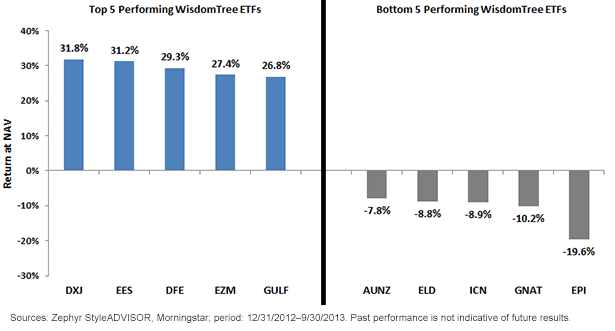

Our Best and Worst Performing Funds through Q3 2013

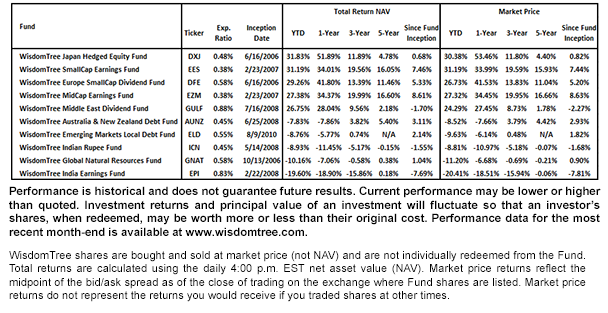

Average Annual Returns as of 9/30/2013

Average Annual Returns as of 9/30/2013

The “Bottom 5”

WisdomTree’s five worst-performing ETFs on a year-to-date basis may represent some pockets of underlying relative value—the types of areas where a contrarian investor may want to focus.

• GNAT: This fund focuses on equities within natural resource sectors, and it is the second worst-performing of all WisdomTree’s equity Funds year-to-date. However, if we compare the price-to-earnings (P/E) ratio to the S&P 500 Index, a commonly used benchmark for the performance of U.S. equities, it is nearly 30% lower. Generally speaking, natural resources are necessary inputs to help fuel overall global growth, so this recent negative performance could be an opportunity.

• Emerging Markets: ELD, ICN and EPI all fit a common theme of different ways in which to generate exposure to emerging markets, and in the case of ICN and EPI, to India. Each has a negative return year-to-date. In the case of India, there has been great volatility. A change of leadership at the Reserve Bank of India (RBI) in the beginning of September has been viewed positively, but India’s difficulties are far from solved. ELD, to us, could be the more interesting opportunity, in that its performance year-to-date is down more than other broad-based WisdomTree equity Funds focused on the emerging markets. While certainly not without risk,locally denominated debt in emerging markets has been hard hit during 2013 thus far—and may represent a possible valuation opportunity.

• AUNZ: The Australian and New Zealand economies are strongly connected to commodities—a factor that could have influenced some of the negative performance in 2013 year-to-date. However, the more important factor to note is that the Australian dollar has lost 10.4% against the U.S. dollar over this period, and the Fund’s negative performance can largely be explained by this currency move.

Conclusion

While there is truly no way to predict future inflection points for different funds, we believe it is always interesting to consider both sides of the performance spectrum. Top-performing funds are typically well-noted, garnering significant attention. Much less noted are the bottom performers—and at times these could have the potential to be the top performers of tomorrow.

Data source is Bloomberg unless otherwise noted.

1As represented by the MSCI Japan Local Currency Index.

2As represented by the S&P 500 Index.

3Mid- and small-cap segments are represented by the S&P MidCap 400 and Russell 2000 indexes, respectively.

4As represented by the WisdomTree Middle East Dividend Index.

5As represented by the WisdomTree Europe SmallCap Dividend Index.

The “Bottom 5”

WisdomTree’s five worst-performing ETFs on a year-to-date basis may represent some pockets of underlying relative value—the types of areas where a contrarian investor may want to focus.

• GNAT: This fund focuses on equities within natural resource sectors, and it is the second worst-performing of all WisdomTree’s equity Funds year-to-date. However, if we compare the price-to-earnings (P/E) ratio to the S&P 500 Index, a commonly used benchmark for the performance of U.S. equities, it is nearly 30% lower. Generally speaking, natural resources are necessary inputs to help fuel overall global growth, so this recent negative performance could be an opportunity.

• Emerging Markets: ELD, ICN and EPI all fit a common theme of different ways in which to generate exposure to emerging markets, and in the case of ICN and EPI, to India. Each has a negative return year-to-date. In the case of India, there has been great volatility. A change of leadership at the Reserve Bank of India (RBI) in the beginning of September has been viewed positively, but India’s difficulties are far from solved. ELD, to us, could be the more interesting opportunity, in that its performance year-to-date is down more than other broad-based WisdomTree equity Funds focused on the emerging markets. While certainly not without risk,locally denominated debt in emerging markets has been hard hit during 2013 thus far—and may represent a possible valuation opportunity.

• AUNZ: The Australian and New Zealand economies are strongly connected to commodities—a factor that could have influenced some of the negative performance in 2013 year-to-date. However, the more important factor to note is that the Australian dollar has lost 10.4% against the U.S. dollar over this period, and the Fund’s negative performance can largely be explained by this currency move.

Conclusion

While there is truly no way to predict future inflection points for different funds, we believe it is always interesting to consider both sides of the performance spectrum. Top-performing funds are typically well-noted, garnering significant attention. Much less noted are the bottom performers—and at times these could have the potential to be the top performers of tomorrow.

Data source is Bloomberg unless otherwise noted.

1As represented by the MSCI Japan Local Currency Index.

2As represented by the S&P 500 Index.

3Mid- and small-cap segments are represented by the S&P MidCap 400 and Russell 2000 indexes, respectively.

4As represented by the WisdomTree Middle East Dividend Index.

5As represented by the WisdomTree Europe SmallCap Dividend Index.Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in real estate involve additional special risks, such as credit risk, interest rate fluctuations and the effect of varied economic conditions. Funds that focus their investments in one country or region may be significantly impacted by events and developments associated with the region, which can adversely affect performance. Funds focusing on a single sector and/or smaller companies generally experience greater price volatility. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation, intervention and political developments. Due to the investment strategy of certain Funds, they may make higher capital gain distributions than other ETFs. Please read each Fund’s prospectus for specific details regarding the Fund’s risk profile.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.