Germany: Engine of European Growth

Conclusion

In summary, the macroeconomic environment in Germany has displayed signs of stabilization and potential for stronger growth in the months ahead. The improvement in global growth, led by stronger data out of China and most other developed market countries, continues to provide tailwind for sustained improvements on the German economic front. Barring any major policy missteps by the European central Bank (ECB) and peripheral growth faltering, we believe that Germany is on track to continued economic improvement.

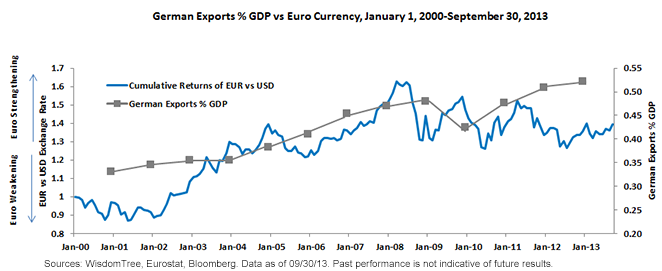

For U.S. investors, one of the primary questions surrounding investments in Germany is not the strength of its economy but whether one has an optimistic outlook on the direction of the euro. The euro does not just represent Germany but the 17 separate nations that are part of the eurozone. There are a number of reasons why the U.S. dollar might gain ground against the euro over time—and we will explore these in future blog posts. An environment of a weakening euro (or U.S. dollar strength) could be very supportive of German exports, given Germany’s export prowess. The importance of hedging the euro could thus become of prime importance for capitalizing on the best opportunities of German equities if the dollar rises (or the euro falls) in value.

WisdomTree has created the Germany Hedged Equity Index to focus on a broad basket of German exporters while hedging out the euro’s fluctuations against the dollar to serve as a broad benchmark for this theme. We will be writing more about the case for this strategy over the coming days.

1Source: Eurostat, June 2013.

2Source: Eurostat, June 2013.

3Source: German Federal Statistical Office, July 3013.

4Sources: Information and Forschung Institute (IFO), Bloomberg, September 2013.

5Source: German Federal Statistical Office, July 3013.

6Sources: Information and Forschung Institute (IFO), Bloomberg, September 2013.

Conclusion

In summary, the macroeconomic environment in Germany has displayed signs of stabilization and potential for stronger growth in the months ahead. The improvement in global growth, led by stronger data out of China and most other developed market countries, continues to provide tailwind for sustained improvements on the German economic front. Barring any major policy missteps by the European central Bank (ECB) and peripheral growth faltering, we believe that Germany is on track to continued economic improvement.

For U.S. investors, one of the primary questions surrounding investments in Germany is not the strength of its economy but whether one has an optimistic outlook on the direction of the euro. The euro does not just represent Germany but the 17 separate nations that are part of the eurozone. There are a number of reasons why the U.S. dollar might gain ground against the euro over time—and we will explore these in future blog posts. An environment of a weakening euro (or U.S. dollar strength) could be very supportive of German exports, given Germany’s export prowess. The importance of hedging the euro could thus become of prime importance for capitalizing on the best opportunities of German equities if the dollar rises (or the euro falls) in value.

WisdomTree has created the Germany Hedged Equity Index to focus on a broad basket of German exporters while hedging out the euro’s fluctuations against the dollar to serve as a broad benchmark for this theme. We will be writing more about the case for this strategy over the coming days.

1Source: Eurostat, June 2013.

2Source: Eurostat, June 2013.

3Source: German Federal Statistical Office, July 3013.

4Sources: Information and Forschung Institute (IFO), Bloomberg, September 2013.

5Source: German Federal Statistical Office, July 3013.

6Sources: Information and Forschung Institute (IFO), Bloomberg, September 2013.Important Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Investments focused in Germany are increasing the impact of events and developments associated with the region, which can adversely affect performance.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.