Introducing the WisdomTree Korea Hedged Equity Index

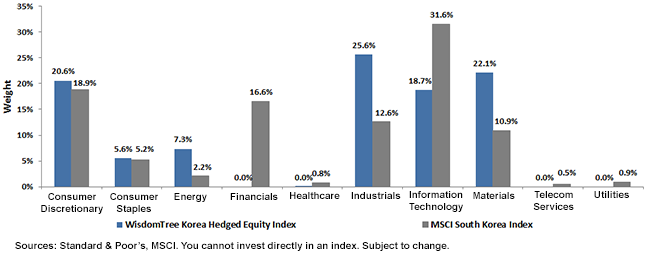

• Financials: The most notable under-weight for WTKRH (due to its local market bias) is in the Financials sector, where the Index actually has no exposure but the MSCI South Korea Index has almost 17%.

• Industrials and Materials: The two most notable over-weights for WTKRH are in the Industrials and Materials sectors. WTKRH has about twice the weight of the MSCI South Korea Index in each respective sector. It’s interesting to note what some of the largest holdings in these sectors in WTKRH actually do.

o Large Industrial Base: Hyundai Heavy Industries is a large industrial and has been the world’s number one shipbuilder since 1983.5 In fact, 40% of its revenues come from the export of ships—specifically transporters of liquefied natural gas, containerships and drillships.6

o Firms such as Daelim and POSCO are also interesting to us because of the variety of their subsidiaries. For example, Daelim has involvement in powerplant construction around the world, whereas POSCO was recently able to ensure that it could produce the 313 different types of sheet metal required by Japanese automakers.7

• Information Technology: The Information Technology sector represents another significant under-weight for WTKRH vs. the MSCI South Korea Index, due to both the sector and individual security caps.

Conclusion

At WisdomTree, we are excited to expand our family of currency-hedged indexes from Japan to Europe, to the United Kingdom, Germany and now Korea. As investors consider the type of equity exposure they add to their portfolio, we see a growing awareness about undesired bets on currency changes—when it is equity markets that are viewed as the real opportunities. We believe that currency-hedged strategies are an important new tool in the toolbox, providing unique equity market exposures.

For current holdings of the WisdomTree Korea Hedged Equity Index, please click here.

1Refers to the WisdomTree DEFA Hedged Equity Index, which consisted of exposures to developed world equities and currencies such as the euro, Japanese yen, British pound, Danish krone, Norwegian krone, Swedish krona and others.

2Relatively inexpensive cost of hedging: Refers to how across many developed markets, such as Japan, the United Kingdom and the euro area, central banks are making efforts to keep short-term interest rates at low levels that are quite similar to those in the United States.

3Source: MSCI, as of 9/30/2013.

4Between annual rebalances, individual security and sector weights may fluctuate above 10%, 4.5% and 25%, respectively.

5Source: Hyundai Heavy Industries Annual Report 2012.

6Source: Bloomberg, as of 9/30/2013.

7Sources: POSCO 3Q 2012 Operating Performance Investor Presentation (October 23, 2012) and Daelim Industries 2012 Annual Report.

• Financials: The most notable under-weight for WTKRH (due to its local market bias) is in the Financials sector, where the Index actually has no exposure but the MSCI South Korea Index has almost 17%.

• Industrials and Materials: The two most notable over-weights for WTKRH are in the Industrials and Materials sectors. WTKRH has about twice the weight of the MSCI South Korea Index in each respective sector. It’s interesting to note what some of the largest holdings in these sectors in WTKRH actually do.

o Large Industrial Base: Hyundai Heavy Industries is a large industrial and has been the world’s number one shipbuilder since 1983.5 In fact, 40% of its revenues come from the export of ships—specifically transporters of liquefied natural gas, containerships and drillships.6

o Firms such as Daelim and POSCO are also interesting to us because of the variety of their subsidiaries. For example, Daelim has involvement in powerplant construction around the world, whereas POSCO was recently able to ensure that it could produce the 313 different types of sheet metal required by Japanese automakers.7

• Information Technology: The Information Technology sector represents another significant under-weight for WTKRH vs. the MSCI South Korea Index, due to both the sector and individual security caps.

Conclusion

At WisdomTree, we are excited to expand our family of currency-hedged indexes from Japan to Europe, to the United Kingdom, Germany and now Korea. As investors consider the type of equity exposure they add to their portfolio, we see a growing awareness about undesired bets on currency changes—when it is equity markets that are viewed as the real opportunities. We believe that currency-hedged strategies are an important new tool in the toolbox, providing unique equity market exposures.

For current holdings of the WisdomTree Korea Hedged Equity Index, please click here.

1Refers to the WisdomTree DEFA Hedged Equity Index, which consisted of exposures to developed world equities and currencies such as the euro, Japanese yen, British pound, Danish krone, Norwegian krone, Swedish krona and others.

2Relatively inexpensive cost of hedging: Refers to how across many developed markets, such as Japan, the United Kingdom and the euro area, central banks are making efforts to keep short-term interest rates at low levels that are quite similar to those in the United States.

3Source: MSCI, as of 9/30/2013.

4Between annual rebalances, individual security and sector weights may fluctuate above 10%, 4.5% and 25%, respectively.

5Source: Hyundai Heavy Industries Annual Report 2012.

6Source: Bloomberg, as of 9/30/2013.

7Sources: POSCO 3Q 2012 Operating Performance Investor Presentation (October 23, 2012) and Daelim Industries 2012 Annual Report.Important Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments focusing on specific regions or countries increase the impact of events and developments associated with the region or country, which can adversely affect performance. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Derivative investments can be volatile, and these investments may be less liquid than other securities, and more sensitive to the effect of varied economic conditions.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.