What Do Changes in Inflation Mean for Japanese Bond Markets?

For definitions of terms in the chart, please visit our Glossary.

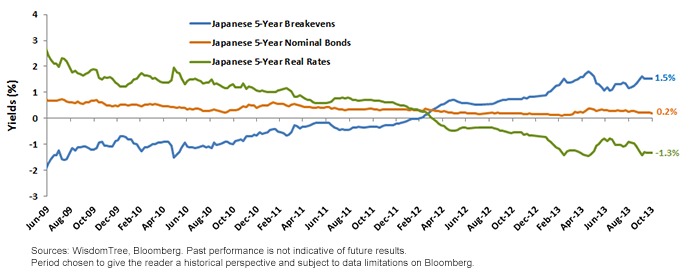

The Japanese five-year breakevens (blue line) are a representation of investors’ longer-term inflation outlook. While the blue line has spent much of the decade in negative (deflationary) territory, it broke into positive (inflationary) territory in February of 2012. This move in expectations coincides with the Bank of Japan’s (BOJ) first announcement of a 1% inflation target.

• The five-year breakevens imply that markets are expecting inflation to average 1.5% per year over the next five years.

• Five-year nominal yields in Japan have remained relatively range bound since June of 2009. The nominal yield is simply the annual income one would receive from holding a five-year Japanese government bond (JGB). In fact, nominal yields have tended to decline during this period.

• The five-year real yields are estimated by deducting inflation expectations from the nominal

yields. In February of 2012, these real yields started trending into negative territory and have firmly remained there since. Currently, the real yield on five-year inflation-linked bonds rests at –1.34%.

As a result of the BOJ’s efforts to achieve a 2% inflation target by the end of 2014, at some point in the future Japanese bond investors will demand greater compensation (via higher yields) in order to preserve future purchasing power and offset inflation.

In a recent speech appearance at the Council on Foreign Relations, the BOJ’s new governor, Haruhiko Kuroda, said that Japanese bond yields may “eventually” climb if policy makers are able to boost expectations for price increases. He added that “‘If we successfully raise inflation expectations to 2%,’ it is ‘irrational’ for bondholders to ‘accept’ such low interest rates.”1

While inflation in Japan is a relatively recent phenomenon, we believe investors may wish to see a longer-term trend before significantly altering their asset mix. However, with bond returns no longer being boosted by deflation, we believe Japanese investors will eventually transition a portion of their portfolios into riskier assets, such as equities or foreign bonds, as they seek to boost returns.

Read the full research here.

1Caroline Salas Gage, “Kuroda Says BOJ Prepared to Do What’s Necessary on Deflation,” Bloomberg, 10/10/13.

For definitions of terms in the chart, please visit our Glossary.

The Japanese five-year breakevens (blue line) are a representation of investors’ longer-term inflation outlook. While the blue line has spent much of the decade in negative (deflationary) territory, it broke into positive (inflationary) territory in February of 2012. This move in expectations coincides with the Bank of Japan’s (BOJ) first announcement of a 1% inflation target.

• The five-year breakevens imply that markets are expecting inflation to average 1.5% per year over the next five years.

• Five-year nominal yields in Japan have remained relatively range bound since June of 2009. The nominal yield is simply the annual income one would receive from holding a five-year Japanese government bond (JGB). In fact, nominal yields have tended to decline during this period.

• The five-year real yields are estimated by deducting inflation expectations from the nominal

yields. In February of 2012, these real yields started trending into negative territory and have firmly remained there since. Currently, the real yield on five-year inflation-linked bonds rests at –1.34%.

As a result of the BOJ’s efforts to achieve a 2% inflation target by the end of 2014, at some point in the future Japanese bond investors will demand greater compensation (via higher yields) in order to preserve future purchasing power and offset inflation.

In a recent speech appearance at the Council on Foreign Relations, the BOJ’s new governor, Haruhiko Kuroda, said that Japanese bond yields may “eventually” climb if policy makers are able to boost expectations for price increases. He added that “‘If we successfully raise inflation expectations to 2%,’ it is ‘irrational’ for bondholders to ‘accept’ such low interest rates.”1

While inflation in Japan is a relatively recent phenomenon, we believe investors may wish to see a longer-term trend before significantly altering their asset mix. However, with bond returns no longer being boosted by deflation, we believe Japanese investors will eventually transition a portion of their portfolios into riskier assets, such as equities or foreign bonds, as they seek to boost returns.

Read the full research here.

1Caroline Salas Gage, “Kuroda Says BOJ Prepared to Do What’s Necessary on Deflation,” Bloomberg, 10/10/13.Important Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments focused in Japan are increasing the impact of events and developments associated with the region, which can adversely affect performance.

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.