Equity Markets Setting New Highs: What Is Your Index Going to Do about It?

For definitions of indexes in the chart, please go to Glossary.

Behind the Scenes of Equity Market Highs

Equity prices can often be explained by one of two variables:

• Earnings Growth: If the rate of earnings-per-share (EPS) growth is similar to the rate of price growth, you’ll tend to see price-to-earnings (P/E) ratios remaining fairly constant, even in the face of potentially compelling returns. In this case, one can say that equity returns were largely being driven by earnings growth.

• Multiple Expansion: If, on the other hand, EPS growth was slow to non-existent or even falling but prices were rising, you’ll tend to see price-to-earnings (P/E) ratios rising (in other words, multiple expansion). In this case, investors may be envisioning potential future earnings growth and be willing to pay more for it today. Therefore, returns aren’t being driven by current earnings growth but rather by multiple expansion.

This Year’s Case Study in Multiple Expansion

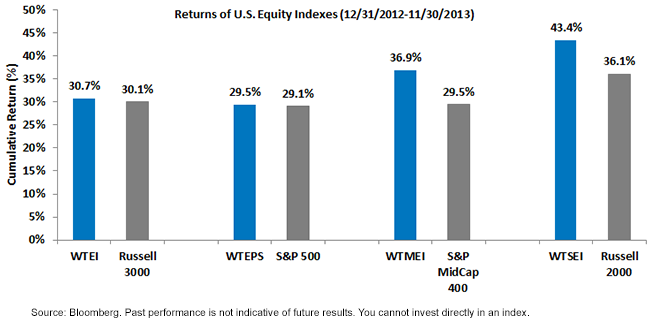

2013’s rally, for the most part, was driven by multiple expansion. Below, we look at how large-cap multiple expansion compared to that of small caps, as well as how market capitalization-weighted indexes performed against earnings-weighted indexes.

For definitions of indexes in the chart, please go to Glossary.

Behind the Scenes of Equity Market Highs

Equity prices can often be explained by one of two variables:

• Earnings Growth: If the rate of earnings-per-share (EPS) growth is similar to the rate of price growth, you’ll tend to see price-to-earnings (P/E) ratios remaining fairly constant, even in the face of potentially compelling returns. In this case, one can say that equity returns were largely being driven by earnings growth.

• Multiple Expansion: If, on the other hand, EPS growth was slow to non-existent or even falling but prices were rising, you’ll tend to see price-to-earnings (P/E) ratios rising (in other words, multiple expansion). In this case, investors may be envisioning potential future earnings growth and be willing to pay more for it today. Therefore, returns aren’t being driven by current earnings growth but rather by multiple expansion.

This Year’s Case Study in Multiple Expansion

2013’s rally, for the most part, was driven by multiple expansion. Below, we look at how large-cap multiple expansion compared to that of small caps, as well as how market capitalization-weighted indexes performed against earnings-weighted indexes.

For definitions of indexes in the chart, please go to Glossary.

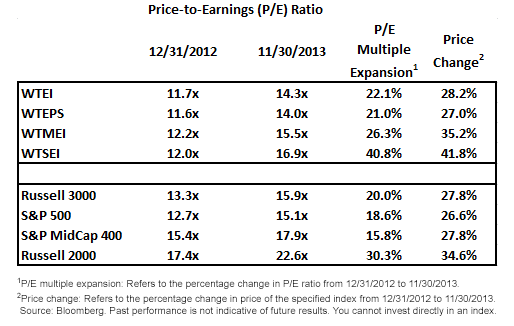

• At year-end 2012, the S&P 500 was selling at 12.7x estimated earnings. Eleven months later it had increased to 15.1x estimated earnings. This multiple expansion represented a large part of the 26.6% change in the S&P 500 price levels.

• WisdomTree Mid & Small Caps Lead the Way: We saw earlier that WTMEI and WTSEI delivered returns greater than 35%. The notable outlier, however, in terms of multiple expansion is WTSEI—the only Index shown with multiple expansion greater than 40%.

• Small Caps Notable for Multiple Expansion: Whether one looks at WTSEI in the WisdomTree Earnings family or at the Russell 2000 Index among the market capitalization-weighted benchmarks, multiple expansion among small caps is notably higher than in the other size segments.

What Is Your Index Going to Do about It?

In an environment of rising P/E ratios, we know that stocks are necessarily becoming more expensive relative to their earnings. Market capitalization-weighted indexes will simply hold greater proportions of stocks that have increased in market capitalization, in other words, they will hold more of what has increased in price. These indexes may also continue to hold stocks that have generated negative earnings over the prior 12 months.

WisdomTree’s Earnings Indexes, on the other hand, do two things that market capitalization-weighted indexes do not do:

• Rebalance to a Concept of Relative Value: Each year, the relationship between price performance and earnings growth is judged for each constituent. WisdomTree’s Earnings Indexes will tend to decrease weight to firms where price appreciation outpaced earnings growth and add weight to firms where earnings growth outpaced price appreciation—in essence, finding potentially underappreciated nooks and crannies of the market.

• Elimination of Firms with No Profits: Each ongoing (or new) constituent of WisdomTree’s Earnings Indexes must demonstrate cumulative profitability over the prior four quarters leading up to the annual November 30 screening. Firms that cannot do so don’t make the cut, thereby helping to mitigate the upward pressure on Index P/E ratios caused by firms with negative earnings.

The Heart of the Matter: Indexes That Respond to Fundamentals

We all know that stocks do not tend to move in any one direction in a straight line and that past performance does not indicate future results. Therefore, after such a strong year in U.S. equities, there may be benefits to shifting weight away from some of the top-performing companies most responsible for these results and toward those that might have been underappreciated by the market despite growing their earnings. In an ongoing discussion about the benefits of “smart beta”-related indexes, we will be discussing how a key element of the smart beta family of indexes is their rules-based rebalance that we believe can help manage valuation risks in the market.

1Refers to the Russell 3000 Index, S&P 500 Index, S&P MidCap 400 Index and Russell 2000 Index.

2Refers to the 12/31/2012 to 11/30/2013 period.

3Large-cap refers to the S&P 500 Index.

4Mid-cap refers to the S&P MidCap 400 Index.

5Small-cap refers to the Russell 2000 Index.

6Source: Bloomberg, as of 11/30/2013.

For definitions of indexes in the chart, please go to Glossary.

• At year-end 2012, the S&P 500 was selling at 12.7x estimated earnings. Eleven months later it had increased to 15.1x estimated earnings. This multiple expansion represented a large part of the 26.6% change in the S&P 500 price levels.

• WisdomTree Mid & Small Caps Lead the Way: We saw earlier that WTMEI and WTSEI delivered returns greater than 35%. The notable outlier, however, in terms of multiple expansion is WTSEI—the only Index shown with multiple expansion greater than 40%.

• Small Caps Notable for Multiple Expansion: Whether one looks at WTSEI in the WisdomTree Earnings family or at the Russell 2000 Index among the market capitalization-weighted benchmarks, multiple expansion among small caps is notably higher than in the other size segments.

What Is Your Index Going to Do about It?

In an environment of rising P/E ratios, we know that stocks are necessarily becoming more expensive relative to their earnings. Market capitalization-weighted indexes will simply hold greater proportions of stocks that have increased in market capitalization, in other words, they will hold more of what has increased in price. These indexes may also continue to hold stocks that have generated negative earnings over the prior 12 months.

WisdomTree’s Earnings Indexes, on the other hand, do two things that market capitalization-weighted indexes do not do:

• Rebalance to a Concept of Relative Value: Each year, the relationship between price performance and earnings growth is judged for each constituent. WisdomTree’s Earnings Indexes will tend to decrease weight to firms where price appreciation outpaced earnings growth and add weight to firms where earnings growth outpaced price appreciation—in essence, finding potentially underappreciated nooks and crannies of the market.

• Elimination of Firms with No Profits: Each ongoing (or new) constituent of WisdomTree’s Earnings Indexes must demonstrate cumulative profitability over the prior four quarters leading up to the annual November 30 screening. Firms that cannot do so don’t make the cut, thereby helping to mitigate the upward pressure on Index P/E ratios caused by firms with negative earnings.

The Heart of the Matter: Indexes That Respond to Fundamentals

We all know that stocks do not tend to move in any one direction in a straight line and that past performance does not indicate future results. Therefore, after such a strong year in U.S. equities, there may be benefits to shifting weight away from some of the top-performing companies most responsible for these results and toward those that might have been underappreciated by the market despite growing their earnings. In an ongoing discussion about the benefits of “smart beta”-related indexes, we will be discussing how a key element of the smart beta family of indexes is their rules-based rebalance that we believe can help manage valuation risks in the market.

1Refers to the Russell 3000 Index, S&P 500 Index, S&P MidCap 400 Index and Russell 2000 Index.

2Refers to the 12/31/2012 to 11/30/2013 period.

3Large-cap refers to the S&P 500 Index.

4Mid-cap refers to the S&P MidCap 400 Index.

5Small-cap refers to the Russell 2000 Index.

6Source: Bloomberg, as of 11/30/2013.Important Risks Related to this Article

Investments focusing on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.