European Equities Selling at a Discount to Historical Averages

For definitions of indexes in the chart, please visit our Glossary.

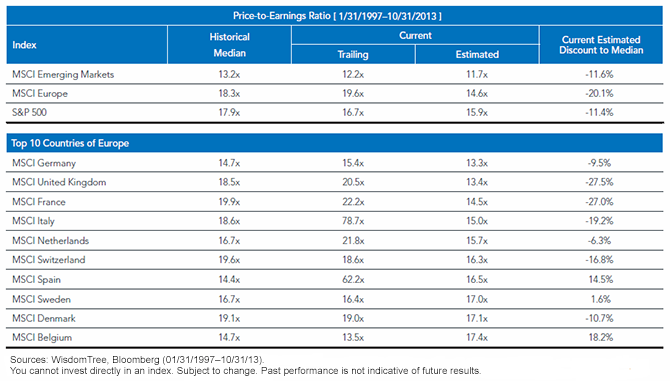

• Estimated Earnings Improvement Strong for Europe – Of the major regional indexes, the MSCI Europe Index showed the largest improvement in the estimated P/E ratio, thus signaling the greatest expectations for earnings growth compared to the S&P 500 and MSCI Emerging Markets indexes.

• Within Europe, the best improvements in expected earnings look to be in Italy and Spain, which have elevated P/E ratios on a trailing 12-month basis but see more normalized earnings and valuations in line with the rest of Europe. It is important for these two countries to begin normalizing, because they have provided some of the greatest headwinds for the European economy over the past six quarters.

• Europe Region with the Largest Discount to Its Own History – Europe’s estimated P/E ratio compared to its historical median showed a discount of 20%, greater than both the S&P 500 Index and the MSCI Emerging Markets Index. To be fair, the emerging markets have the lowest absolute valuation, but they have historically sold at a lower valuation compared to such developed markets as Europe or the United States.

• United Kingdom, Germany, France Lowest-Priced Markets – Looking within the individual country markets we notice the United Kingdom and Germany leading the way with the lowest estimated P/E ratios—just above 13x earnings and about 10% lower than Europe’s valuation as a whole. Both countries being among the region’s top economies, it is interesting that they also have the lowest current valuations. If one looked for the highest discount to its historical median, France takes the second spot after the United Kingdom. France also happens to have the third-lowest estimated P/E ratio.

Implementation

Europe has been one of the primary risks for the global economy—with sluggish growth, over-leveraged countries and banks being a prime concern for many investors. With these concerns and risks, it may be no surprise that Europe looks attractive from a price-to-earnings perspective, compared to other regions and even its own history. If Europe’s economy can expand upon its recent growth, it could be very supportive for future earnings growth and the regional equity markets. We feel there are different ways to play the European recovery theme, depending on one’s conviction, and WisdomTree has designed many different Indexes to provide exposure:

• WisdomTree Europe SmallCap Dividend Index – designed to provide exposure to the small-capitalization segment of the European dividend-paying market

• WisdomTree Europe Hedged Equity Index – designed to provide exposure to large-capitalization European exporters while at the same time neutralizing the currency exposure

• WisdomTree United Kingdom Hedged Equity Index – designed to provide exposure to global exporters listed in the United Kingdom while at the same time neutralizing the currency exposure

• WisdomTree Germany Hedged Equity Index – designed to provide exposure to German exporters while at the same time neutralizing the currency exposure

Read the full research here.

For definitions of indexes in the chart, please visit our Glossary.

• Estimated Earnings Improvement Strong for Europe – Of the major regional indexes, the MSCI Europe Index showed the largest improvement in the estimated P/E ratio, thus signaling the greatest expectations for earnings growth compared to the S&P 500 and MSCI Emerging Markets indexes.

• Within Europe, the best improvements in expected earnings look to be in Italy and Spain, which have elevated P/E ratios on a trailing 12-month basis but see more normalized earnings and valuations in line with the rest of Europe. It is important for these two countries to begin normalizing, because they have provided some of the greatest headwinds for the European economy over the past six quarters.

• Europe Region with the Largest Discount to Its Own History – Europe’s estimated P/E ratio compared to its historical median showed a discount of 20%, greater than both the S&P 500 Index and the MSCI Emerging Markets Index. To be fair, the emerging markets have the lowest absolute valuation, but they have historically sold at a lower valuation compared to such developed markets as Europe or the United States.

• United Kingdom, Germany, France Lowest-Priced Markets – Looking within the individual country markets we notice the United Kingdom and Germany leading the way with the lowest estimated P/E ratios—just above 13x earnings and about 10% lower than Europe’s valuation as a whole. Both countries being among the region’s top economies, it is interesting that they also have the lowest current valuations. If one looked for the highest discount to its historical median, France takes the second spot after the United Kingdom. France also happens to have the third-lowest estimated P/E ratio.

Implementation

Europe has been one of the primary risks for the global economy—with sluggish growth, over-leveraged countries and banks being a prime concern for many investors. With these concerns and risks, it may be no surprise that Europe looks attractive from a price-to-earnings perspective, compared to other regions and even its own history. If Europe’s economy can expand upon its recent growth, it could be very supportive for future earnings growth and the regional equity markets. We feel there are different ways to play the European recovery theme, depending on one’s conviction, and WisdomTree has designed many different Indexes to provide exposure:

• WisdomTree Europe SmallCap Dividend Index – designed to provide exposure to the small-capitalization segment of the European dividend-paying market

• WisdomTree Europe Hedged Equity Index – designed to provide exposure to large-capitalization European exporters while at the same time neutralizing the currency exposure

• WisdomTree United Kingdom Hedged Equity Index – designed to provide exposure to global exporters listed in the United Kingdom while at the same time neutralizing the currency exposure

• WisdomTree Germany Hedged Equity Index – designed to provide exposure to German exporters while at the same time neutralizing the currency exposure

Read the full research here.Important Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments focused in Europe are increasing the impact of events and developments associated with the region, which can adversely affect performance. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Investments focusing on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.