Emerging Market Consumer Growth in Automobiles: Great Wall Motor Company

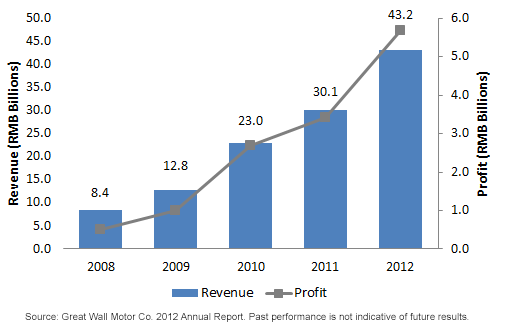

• Impressive Historical Growth – Similar to its most recent reporting period, the Great Wall Motor Company has seen impressive growth in sales and profitability over the past five years. Revenue is up by a factor of 5, while profits have grown by a factor of 11. Even more impressive than the annual growth rate was Great Wall’s ability to grow profitability twice as fast as sales over the period. Typically, when profitability increases faster than revenues, it’s a sign that a company is experiencing higher margins and increased efficiency, which is also beneficial for future growth.

• Profit Growth Exceeded Stock Return – As a result of these impressive results, Great Wall Motor Company stock appreciated over 511%, or 43.6% on an average annual basis, from December 31, 2007, to December 31, 2012. This is even a more impressive considering the MSCI China was down 16% over the period, or -3.5% on an average annual basis. Although some might be concerned that valuations have become stretched, I think it is important to remember that profitability grew even faster than price over the period, essentially indicating that the valuations have actually improved from a price-to-earnings perspective.

Potential Outlook

Despite market concerns over China’s economic growth prospects, it is expected that domestic consumption will continue to grow steadily due to the country’s colossal potential purchasing power.4

The Great Wall Motor Company is aggressively investing in its brand, trying to grow market share through constant improvement of its product mix via yearly updates and by launching new products such as the Haval H2, H7 and H8 models.

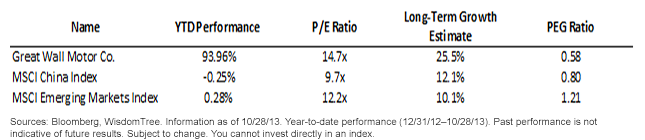

Since investors are easily enamored with the theme of consumer growth in emerging markets, we believe that valuation risk is one of the single greatest risks to consumer-oriented stocks and sectors in the emerging markets today. Even after discussing the above profitability growth, one might consider Great Wall Motor Company as potentially overvalued after it has grown over 90% for the first 10 months of the year, but we would point to both the price-to-earnings ratio and growth expectations for perspective. Although it is currently trading at a higher valuation than both the domestic and broader emerging markets from a price-to-earnings ratio, it doesn’t look overvalued after incorporating its expected growth expectations, displayed through the PEG ratio.

• Impressive Historical Growth – Similar to its most recent reporting period, the Great Wall Motor Company has seen impressive growth in sales and profitability over the past five years. Revenue is up by a factor of 5, while profits have grown by a factor of 11. Even more impressive than the annual growth rate was Great Wall’s ability to grow profitability twice as fast as sales over the period. Typically, when profitability increases faster than revenues, it’s a sign that a company is experiencing higher margins and increased efficiency, which is also beneficial for future growth.

• Profit Growth Exceeded Stock Return – As a result of these impressive results, Great Wall Motor Company stock appreciated over 511%, or 43.6% on an average annual basis, from December 31, 2007, to December 31, 2012. This is even a more impressive considering the MSCI China was down 16% over the period, or -3.5% on an average annual basis. Although some might be concerned that valuations have become stretched, I think it is important to remember that profitability grew even faster than price over the period, essentially indicating that the valuations have actually improved from a price-to-earnings perspective.

Potential Outlook

Despite market concerns over China’s economic growth prospects, it is expected that domestic consumption will continue to grow steadily due to the country’s colossal potential purchasing power.4

The Great Wall Motor Company is aggressively investing in its brand, trying to grow market share through constant improvement of its product mix via yearly updates and by launching new products such as the Haval H2, H7 and H8 models.

Since investors are easily enamored with the theme of consumer growth in emerging markets, we believe that valuation risk is one of the single greatest risks to consumer-oriented stocks and sectors in the emerging markets today. Even after discussing the above profitability growth, one might consider Great Wall Motor Company as potentially overvalued after it has grown over 90% for the first 10 months of the year, but we would point to both the price-to-earnings ratio and growth expectations for perspective. Although it is currently trading at a higher valuation than both the domestic and broader emerging markets from a price-to-earnings ratio, it doesn’t look overvalued after incorporating its expected growth expectations, displayed through the PEG ratio.

Conclusion

Regardless of WTEMCG’s current positioning, the biggest ongoing benefit of the methodology, I believe, comes from the ongoing disciplined rebalancing process. The fast growth rates of autos in emerging countries and large numbers of possible purchases are two elements that have the potential to make investors forget some of the more basic elements of investing—such as valuation. From a selection standpoint, for constituents to maintain inclusion, higher earnings yields will be favored over lower earnings yields. From a weighting standpoint, qualifying firms whose price levels rise but whose earnings stay stable or decline will tend to see reductions in weight. At each annual rebalance, depending on the market environment, the natural focus of the Index will continue to be sensitive to valuation. The Great Wall Motor Company exemplifies the theme of the WTEMCG, as it is a company well positioned to benefit from a major macroeconomic trend of a rising consumer and middle class in China—but the investment strategy has a disciplined focus on valuations, and GWM does not appear expensive, given its growth trajectory.

For current holdings of the WisdomTree Emerging Markets Consumer Growth Index, please click here.

1Source: http://www.gwm-global.com/company/index.html.

2Source: http://www.gwm-global.com/company/index.html.

3Source: Great Wall Motor Company 2013 Interim Report.

4Sources: Great Wall Motor Company and China Association of Automobile Manufacturers.

5Source: Great Wall Motor Company 2013 Interim Report.

Conclusion

Regardless of WTEMCG’s current positioning, the biggest ongoing benefit of the methodology, I believe, comes from the ongoing disciplined rebalancing process. The fast growth rates of autos in emerging countries and large numbers of possible purchases are two elements that have the potential to make investors forget some of the more basic elements of investing—such as valuation. From a selection standpoint, for constituents to maintain inclusion, higher earnings yields will be favored over lower earnings yields. From a weighting standpoint, qualifying firms whose price levels rise but whose earnings stay stable or decline will tend to see reductions in weight. At each annual rebalance, depending on the market environment, the natural focus of the Index will continue to be sensitive to valuation. The Great Wall Motor Company exemplifies the theme of the WTEMCG, as it is a company well positioned to benefit from a major macroeconomic trend of a rising consumer and middle class in China—but the investment strategy has a disciplined focus on valuations, and GWM does not appear expensive, given its growth trajectory.

For current holdings of the WisdomTree Emerging Markets Consumer Growth Index, please click here.

1Source: http://www.gwm-global.com/company/index.html.

2Source: http://www.gwm-global.com/company/index.html.

3Source: Great Wall Motor Company 2013 Interim Report.

4Sources: Great Wall Motor Company and China Association of Automobile Manufacturers.

5Source: Great Wall Motor Company 2013 Interim Report.Important Risks Related to this Article

Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.