Emerging Market Fixed Income: Focusing on Flows

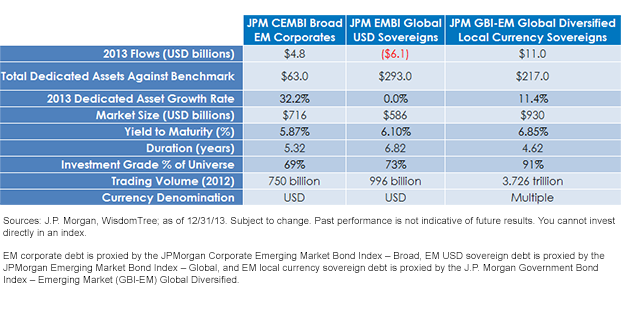

For definitions of indexes in the chart, please visit our Glossary.

Looking to the year ahead, we believe that many of the same elements that drove 2013’s increased adoption of emerging market credits may hold. Namely, improving issuers’ credit profiles, shorter duration than EM USD sovereigns and attractive yield levels (read previous blog post here). Even though U.S. interest rates are currently forecast to rise this year, positioning in emerging market corporate debt tends to be much lighter than other fixed income sectors6. We believe that as developed world growth continues, many of the large, multinational EM corporations will stand to benefit. From a valuation perspective, investment-grade-rated EM issuers now have yields more in line with single-B-rated issuers in the U.S. and Europe7. While total returns may be dampened on account of rising U.S. interest rates, we believe that EM corporates are currently attractively priced against other similar credit quality assets.

1Source: J.P. Morgan, as of 1/8/14.

2Sources: WisdomTree, Bloomberg; as of 12/31/13.

3Source: J.P. Morgan.

4Source: J.P. Morgan.

5Joyce Chang, “Emerging Market Outlook and Strategy,” J.P. Morgan, 1/8/14.

6Source: J.P. Morgan, as of 1/8/14.

7Sources: J.P. Morgan, Standard & Poor’s; as of 1/8/14.

For definitions of indexes in the chart, please visit our Glossary.

Looking to the year ahead, we believe that many of the same elements that drove 2013’s increased adoption of emerging market credits may hold. Namely, improving issuers’ credit profiles, shorter duration than EM USD sovereigns and attractive yield levels (read previous blog post here). Even though U.S. interest rates are currently forecast to rise this year, positioning in emerging market corporate debt tends to be much lighter than other fixed income sectors6. We believe that as developed world growth continues, many of the large, multinational EM corporations will stand to benefit. From a valuation perspective, investment-grade-rated EM issuers now have yields more in line with single-B-rated issuers in the U.S. and Europe7. While total returns may be dampened on account of rising U.S. interest rates, we believe that EM corporates are currently attractively priced against other similar credit quality assets.

1Source: J.P. Morgan, as of 1/8/14.

2Sources: WisdomTree, Bloomberg; as of 12/31/13.

3Source: J.P. Morgan.

4Source: J.P. Morgan.

5Joyce Chang, “Emerging Market Outlook and Strategy,” J.P. Morgan, 1/8/14.

6Source: J.P. Morgan, as of 1/8/14.

7Sources: J.P. Morgan, Standard & Poor’s; as of 1/8/14.Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Derivative investments can be volatile, and these investments may be less liquid than other securities, and more sensitive to the effects of varied economic conditions. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. In addition, when interest rates fall, income may decline. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner, or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. Unlike typical exchange-traded funds, there is no index that the Funds attempt to track or replicate. Thus, the ability of the Funds to achieve their objective will depend on the effectiveness of the portfolio manager. Due to the investment strategy of these Funds, they may make higher capital gain distributions than other ETFs. Please read each Fund’s prospectus for specific details regarding each Fund’s risk profile. ALPS Distributors, Inc. is not affiliated with J.P. Morgan.

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.