European Small Caps Separate from the Pack

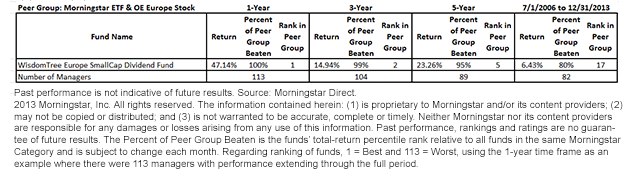

DFE Average Annual Returns, as of 12/31/2013

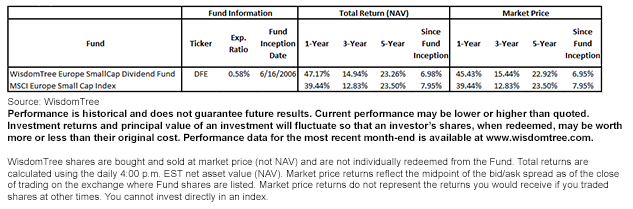

DFE Average Annual Returns, as of 12/31/2013

Background on DFE

DFE is designed to track the returns of the WisdomTree Europe SmallCap Dividend Index after costs, fees and expenses. European small caps are not just in focus because of their great performance run discussed above. When investors consider positioning for a European recovery, we believe that small caps are one of the best choices, because:

• Small-cap stocks are more sensitive to a pickup in the local European economy than many exporters, which are more impacted by the global economy

• Small caps often have greater exposure to cyclical sectors such as Industrials and Consumer Discretionary and less exposure to defensive sectors such as health care, utilities and consumer staples

• As a result of the sector positioning, small caps often have higher betas and move more in sync with the market in both up and down environments.

While gains certainly were strong for European small caps in 2013, many believe the European economic recovery is just getting started. As far as the valuation of stocks in DFE, WisdomTree believes one of the most important focal points has to be on the relative value discipline built into the Index methodology.

The WisdomTree Europe SmallCap Dividend Index is rebalanced annually. In essence, the process takes a detailed look at the relationship between the dividend growth and price performance of European small-cap dividend-payers. Those that grew their dividends but whose prices may not have responded commensurately typically have the best chances of increasing in weight, whereas those whose prices performed very well but whose dividends did not grow commensurately typically have the best chances of decreasing in weight.

WisdomTree believes that taking the chips off the table at regular intervals after strong performance is critical to a strategy seeking to build a strong performance record over time. The rebalance that occurs this June will help re-anchor the constituent stocks back to a sense of relative value after such strong performance gains. We continue to believe European small caps should be considered part of an allocation to Europe’s budding recovery.

1Universe: Morningstar Europe Stock category of ETFs and open-end mutual funds based on the performance of each eligible competitor within this category with full performance from 12/31/2012 to 12/31/2013.

2Source: Morningstar Direct, as of 12/31/2013. Of all U.S.-listed ETFs in Morningstar’s Europe Stock category, DFE was the only one tracking the performance of an index focused purely on small-cap stocks.

Background on DFE

DFE is designed to track the returns of the WisdomTree Europe SmallCap Dividend Index after costs, fees and expenses. European small caps are not just in focus because of their great performance run discussed above. When investors consider positioning for a European recovery, we believe that small caps are one of the best choices, because:

• Small-cap stocks are more sensitive to a pickup in the local European economy than many exporters, which are more impacted by the global economy

• Small caps often have greater exposure to cyclical sectors such as Industrials and Consumer Discretionary and less exposure to defensive sectors such as health care, utilities and consumer staples

• As a result of the sector positioning, small caps often have higher betas and move more in sync with the market in both up and down environments.

While gains certainly were strong for European small caps in 2013, many believe the European economic recovery is just getting started. As far as the valuation of stocks in DFE, WisdomTree believes one of the most important focal points has to be on the relative value discipline built into the Index methodology.

The WisdomTree Europe SmallCap Dividend Index is rebalanced annually. In essence, the process takes a detailed look at the relationship between the dividend growth and price performance of European small-cap dividend-payers. Those that grew their dividends but whose prices may not have responded commensurately typically have the best chances of increasing in weight, whereas those whose prices performed very well but whose dividends did not grow commensurately typically have the best chances of decreasing in weight.

WisdomTree believes that taking the chips off the table at regular intervals after strong performance is critical to a strategy seeking to build a strong performance record over time. The rebalance that occurs this June will help re-anchor the constituent stocks back to a sense of relative value after such strong performance gains. We continue to believe European small caps should be considered part of an allocation to Europe’s budding recovery.

1Universe: Morningstar Europe Stock category of ETFs and open-end mutual funds based on the performance of each eligible competitor within this category with full performance from 12/31/2012 to 12/31/2013.

2Source: Morningstar Direct, as of 12/31/2013. Of all U.S.-listed ETFs in Morningstar’s Europe Stock category, DFE was the only one tracking the performance of an index focused purely on small-cap stocks. Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Funds focusing their investments on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile. Investments focused in Europe are increasing the impact of events and developments associated with the region, which can adversely affect performance.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.