Japanese Households: Expecting Inflation and Shifting Their Portfolios

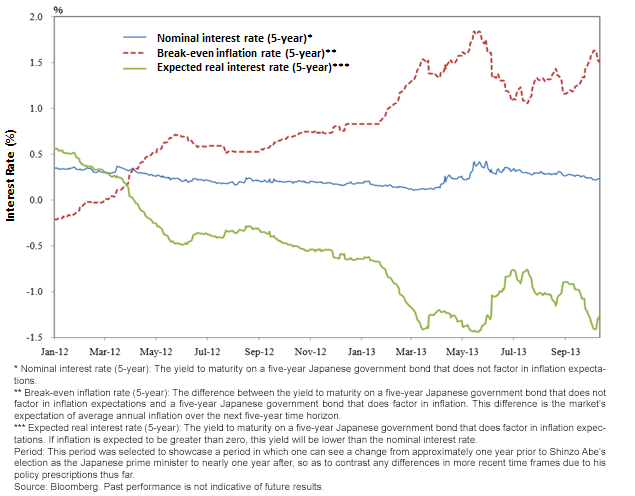

But there is increasing evidence that inflation expectations are becoming more firmly established. Beyond the break-even inflation rates, survey data confirms households are expecting inflation. Iwata stated that 83% of respondents to a Bank of Japan survey expected prices to go up one year from now.2

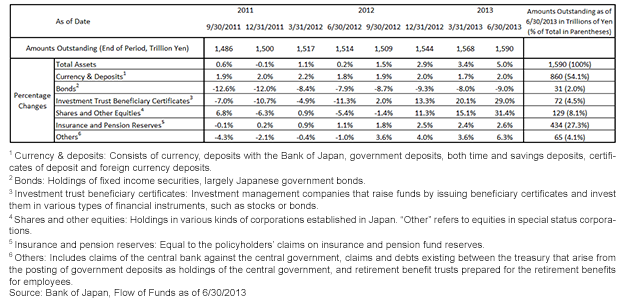

Iwata further stated that the rise in inflation expectations should manifest in shifting portfolio allocations from cash, which earns 0% interest rate and potentially suffers from declines in purchasing power, toward foreign assets and equities. And the portfolio flow data is starting to bear out this shift in allocations. Iwata illustrated the occurring shifts:

According to recent statistics, the financial assets of households at end-June 2013 increased by 5% on a year-on-year basis. Looking at this in detail, while bonds decreased by 9%, shares and equities increased by 31% and investment trusts rose by 29%. The portfolio rebalancing … is actually taking place.3

Japanese Household Assets (as of 6/30/2013)

But there is increasing evidence that inflation expectations are becoming more firmly established. Beyond the break-even inflation rates, survey data confirms households are expecting inflation. Iwata stated that 83% of respondents to a Bank of Japan survey expected prices to go up one year from now.2

Iwata further stated that the rise in inflation expectations should manifest in shifting portfolio allocations from cash, which earns 0% interest rate and potentially suffers from declines in purchasing power, toward foreign assets and equities. And the portfolio flow data is starting to bear out this shift in allocations. Iwata illustrated the occurring shifts:

According to recent statistics, the financial assets of households at end-June 2013 increased by 5% on a year-on-year basis. Looking at this in detail, while bonds decreased by 9%, shares and equities increased by 31% and investment trusts rose by 29%. The portfolio rebalancing … is actually taking place.3

Japanese Household Assets (as of 6/30/2013)

The increase in both equities (at approximately 30%) and investment trusts (such as mutual funds) is impressive but still needs to be put in the context of the low bases they were starting from. Only 8.1% of Japan’s household assets were in shares and other equities, and only 4.5% of total assets were in investment trusts. A full 54.1% was still in “currency and deposits”—or being left in the bank and under the proverbial mattress. These assets are earning essentially a 0% rate of return and suffering losses in purchasing power.

The types of increases in equities and investment trusts we saw in the first and second quarters of 2013 are an important start, but they are just that—a start of what could be a critical adjustment in portfolio allocations. As we discussed in our last blog post, the BOJ’s QQE program is meant to reduce the risk premium (i.e., support higher prices) for the equity markets through their purchases of equities. This recent evidence of households shifting portfolios is thus an encouraging ramification of the QQE program, but I believe we are only in the very early innings of a large shift in portfolio allocations. This shift, if it continues, will be a big driver of Japan’s equity markets over the years and is one of the reasons why I am optimistic for the prospects on Japan’s markets.

1Kikuo Iwata, “Purpose and Mechanism of Quantitative and Qualitative Monetary Easing,” Bank of Japan, October 18, 2013.

2Iwata, 2013.

3Iwata, 2013.

The increase in both equities (at approximately 30%) and investment trusts (such as mutual funds) is impressive but still needs to be put in the context of the low bases they were starting from. Only 8.1% of Japan’s household assets were in shares and other equities, and only 4.5% of total assets were in investment trusts. A full 54.1% was still in “currency and deposits”—or being left in the bank and under the proverbial mattress. These assets are earning essentially a 0% rate of return and suffering losses in purchasing power.

The types of increases in equities and investment trusts we saw in the first and second quarters of 2013 are an important start, but they are just that—a start of what could be a critical adjustment in portfolio allocations. As we discussed in our last blog post, the BOJ’s QQE program is meant to reduce the risk premium (i.e., support higher prices) for the equity markets through their purchases of equities. This recent evidence of households shifting portfolios is thus an encouraging ramification of the QQE program, but I believe we are only in the very early innings of a large shift in portfolio allocations. This shift, if it continues, will be a big driver of Japan’s equity markets over the years and is one of the reasons why I am optimistic for the prospects on Japan’s markets.

1Kikuo Iwata, “Purpose and Mechanism of Quantitative and Qualitative Monetary Easing,” Bank of Japan, October 18, 2013.

2Iwata, 2013.

3Iwata, 2013.

Important Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments focused in Japan are increasing the impact of events and developments associated with the region, which can adversely affect performance.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.