Emerging Market Consumer Growth in Automobiles: Dongfeng Motor Group

Recent Sales and Profitability

• Market Share: In the first half of 2013, Dongfeng Motor Group accounted for 11.2% of sales among the domestic automobile manufacturers in China.2

• Dongfeng Motor Group Sales: In the first half of 2013 sales were approximately 1.2 million units, or 2.9% growth over the same period last year. This growth lagged the 12.3% growth of the broader industry, which sold 10.8 million vehicles.3

Dongfeng attributes its slower growth rate to the following factors:

• General Business Slowdown: “The commercial vehicle market was affected by the prolonged economic downturn and Dongfeng was no exception as its commercial vehicles were mainly used for logistics.”4

• Japan Political Tensions Flare Up and Hurt Japanese Co-Branded Sales: “Sales of Dongfeng Nissan and Dongfeng Honda fell below the sales targets as sales in Japanese-brand passenger vehicles significantly decreased as a whole since mid-September.”5

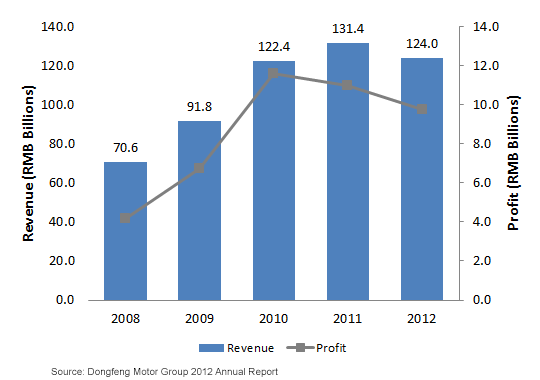

Despite these short-term factors weighing on growth, over the past five years Dongfeng has seen dramatic increases in both sales and profitability.

Figure 1: Dongfeng Motor Group Profitability (RMB Billions)

Recent Sales and Profitability

• Market Share: In the first half of 2013, Dongfeng Motor Group accounted for 11.2% of sales among the domestic automobile manufacturers in China.2

• Dongfeng Motor Group Sales: In the first half of 2013 sales were approximately 1.2 million units, or 2.9% growth over the same period last year. This growth lagged the 12.3% growth of the broader industry, which sold 10.8 million vehicles.3

Dongfeng attributes its slower growth rate to the following factors:

• General Business Slowdown: “The commercial vehicle market was affected by the prolonged economic downturn and Dongfeng was no exception as its commercial vehicles were mainly used for logistics.”4

• Japan Political Tensions Flare Up and Hurt Japanese Co-Branded Sales: “Sales of Dongfeng Nissan and Dongfeng Honda fell below the sales targets as sales in Japanese-brand passenger vehicles significantly decreased as a whole since mid-September.”5

Despite these short-term factors weighing on growth, over the past five years Dongfeng has seen dramatic increases in both sales and profitability.

Figure 1: Dongfeng Motor Group Profitability (RMB Billions)

• Double-Digit Growth – Over the past five calendar years, Dongfeng had average annual revenue growth of more than 11.9% and was able to grow profits by over 18.6%. It is important to note that profitability grew faster than revenue, usually a sign of higher margins and increased efficiency.

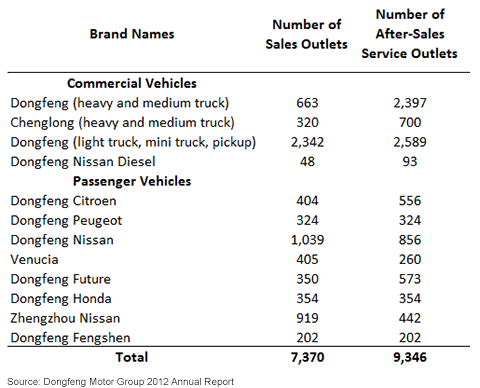

• Recent Sales Declines in Japanese Brands – The dispute between China and Japan over the sovereignty of the Diaoyu Islands in September 2012 had an adverse impact on the sales of Japanese automobile brands in China, and Dongfeng Nissan and Dongfeng Honda were not spared. Although the sales of these brands will likely continue to suffer in the near future, eventually they will begin to normalize. I would also remind investors that Dongfeng is a diversified automobile company with over 12 different brands, as the above chart highlights, and is still in a position to benefit from the growth in incomes across China’s large population.

Outlook

“It is anticipated that the growth of production and sales volume of the Dongfeng Motor Group will continue to outpace the industry, which will further consolidate and enhance its market position in the automobile industry in the [People’s Republic of China].”6

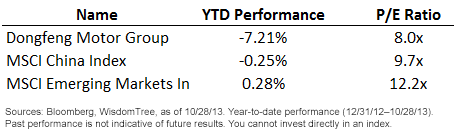

The short-term growth concerns have certainly put pressure on Dongfeng Motor’s price-to-earnings ratio. Dongfeng has underperformed the MSCI China Index in 2013 and is trading below both the Chinese market and the broader emerging market on a price-to-earnings basis.

Yet Dongfeng’s positioning as a market share leader in many categories in China makes it a potentially attractive option for investors looking to capitalize on future growth in the Chinese auto market at what may be temporarily depressed prices.

• Double-Digit Growth – Over the past five calendar years, Dongfeng had average annual revenue growth of more than 11.9% and was able to grow profits by over 18.6%. It is important to note that profitability grew faster than revenue, usually a sign of higher margins and increased efficiency.

• Recent Sales Declines in Japanese Brands – The dispute between China and Japan over the sovereignty of the Diaoyu Islands in September 2012 had an adverse impact on the sales of Japanese automobile brands in China, and Dongfeng Nissan and Dongfeng Honda were not spared. Although the sales of these brands will likely continue to suffer in the near future, eventually they will begin to normalize. I would also remind investors that Dongfeng is a diversified automobile company with over 12 different brands, as the above chart highlights, and is still in a position to benefit from the growth in incomes across China’s large population.

Outlook

“It is anticipated that the growth of production and sales volume of the Dongfeng Motor Group will continue to outpace the industry, which will further consolidate and enhance its market position in the automobile industry in the [People’s Republic of China].”6

The short-term growth concerns have certainly put pressure on Dongfeng Motor’s price-to-earnings ratio. Dongfeng has underperformed the MSCI China Index in 2013 and is trading below both the Chinese market and the broader emerging market on a price-to-earnings basis.

Yet Dongfeng’s positioning as a market share leader in many categories in China makes it a potentially attractive option for investors looking to capitalize on future growth in the Chinese auto market at what may be temporarily depressed prices.

For definitions of indexes in the chart, please go to Glossary.

Conclusion

Regardless of the WisdomTree Emerging Markets Consumer Growth Index’s (WTEMCG) current positioning, the biggest ongoing benefit of the methodology, we believe, comes from the ongoing disciplined rebalancing process. The fast growth rates of the auto market in emerging countries and the large numbers of possible purchases are two elements that have the potential to make investors forget some of the more basic elements of investing—such as valuation. From a selection standpoint, for constituents to maintain inclusion, higher earnings yields will be favored over lower earnings yields. From a weighting standpoint, qualifying firms whose price levels rise but whose earnings stay stable or decline will tend to see reductions in weight. At each annual rebalance, depending on the market environment, the natural focus of the Index will continue to be on valuation.

Dongfeng Motors provides another example of the WTEMCG methodology and investment theme: it is a company poised to benefit from China’s long-term consumer growth potential. In this case, the stock is selling at below-market valuation multiples because of what looks like short-term factors due to political tensions with Japan. In my opinion, these political factors are likely to dissipate over time and Dongfeng could be well positioned to resume its long-term growth trajectory.

1Source: Dongfeng Motor Group 2013 Interim Report.

2Source: Dongfeng Motor Group 2013 Interim Report.

3Source: Dongfeng Motor Group 2013 Interim Report.

4Source: Dongfeng Motor Group 2012 Annual Report.

5Source: Dongfeng Motor Group 2012 Annual Report.

6Source: Dongfeng Motor Group 2013 Interim Report.

As of 10/31/2013, the weight of the Dongfeng Motor Group in the WisdomTree Emerging Markets Consumer Growth Index was 2.54%.

For definitions of indexes in the chart, please go to Glossary.

Conclusion

Regardless of the WisdomTree Emerging Markets Consumer Growth Index’s (WTEMCG) current positioning, the biggest ongoing benefit of the methodology, we believe, comes from the ongoing disciplined rebalancing process. The fast growth rates of the auto market in emerging countries and the large numbers of possible purchases are two elements that have the potential to make investors forget some of the more basic elements of investing—such as valuation. From a selection standpoint, for constituents to maintain inclusion, higher earnings yields will be favored over lower earnings yields. From a weighting standpoint, qualifying firms whose price levels rise but whose earnings stay stable or decline will tend to see reductions in weight. At each annual rebalance, depending on the market environment, the natural focus of the Index will continue to be on valuation.

Dongfeng Motors provides another example of the WTEMCG methodology and investment theme: it is a company poised to benefit from China’s long-term consumer growth potential. In this case, the stock is selling at below-market valuation multiples because of what looks like short-term factors due to political tensions with Japan. In my opinion, these political factors are likely to dissipate over time and Dongfeng could be well positioned to resume its long-term growth trajectory.

1Source: Dongfeng Motor Group 2013 Interim Report.

2Source: Dongfeng Motor Group 2013 Interim Report.

3Source: Dongfeng Motor Group 2013 Interim Report.

4Source: Dongfeng Motor Group 2012 Annual Report.

5Source: Dongfeng Motor Group 2012 Annual Report.

6Source: Dongfeng Motor Group 2013 Interim Report.

As of 10/31/2013, the weight of the Dongfeng Motor Group in the WisdomTree Emerging Markets Consumer Growth Index was 2.54%.Important Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.