Why European Small Caps Performed Strongly in 2013

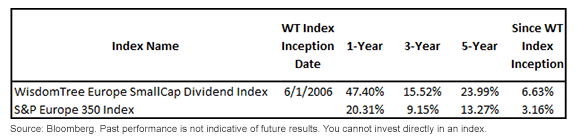

Average Annual Returns (as of 12/31/2013)

Average Annual Returns (as of 12/31/2013)

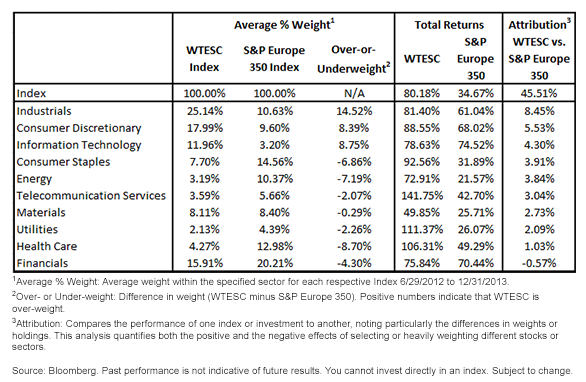

• Outperformance by More Than 45%: WTESC outperformed the S&P Europe 350 by more than 45% cumulatively from the June 2012 inflection point of Europe’s market, with a total return of over 80% over the 18-month period.

• Industrials & Consumer Discretionary Explain One-Third of Differential: WTESC’s attribution relative to the S&P Europe 350 was helped in 9 out of 10 sectors, the exception being Financials (which had strong performance in both large caps and small caps but were under-weight in WTESC). Of the greater than 45% performance advantage, nearly one-third was explained by two sectors—Consumer Discretionary and Industrials—which both had some of the strongest returns in the small-cap category compared to the large-cap category but also received more than twice the cumulative weight in small caps than in large caps.

• Cyclical Recovery Drivers: The next two sectors most responsible for WTESC’s outperformance continue along the theme of a cyclically driven recovery. Information Technology is a sector that is sensitive to economic trends, and it received almost 4x the weight in small caps than in large caps, and these stocks had much better returns than European large caps in general. Also, Consumer Staples, a more defensive and less cyclical sector, is under-weight in small caps compared to large caps, and that under-weight contributed to WTESC’s outperformance.

Completion with Economic Sensitivity

When investors think about Europe and making an allocation, many times their first thoughts are for the more well-known large-cap companies. While these have certainly performed well, we believe that investors who are excited about Europe’s improving economic prospects should complement their positions with exposures to European small caps. These strategies may have the potential to capture the economic sensitivity driving the allocation decision in the first place.

1Source: Bloomberg. Period: 6/29/2012 to 12/31/2013.

• Outperformance by More Than 45%: WTESC outperformed the S&P Europe 350 by more than 45% cumulatively from the June 2012 inflection point of Europe’s market, with a total return of over 80% over the 18-month period.

• Industrials & Consumer Discretionary Explain One-Third of Differential: WTESC’s attribution relative to the S&P Europe 350 was helped in 9 out of 10 sectors, the exception being Financials (which had strong performance in both large caps and small caps but were under-weight in WTESC). Of the greater than 45% performance advantage, nearly one-third was explained by two sectors—Consumer Discretionary and Industrials—which both had some of the strongest returns in the small-cap category compared to the large-cap category but also received more than twice the cumulative weight in small caps than in large caps.

• Cyclical Recovery Drivers: The next two sectors most responsible for WTESC’s outperformance continue along the theme of a cyclically driven recovery. Information Technology is a sector that is sensitive to economic trends, and it received almost 4x the weight in small caps than in large caps, and these stocks had much better returns than European large caps in general. Also, Consumer Staples, a more defensive and less cyclical sector, is under-weight in small caps compared to large caps, and that under-weight contributed to WTESC’s outperformance.

Completion with Economic Sensitivity

When investors think about Europe and making an allocation, many times their first thoughts are for the more well-known large-cap companies. While these have certainly performed well, we believe that investors who are excited about Europe’s improving economic prospects should complement their positions with exposures to European small caps. These strategies may have the potential to capture the economic sensitivity driving the allocation decision in the first place.

1Source: Bloomberg. Period: 6/29/2012 to 12/31/2013.Important Risks Related to this Article

Investments focused in Europe are increasing the impact of events and developments associated with the region, which can adversely affect performance. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments focusing on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.