Emerging Market Central Banks Switch to Defense to Protect Economies

Turkey

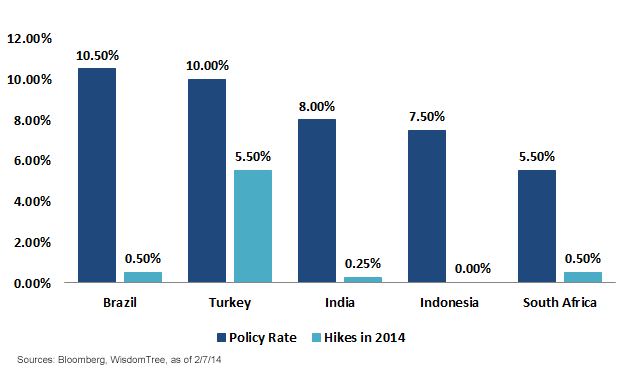

In perhaps the biggest headline to come out of the emerging markets in recent weeks, the Central Bank of the Republic of Turkey (CBRT) raised all three of its main policy rates by significant margins.1 In the announcement, investors were instructed to focus on the one-week rate—which was raised from 4.5% to 10%— as the new policy benchmark going forward. The CBRT was forced to react definitively after an earlier policy meeting disappointed investors and the lira plunged. We remain cautious about the underlying fundamentals in Turkey but believe that the central bank’s policy change must be given time before we can fully understand its effects. While many economists believe that the CBRT had previously succumbed to political pressures, we see the most recent move as a significant signal that it is committed to a more independent approach going forward. As a result of this policy change, interest rates in Turkey are now the second highest in the emerging markets that WisdomTree monitors. Even though we believe volatility will undoubtedly continue to persist, we are somewhat more constructive on the emerging markets as investors assess whether broad-based selling may have overshot. Since the central bank announced its bold 5.5% rate hike, the Turkish lira is the single best-performing EM currency (as of February 7).

South Africa

In an unexpected change in policy, the South African Reserve Bank hiked interest rates by 50 basis points in an effort to support the rand.2 This marked the first change in monetary policy since 2008. With continued softness in commodity prices due to decreased global demand and ongoing worker strikes, South Africa’s gross domestic product (GDP) growth has continued to wane. Although the unexpected hike in rates was meant to help mitigate inflationary pressures (which are due to increased import costs from a weakened currency), sustaining these higher borrowing costs may also serve as a drag on growth. With national elections occurring in early May, the ruling African National Congress should seek to redouble its efforts to help promote growth. While WisdomTree’s under-weight to South Africa relative to our performance benchmark has helped reduce our exposure to rising bond yields and a falling rand, we continue to monitor evolving conditions closely.

India

With the second rate hike from the Reserve Bank of India in only three months, we believe that its governor, Dr. Raghuram Rajan, is continuing to bolster his inflation-fighting credentials. While lower energy and commodity prices have helped contain India’s current account deficit, we believe that other changes being enacted by policy makers including Rajan are helping to attract foreign investment. In our view, should the path of reform continue in India, we believe that the rupee may provide one of the strongest turnaround stories for 2014. While the future outlook for inflation will largely dictate policy decisions going forward, we believe the level of carry available in India (approximately 8%3) continues to provide an attractive buffer against further currency weakness. In 2013, the rupee slid to all-time lows against the U.S. dollar. With broader emerging market sentiment potentially improving, we are generally positive on the Indian economy in 2014.

Brazil

2013 was a difficult year for the Brazilian economy and the Brazilian real. Given the size of its market, outflows from Brazilian assets in 2013 were among the highest in the emerging world. Although the Brazilian Central Bank has continued to increase the benchmark SELIC Rate in a measured fashion since April 2013, the increase of 3.25% in short-term borrowing costs has coincided with a near 17% devaluation of the currency.4 Although growth has remained sluggish, the yields being offered in the Brazilian currency and bond markets may be difficult to ignore. Although the real’s performance in 2013 was the worst since the global financial crisis, at current levels, we believe that the real may have overshot. Additionally, the currency would need to depreciate by an additional 9% to result in a zero total return for investors.5 At those levels, the real would be trading at prices not seen since 2005, when the growth machine in Brazil was just kicking off after its debt restructuring in 2002. While the growth story continues to be a concern, potential positive headlines from the World Cup this summer as well as an already pessimistic EM market may surprise in the second half of 2014. However, positive asset flows into Brazil will be critical if a rebound in the real is to materialize.

While emerging market-focused investors have been stung by significant underperformance compared to developed markets, we continue to believe that the longer-term emerging market thesis is intact. With the Federal Reserve continuing along its path of policy normalization, we believe that volatility will continue to increase against virtually all asset classes. With valuations not seen since 2008 or earlier, an increase in allocations to emerging markets may result in positive returns, should these contrarian allocations begin to gain traction in more investors’ portfolios.

1Source: Bloomberg, as of 1/28/14.

2Source: Bloomberg, as of 1/29/14.

3Source: Bloomberg, as of 2/7/14.

4Source: Bloomberg, as of 12/31/13.

5Given the fact that the interest rates available to foreign investors are higher than in the U.S.

Turkey

In perhaps the biggest headline to come out of the emerging markets in recent weeks, the Central Bank of the Republic of Turkey (CBRT) raised all three of its main policy rates by significant margins.1 In the announcement, investors were instructed to focus on the one-week rate—which was raised from 4.5% to 10%— as the new policy benchmark going forward. The CBRT was forced to react definitively after an earlier policy meeting disappointed investors and the lira plunged. We remain cautious about the underlying fundamentals in Turkey but believe that the central bank’s policy change must be given time before we can fully understand its effects. While many economists believe that the CBRT had previously succumbed to political pressures, we see the most recent move as a significant signal that it is committed to a more independent approach going forward. As a result of this policy change, interest rates in Turkey are now the second highest in the emerging markets that WisdomTree monitors. Even though we believe volatility will undoubtedly continue to persist, we are somewhat more constructive on the emerging markets as investors assess whether broad-based selling may have overshot. Since the central bank announced its bold 5.5% rate hike, the Turkish lira is the single best-performing EM currency (as of February 7).

South Africa

In an unexpected change in policy, the South African Reserve Bank hiked interest rates by 50 basis points in an effort to support the rand.2 This marked the first change in monetary policy since 2008. With continued softness in commodity prices due to decreased global demand and ongoing worker strikes, South Africa’s gross domestic product (GDP) growth has continued to wane. Although the unexpected hike in rates was meant to help mitigate inflationary pressures (which are due to increased import costs from a weakened currency), sustaining these higher borrowing costs may also serve as a drag on growth. With national elections occurring in early May, the ruling African National Congress should seek to redouble its efforts to help promote growth. While WisdomTree’s under-weight to South Africa relative to our performance benchmark has helped reduce our exposure to rising bond yields and a falling rand, we continue to monitor evolving conditions closely.

India

With the second rate hike from the Reserve Bank of India in only three months, we believe that its governor, Dr. Raghuram Rajan, is continuing to bolster his inflation-fighting credentials. While lower energy and commodity prices have helped contain India’s current account deficit, we believe that other changes being enacted by policy makers including Rajan are helping to attract foreign investment. In our view, should the path of reform continue in India, we believe that the rupee may provide one of the strongest turnaround stories for 2014. While the future outlook for inflation will largely dictate policy decisions going forward, we believe the level of carry available in India (approximately 8%3) continues to provide an attractive buffer against further currency weakness. In 2013, the rupee slid to all-time lows against the U.S. dollar. With broader emerging market sentiment potentially improving, we are generally positive on the Indian economy in 2014.

Brazil

2013 was a difficult year for the Brazilian economy and the Brazilian real. Given the size of its market, outflows from Brazilian assets in 2013 were among the highest in the emerging world. Although the Brazilian Central Bank has continued to increase the benchmark SELIC Rate in a measured fashion since April 2013, the increase of 3.25% in short-term borrowing costs has coincided with a near 17% devaluation of the currency.4 Although growth has remained sluggish, the yields being offered in the Brazilian currency and bond markets may be difficult to ignore. Although the real’s performance in 2013 was the worst since the global financial crisis, at current levels, we believe that the real may have overshot. Additionally, the currency would need to depreciate by an additional 9% to result in a zero total return for investors.5 At those levels, the real would be trading at prices not seen since 2005, when the growth machine in Brazil was just kicking off after its debt restructuring in 2002. While the growth story continues to be a concern, potential positive headlines from the World Cup this summer as well as an already pessimistic EM market may surprise in the second half of 2014. However, positive asset flows into Brazil will be critical if a rebound in the real is to materialize.

While emerging market-focused investors have been stung by significant underperformance compared to developed markets, we continue to believe that the longer-term emerging market thesis is intact. With the Federal Reserve continuing along its path of policy normalization, we believe that volatility will continue to increase against virtually all asset classes. With valuations not seen since 2008 or earlier, an increase in allocations to emerging markets may result in positive returns, should these contrarian allocations begin to gain traction in more investors’ portfolios.

1Source: Bloomberg, as of 1/28/14.

2Source: Bloomberg, as of 1/29/14.

3Source: Bloomberg, as of 2/7/14.

4Source: Bloomberg, as of 12/31/13.

5Given the fact that the interest rates available to foreign investors are higher than in the U.S.Important Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Investments focused in Turkey, Brazil, South Africa and/or India are increasing the impact of events and developments associated with the respective region, which can adversely affect performance.