one reason these sectors have exhibited strong performance is their exposure to the emerging market consumer. I also believe the growing emerging market consumer class has the potential to drive much of the economic growth in the region. Given the emerging markets’ youthful demographics and the potential for their low per capita incomes to catch up with those of the developed world, this segment is likely to be a major driver of the region and of global growth. Yet most major market indexes have very little exposure to these indexes as a group—the traditional MSCI Emerging Markets Index has around 27% exposure to these sectors.1 This is one of the reasons we created the WisdomTree Emerging Markets Consumer Growth Index (WTEMCG), which has around 73% exposure to these sectors.2

• Commodity Sectors Underperform: Commodity sectors encompass Energy and Materials, which are very globally sensitive and whose performance is largely driven by global events and China’s demand, in particular. I believe one of the reasons commodity sectors have exhibited some of the worst relative performance is a result of the economic slowdown in the region, and the economic rebalancing that is occurring in China from investment-led growth to a consumer focus. Energy and Materials also comprise a large percentage of traditional exposure to emerging markets, on average around 25% of the MSCI Emerging Markets Index over the prior three years. Note that WTEMCG starts by screening these sectors out and thus has zero exposure to them.

• Financials Sector Underperforms: Although the global financial crisis began in the United States, it had repercussions around the world. While financials have been healing and performing better in the U.S. over the last three years, emerging market financials have been laggards during that time. Concerns over rapid credit expansion and the potential for a rise in bad loans seem to be most prevalent among Chinese banks, specifically regarding the “true” quality of the loans on the banks’ books. In a slowing economy, and certainly in a recession, defaults rise, and this is a potential concern for many.

Potential Emerging Market Outtakes

• Focus on Emerging Market Consumers: Investors who are steadfast in their belief that a growing middle class in the emerging markets will continue to support local economic consumption, but who are concerned about macro-sensitive sectors, should look toward the WisdomTree Emerging Markets Consumer Growth Index. WTEMCG is a fundamentally weighted index that consists of stocks that best exemplify growth trends in emerging market consumers and their local economies by focusing on stocks in the consumer growth sectors and at the same time excluding some of the more macro-sensitive sectors—especially energy and materials stocks. One of the reasons I think the stocks in WTEMCG are attractive at the present time is that they sell at a similar valuation multiple to the MSCI Emerging Markets Index as a whole, but without some of the more depressed areas such as commodity sectors or the large Chinese banks. This fact alone makes it an attractive basket to me.

• Focus on Valuations: Investors who are interested in identifying the lowest-priced sectors should focus on the WisdomTree Emerging Markets Equity Income Index (WTEMHY). WTEMHY is a fundamentally weighted index that screens for the highest-dividend-yielding stocks within the emerging markets and then weights those stocks based on cash dividends paid. Currently the methodology has positioned the bulk of the index weight in the Financials, Energy and Materials sectors, which happen to be some of the lowest-priced sectors in the emerging markets. For investors looking for the most value-centric part of emerging markets, WTEMHY currently embodies this valuation mindset.

Conclusion

I believe the recent emerging market performance and negative sentiment has created potential opportunities. While not all sectors have performed poorly, it is important to understand the relationship between prices and fundamentals. Markets may deviate from the underlying fundamental value for a number of reasons and can stay irrational for long periods, but I believe they eventually revert back to the underlying fundamentals. As a result, investors shouldn’t abandon the asset class but instead focus on an area of the market they feel confident about and do so through a rules-based strategy that focuses on fundamentals.

1Sector weight as of 12/31/13.

2Sector weight as of 12/31/13.Important Risks Related to this Article

Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments focused in China are increasing the impact of events and developments associated with the region, which can adversely affect performance.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.