Is South Korea a Developed or an Emerging Market? Depends Who You Ask.

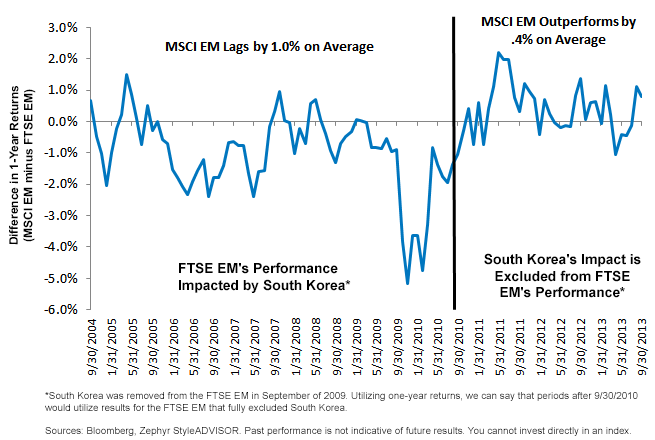

• South Korea Included in FTSE EM: As we see in the above chart, during this period (9/30/2003 to 9/30/2010) the MSCI EM lags the FTSE EM by an average of 1.0%.

• South Korea Excluded from FTSE EM: As we see in the above chart, during this period (9/30/2010 to 9/30/2013) the MSCI EM outperforms the FTSE EM by an average of .4%.

Of course, since there is no way to know ahead of time whether South Korea’s equity market will under- or outperform, we can’t say that excluding South Korea will always hurt FTSE EM’s performance compared to MSCI EM. What we can say is that South Korea is a major exposure in MSCI EM—the second-largest country weight as of September 30, 20133, so its exclusion could potentially result in significant differences in performance.

Conclusion: Single-Country Indexes for South Korea Could Be of Interest

For those utilizing strategies that track the performance of the FTSE EM after costs, fees and expenses, single-country indexes for South Korea could be of interest. Even looking toward the FTSE Developed ex North America Index may not be enough, as South Korea garnered only an approximate weight of 4% as of September 30, 2013. Performance differentials to the MSCI EM could be important, and any potential mitigation of their impact could be beneficial.

1Source: Woods, 2013.

2Source: Woods, 2013.

3Source: HSCI, 2013.

• South Korea Included in FTSE EM: As we see in the above chart, during this period (9/30/2003 to 9/30/2010) the MSCI EM lags the FTSE EM by an average of 1.0%.

• South Korea Excluded from FTSE EM: As we see in the above chart, during this period (9/30/2010 to 9/30/2013) the MSCI EM outperforms the FTSE EM by an average of .4%.

Of course, since there is no way to know ahead of time whether South Korea’s equity market will under- or outperform, we can’t say that excluding South Korea will always hurt FTSE EM’s performance compared to MSCI EM. What we can say is that South Korea is a major exposure in MSCI EM—the second-largest country weight as of September 30, 20133, so its exclusion could potentially result in significant differences in performance.

Conclusion: Single-Country Indexes for South Korea Could Be of Interest

For those utilizing strategies that track the performance of the FTSE EM after costs, fees and expenses, single-country indexes for South Korea could be of interest. Even looking toward the FTSE Developed ex North America Index may not be enough, as South Korea garnered only an approximate weight of 4% as of September 30, 2013. Performance differentials to the MSCI EM could be important, and any potential mitigation of their impact could be beneficial.

1Source: Woods, 2013.

2Source: Woods, 2013.

3Source: HSCI, 2013.Important Risks Related to this Article

Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Investments focused in Korea are increasing the impact of events and developments associated with the region, which can adversely affect performance. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.