Emerging Market Consumer Growth in Automobiles

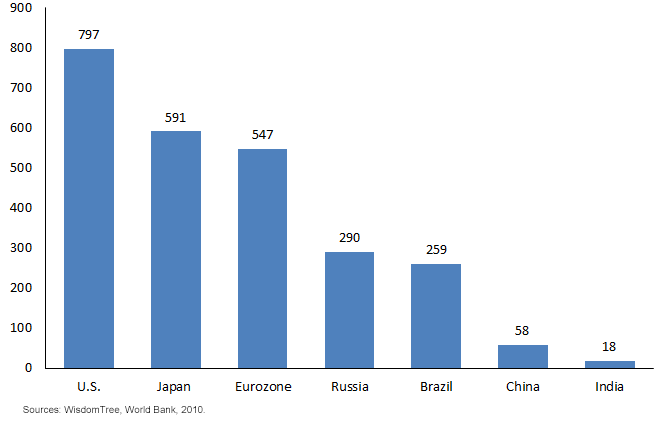

• Contrasting BRIC Ownership with U.S. – China has less than one-tenth the per capita automobile ownership of the United States or Japan, while India’s automobile penetration is a further two-thirds lower. China and India are the two largest countries by population, indicating a substantial market as their per capita ownership converges with that of the developed world. Brazil and Russia still have roughly one-third of the car ownership of the United States.

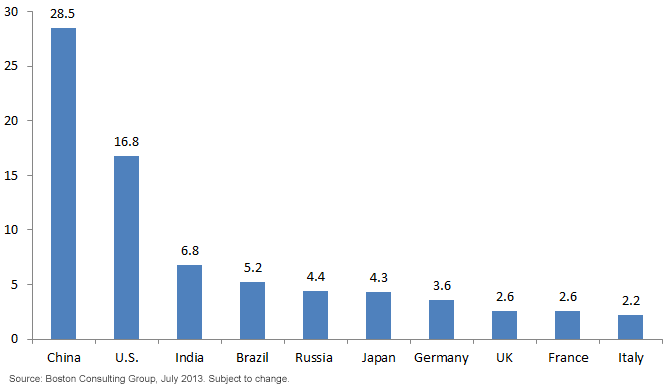

The EM consumer has driven much of the economic growth in EM since 20001, and many are expecting this trend to accelerate as income levels rise. This growth potential can be displayed through estimated vehicle sales provided by the Boston Consulting Group.

Figure 2: 2020 Estimated Vehicle Sales (Millions)

• Contrasting BRIC Ownership with U.S. – China has less than one-tenth the per capita automobile ownership of the United States or Japan, while India’s automobile penetration is a further two-thirds lower. China and India are the two largest countries by population, indicating a substantial market as their per capita ownership converges with that of the developed world. Brazil and Russia still have roughly one-third of the car ownership of the United States.

The EM consumer has driven much of the economic growth in EM since 20001, and many are expecting this trend to accelerate as income levels rise. This growth potential can be displayed through estimated vehicle sales provided by the Boston Consulting Group.

Figure 2: 2020 Estimated Vehicle Sales (Millions)

• BRIC Vehicle Sales Expected to Lead – These countries are expected to be four out of the five largest purchasers of vehicles by 2020. They are expected to collectively purchase almost 45 million vehicles; over 30% more than their collective G7 developed peers. Leading the way is China, which is expected to purchase approximately 70% more vehicles than the U.S.

How to Participate in This Development?

Few will argue that investors will need exposure to the automobile industry to capitalize on this development, but some will debate the best way to access these future consumers. One could say General Motors, Ford, Volkswagen—large multinationals—have a growing presence in China, and their growth will come from sales in China. However, I believe a better way to capitalize is to focus on local companies that derive a majority of their revenues from within these countries.

According to the China Association of Auto Manufacturers, for the first nine months of 2013, Chinese auto companies led in market share and were responsible for approximately 40% of the Chinese market. I believe these local companies often know their consumer market best and have direct access to consumers through their dominant market share. It is for that reason that we have created an index designed specifically to reflect this theme across the broader emerging market economies.

The WisdomTree Emerging Markets Consumer Growth Index

The WisdomTree Emerging Markets Consumer Growth Index (WTEMCG) strives to provide exposure to the emerging market consumer growth trend with a broadly diversified and inclusive approach to selection, while at the same time maintaining sensitivity to valuation.

As a result of its index rules, screening criteria and selection methodology, WTEMCG currently has over 15% exposure to the automobile industry. Some of the top names in autos in WTEMCG include: Astra International (an Indonesian company), Dongfeng Motor Group Co. and Great Wall Motor Co. (two Chinese companies), and Tata Motors (an Indian company). In a future blog post, I will go into greater detail about the trends these companies are seeing in their respective markets. To see the full list of Index constituents, please click here.

For current holdings of the WisdomTree Emerging Markets Consumer Growth Index, please click here.

1Source: Bhanu Baweja and Christine Li, “EM by the Numbers: Trying to Get That Engine Going,” UBS Investment Research, 7/26/13.

• BRIC Vehicle Sales Expected to Lead – These countries are expected to be four out of the five largest purchasers of vehicles by 2020. They are expected to collectively purchase almost 45 million vehicles; over 30% more than their collective G7 developed peers. Leading the way is China, which is expected to purchase approximately 70% more vehicles than the U.S.

How to Participate in This Development?

Few will argue that investors will need exposure to the automobile industry to capitalize on this development, but some will debate the best way to access these future consumers. One could say General Motors, Ford, Volkswagen—large multinationals—have a growing presence in China, and their growth will come from sales in China. However, I believe a better way to capitalize is to focus on local companies that derive a majority of their revenues from within these countries.

According to the China Association of Auto Manufacturers, for the first nine months of 2013, Chinese auto companies led in market share and were responsible for approximately 40% of the Chinese market. I believe these local companies often know their consumer market best and have direct access to consumers through their dominant market share. It is for that reason that we have created an index designed specifically to reflect this theme across the broader emerging market economies.

The WisdomTree Emerging Markets Consumer Growth Index

The WisdomTree Emerging Markets Consumer Growth Index (WTEMCG) strives to provide exposure to the emerging market consumer growth trend with a broadly diversified and inclusive approach to selection, while at the same time maintaining sensitivity to valuation.

As a result of its index rules, screening criteria and selection methodology, WTEMCG currently has over 15% exposure to the automobile industry. Some of the top names in autos in WTEMCG include: Astra International (an Indonesian company), Dongfeng Motor Group Co. and Great Wall Motor Co. (two Chinese companies), and Tata Motors (an Indian company). In a future blog post, I will go into greater detail about the trends these companies are seeing in their respective markets. To see the full list of Index constituents, please click here.

For current holdings of the WisdomTree Emerging Markets Consumer Growth Index, please click here.

1Source: Bhanu Baweja and Christine Li, “EM by the Numbers: Trying to Get That Engine Going,” UBS Investment Research, 7/26/13.Important Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Diversification does not eliminate the risk of experiencing investment losses.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.