After Strong Performance in a Tough Year for Currencies, What’s Next for the Chinese Yuan?

What’s Next for 2014?

In November, top Chinese government officials met for the Third Plenary Session of the 18th CPC Central Committee (3rd Plenum). As part of the most significant slate of reforms announced in two decades, we believe some of the most interesting relate to the future path of exchange and interest rates. The key takeaway from the announcement implied that the government should allow the market to play a bigger role in the allocation of capital and resources. Similarly, many economists believe that the government is currently taking steps to allow the market to play a greater role in setting interest rates. We view this development as significant, given that we outlined it as one of the necessary prerequisites for the opening of the capital account, eventually leading to the free flow of capital into and out of mainland China.

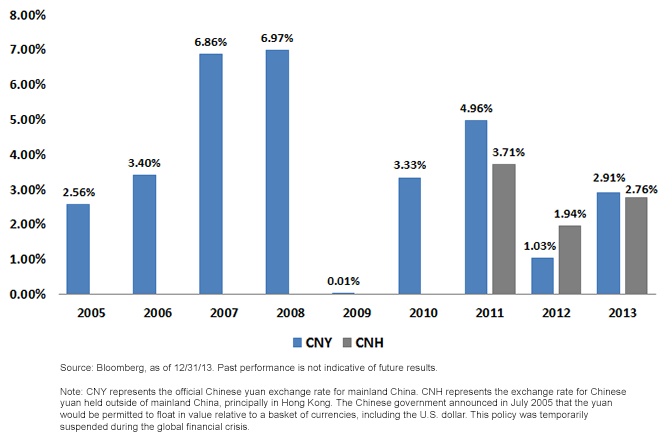

For 2014, we believe that demand for Chinese assets and currency will continue to increase, supporting a modest appreciation of the yuan. As we mentioned in a previous blog post with concern in the U.S. about rising interest rates, we believe the yuan continues to be an attractive alternative to short-term U.S. fixed income. With a historical volatility of approximately 2%, the Chinese yuan may present investors with yet another way to increase the geographic breadth of their international investments. In our view, the Chinese yuan continues to make strides in global trade and financial markets. As a result, we believe that the yuan may continue to increase its significance in many investors’ portfolios.

1Source: Bloomberg, as of 12/31/13.

2Source: Bank for International Settlements (BIS) Triennial Survey, 2013.

3Source: SWIFT data, as of 12/3/13.

4Standard Chartered Bank, as of 1/7/14.

5Source: Bloomberg, as of 12/31/13.

6Group of 10: Belgium, Canada, France, Germany, Italy, Japan, Netherlands, Sweden, United Kingdom and United States.

What’s Next for 2014?

In November, top Chinese government officials met for the Third Plenary Session of the 18th CPC Central Committee (3rd Plenum). As part of the most significant slate of reforms announced in two decades, we believe some of the most interesting relate to the future path of exchange and interest rates. The key takeaway from the announcement implied that the government should allow the market to play a bigger role in the allocation of capital and resources. Similarly, many economists believe that the government is currently taking steps to allow the market to play a greater role in setting interest rates. We view this development as significant, given that we outlined it as one of the necessary prerequisites for the opening of the capital account, eventually leading to the free flow of capital into and out of mainland China.

For 2014, we believe that demand for Chinese assets and currency will continue to increase, supporting a modest appreciation of the yuan. As we mentioned in a previous blog post with concern in the U.S. about rising interest rates, we believe the yuan continues to be an attractive alternative to short-term U.S. fixed income. With a historical volatility of approximately 2%, the Chinese yuan may present investors with yet another way to increase the geographic breadth of their international investments. In our view, the Chinese yuan continues to make strides in global trade and financial markets. As a result, we believe that the yuan may continue to increase its significance in many investors’ portfolios.

1Source: Bloomberg, as of 12/31/13.

2Source: Bank for International Settlements (BIS) Triennial Survey, 2013.

3Source: SWIFT data, as of 12/3/13.

4Standard Chartered Bank, as of 1/7/14.

5Source: Bloomberg, as of 12/31/13.

6Group of 10: Belgium, Canada, France, Germany, Italy, Japan, Netherlands, Sweden, United Kingdom and United States.Important Risks Related to this Article

Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments focused in China are increasing the impact of events and developments associated with the region, which can adversely affect performance.