One of the nice things about watching the exchange-traded fund (ETF) industry every day is that you get to see how the universe of ETF users reacts to changing market conditions. That collective response usually takes the form of aggregated net inflows into or outflows from defined asset classes, which ETFs track pretty precisely.

Through February 5, 2014, more than $20 billion had flowed out of ETFs year-to-date, as investors took cover during a sharp market pullback. What categories did the money flow out of? U.S.

large-,

mid- and

small caps, emerging market equity and the more sensitive and

cyclical sectors of the

S&P 500 ranked within the top categories for redemptions. But the more interesting question is, what were investors buying? Billions flowed into U.S. Treasury ETFs of both intermediate- and longer-term

durations. No surprise there. What may surprise some is that, despite the global sell-off in stocks, on a year-to-date basis billions in new inflows still remained in ETFs that provide exposure to the European and U.K. equity markets.

On Thursday, February 6, 2014, the European Central Bank (ECB) and the Bank of England (BOE) gave European investors a reason to cheer: both central banks left their already low

interest rates unchanged. Whereas inflation in the U.K. is running at 2%, inflation in Europe is running below 1%, less than half the ECB’s target. With unemployment for the euro region estimated at 12%, and economic recovery just beginning to kindle on the continent, the ECB said in a written statement that its key interest rates would “remain at present or lower levels for an extended period of time.” If the inflation rate continues to trend toward zero, it’s possible that the ECB could entertain ever more creative forms of

monetary easing, including U.S. and Japan-style

quantitative easing. Europe needs both faster economic growth and some measure of inflation, in part so that the region’s heavily indebted governments to the south have some way of growing out of, or inflating away, their sovereign debt burden. European and U.K. equity markets rallied on the interest rate news, although major equity indexes in Europe still remain well below their 2007 peaks.

One of the reasons I’m optimistic that global equity markets will rally from these levels is that if investors were really worried about the global economy heading into recession, we would probably have seen small-cap stocks decline more than large-cap stocks around the world over the past three weeks. That happened in the U.S.—probably because small caps, after a huge 2013, were a juicy target for profit taking. But it did not happen in Europe, Japan or the rest of the developed and emerging world. In all of those regions, broad-based small-cap indexes held up better than large-caps during the sell-off. That may be a signal that global

reflation and recovery lie ahead—not deflation and recession.

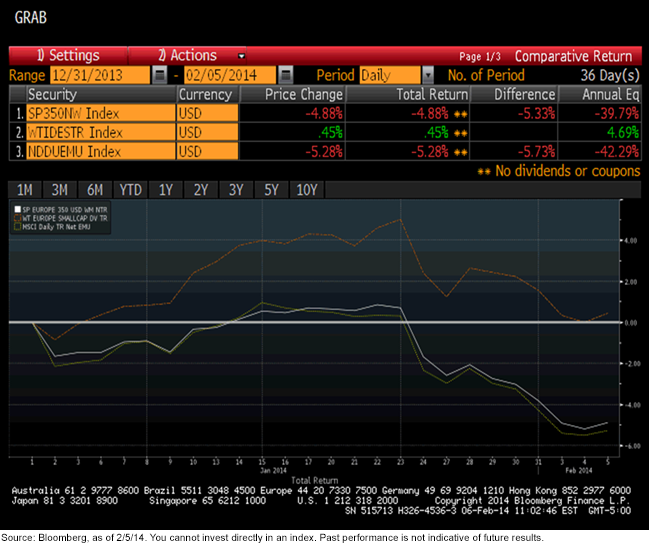

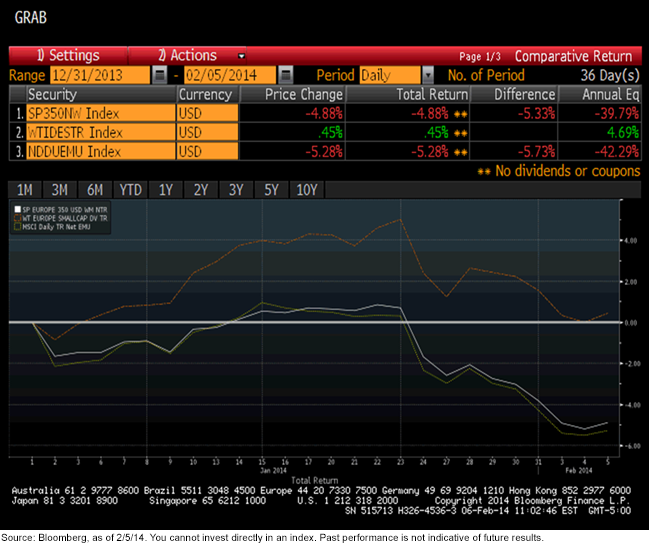

The chart below shows that the

WisdomTree Europe SmallCap Dividend Index actually posted positive gains through February 5, whereas both the

S&P Europe 350 Index and the

MSCI EMU Index (both predominately large cap) posted declines.

Read more on European Small Caps

here.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Funds focusing their investments on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile. Investments focused in Japan are increasing the impact of events and developments associated with the region, which can adversely affect performance. Investments focused in Europe are increasing the impact of events and developments associated with the region, which can adversely affect performance. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments.

Read more on European Small Caps here.

Read more on European Small Caps here.