Where We See Opportunity in German Equities

• In the High Dividend Yield Year Range: As of September 30, 2013, German Equities exhibited a trailing 12-month dividend yield of 2.98%, which is above the median dividend yield of our analysis.

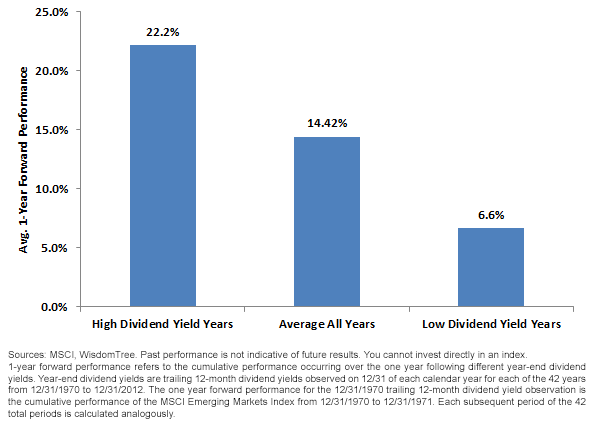

• Significant Dispersion from High to Low: We’ve certainly pointed to this analysis for other equity markets before. The three bars in this figure make the point that valuation is quite important for German Equities. On average, the returns of High Dividend Yield Years eclipsed those of Low Dividend Yield Years by more than 15%. This suggests that as far as timing goes, it was better from a returns perspective to start during a high dividend yield period such as we see in today’s environment.

But What about Price-to-Earnings (P/E) Ratios?

Trailing 12-month dividend yield is merely one way to look at the valuation picture for German Equities. Some also look at P/E ratios. We have P/E data extending back to January 1995. From January 1, 1995, to September 30, 2013, the median P/E ratio for German Equities was approximately 13.7x3. As of September 30, 2013, the P/E ratio was indicated to be 13.8x—very much in line with its median4 .

Conclusion

Our historical valuation work—based primarily around the dividend yield indicator—showed that German Equities performed well following high dividend yield periods. The current levels are indicative of such a period, leading us to conclude that German Equities appear attractively priced based on historical levels.

1Source: WisdomTree, MSCI

2Source: WisdomTree, Bloomberg

3Source: Bloomberg, WisdomTree

4Source: Bloomberg, WisdomTree

• In the High Dividend Yield Year Range: As of September 30, 2013, German Equities exhibited a trailing 12-month dividend yield of 2.98%, which is above the median dividend yield of our analysis.

• Significant Dispersion from High to Low: We’ve certainly pointed to this analysis for other equity markets before. The three bars in this figure make the point that valuation is quite important for German Equities. On average, the returns of High Dividend Yield Years eclipsed those of Low Dividend Yield Years by more than 15%. This suggests that as far as timing goes, it was better from a returns perspective to start during a high dividend yield period such as we see in today’s environment.

But What about Price-to-Earnings (P/E) Ratios?

Trailing 12-month dividend yield is merely one way to look at the valuation picture for German Equities. Some also look at P/E ratios. We have P/E data extending back to January 1995. From January 1, 1995, to September 30, 2013, the median P/E ratio for German Equities was approximately 13.7x3. As of September 30, 2013, the P/E ratio was indicated to be 13.8x—very much in line with its median4 .

Conclusion

Our historical valuation work—based primarily around the dividend yield indicator—showed that German Equities performed well following high dividend yield periods. The current levels are indicative of such a period, leading us to conclude that German Equities appear attractively priced based on historical levels.

1Source: WisdomTree, MSCI

2Source: WisdomTree, Bloomberg

3Source: Bloomberg, WisdomTree

4Source: Bloomberg, WisdomTreeImportant Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Derivative investments can be volatile and these investments may be less liquid than other securities, and more sensitive to the effect of varied economic conditions. Investments focused in Germany are increasing the impact of events and developments associated with the region, which can adversely affect performance. Dividends are not guaranteed and a company’s future abilities to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.