One Way to Manage Risk Internationally: Hedge Euro Risk

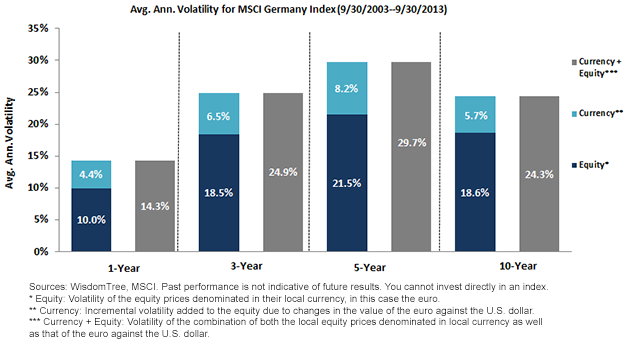

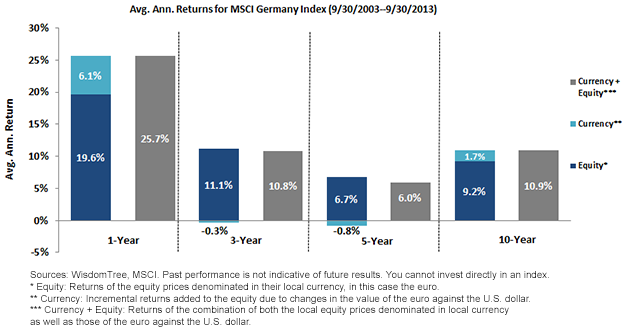

Despite adding significantly to the volatility picture, historically, the euro’s returns have hardly compensated the investor for the additional volatility. The euro returned2:

+ 6.1% over 1 year

- 0.3% per year over 3 years

- 0.8% per year over 5 years

+ 1.7% per year over 10 years

The decline in return over the five years more than wiped out any equity gains over that period.

Despite adding significantly to the volatility picture, historically, the euro’s returns have hardly compensated the investor for the additional volatility. The euro returned2:

+ 6.1% over 1 year

- 0.3% per year over 3 years

- 0.8% per year over 5 years

+ 1.7% per year over 10 years

The decline in return over the five years more than wiped out any equity gains over that period.

We make the case for hedging out euro exposure in order to potentially reduce overall volatility and mitigate the risk of hurting the overall return profile through potentially adverse currency movements.

Conclusion

While we made the case here with respect to Germany, we also could broaden the argument with respect to the Eurozone at large. WisdomTree believes there is an increased need to consider hedging currency risks when it comes to international investing. WisdomTree has thus created a series of hedged equity Indexes that include one for the broader European markets as well as for some of the largest countries in Europe, such as Germany and the United Kingdom.

1Sources: WisdomTree, MSCI.

2Sources: WisdomTree, MSCI, Bloomberg.

We make the case for hedging out euro exposure in order to potentially reduce overall volatility and mitigate the risk of hurting the overall return profile through potentially adverse currency movements.

Conclusion

While we made the case here with respect to Germany, we also could broaden the argument with respect to the Eurozone at large. WisdomTree believes there is an increased need to consider hedging currency risks when it comes to international investing. WisdomTree has thus created a series of hedged equity Indexes that include one for the broader European markets as well as for some of the largest countries in Europe, such as Germany and the United Kingdom.

1Sources: WisdomTree, MSCI.

2Sources: WisdomTree, MSCI, Bloomberg.Important Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Derivative investments can be volatile and these investments may be less liquid than other securities, and more sensitive to the effect of varied economic conditions. Investments focused in Germany are increasing the impact of events and developments associated with the region, which can adversely affect performance.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.